Starling Fixed Rate Saver has leapt from 3.25% to 5.25%.

Too late. You can get 1% more than that in a number of places now. Having it all under one roof is less relevant, too, seeing as you can’t touch it for a year.

Bit of a late reply, I know, but only ended up here because of a touch of fat finger browsing, and weirdly I realise I was actually looking at something today which may provide some form of proof for you.

I was looking at the ombudsman website this morning because I was trying to disprove a statement in another topic, ended up reading some ombudsman decisions - and in the second one I read, dated 19 June, the ombudsman says (emphasis mine):

Mr U raised the matter with Monzo. It has committed to follow the Lending Standards Board Contingent Reimbursement Model (CRM) Code (although it isn’t a signatory), which requires firms to reimburse customers who have been the victims of APP scams like this in all but a limited number of circumstances. Monzo says one or more of those exceptions applies in this case.

The ombudsman restates this later in the document and explicitly applies the code in assessing the complaint and making their decision. That the ombudsman states this as Monzo’s view and treats them accordingly is, I think, about as good as any proof as you can get.

I recommend spending an hour or so reading through ombudsman decisions, and you may find the bar is not as low as you fear.

I correct it in app and weeks to months later nothing changes, the feature may as well be scrapped.

Reported a few before now but yeah, deaf ears and all that.

Merchant Data is a nice to have, nothing more.

My merchant data such as maps and location are always pretty accurate however what is let down is the logos, it’s always very hit and miss ![]()

I’d rather the logo and name, nothing else as I know where I spent the money ![]()

Yeah I completely agree

Isn’t one of the point of the maps though is that you can hopefully try and spot when it looks like your card has been used fraudulently?

I’ve had, on a couple of occasions, especially when I’ve gone away on holiday, where I haven’t recognised a transaction, and then I’ve looked at the map and realised that the seemingly random transaction was a stall in a farmers market, or a gift shop in a village in the middle of nowhere which I did visit that day.

Logos - I don’t care about. In fact, I think it looks ‘cleaner’ with the default category logos rather than the specific merchant data, but maps, for me, is definitely something more important to get right.

I’m not so sure, it could probably help, but you either used your card on said day or you didn’t, and if it was some farmers market, you could’ve been in Sussex, but the maker based and registered in Hatfield, so it wouldn’t really help anything from a maps point of view.

The amount of times I’ve explained that to people who are looking to raise fraud, to then realise it’s something else ![]()

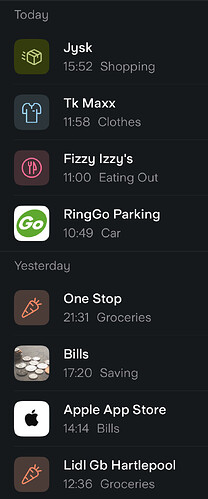

Your best prevention is to monitor your statements daily/weekly, as you’re more likely to recall where you spent money over a short time frame than it is monthly. Takes less than a minute to just have a little scroll through.

Once again, I am reminded of this all-time classic topic:

about time, but still not very impressive.

This isn’t a new feature, though? I’ve been able to add multiple accounts into a contact for years.

Has been there a long time.

Was wondering this morning why companies put old stuff in the blurb.

I suppose it’s a good thing to highlight if your front line and app data is telling you that’s something people aren’t using much.

Looks like Starling bank has/had some virtual card issues ![]()

Staff responded on X, it’s okay now ![]()