Thank god

Starling have changed the way that you manage your overdraft. I’ve had this in my in-app chat twice in the past couple of weeks, along with a push notification each time.

Yes, exactly what I thought ![]()

Yeah, I like this a lot. I wonder if the old slider functionality was playing havoc with people’s credit files, potentially making it look like available credit was going up and down wildly, to (for example) mortgage brokers.

This way Starling reports one consistent figure.

I was just about to echo that - changing your actual credit limit probably really did cause a few issues. They’ve come up with a good solution here.

Moved my spending & bills to Starling to try it out recently, here’s what I think

- I love the interface, by far the best of any bank app I’ve used. It’s very fast, everything is in the right place and it’s not constantly pushing me to upgrade to a higher tier

- Payments in and out happen almost instantaneously

- Spending notifications are very reliable

- The bills manager is excellent

There are a couple of other things though that are making me consider moving my spending to Monzo:

- You can’t set a budget, you can just see how much you’ve spent in each category (even NatWest offers this)

- You can’t earn more than 0.05% interest on easy access spaces, making them pretty useless for saving, only really good for sorting money and budgeting

Also, I’d love it if you could show all transactions, including ones from spaces, on the home screen and filter which ones you see like you can in the spending section.

Sadly you cannot set budgets within starling currently.

I don’t know if there is an all transaction view, certain their statements show everything but unlike Monzo transactions within spaces are not shown, everything is amalgamated. Personally i feel this makes their statements better and they are very easy to read.

Would be nice if you could filter the transactions shown on the homepage to show ones from Spaces, maybe with an icon showing which space/account it came from

My main transaction list does show money moved into and out of spaces but you won’t see things like payments made out of a space within the transaction list. You will only see that on your statement, where starting effectively appear to ignore spaces and only show money in or out, payments, direct debits etc but it’s effectively like spaces don’t exist.

As I previously said it’s much easier to read, I have a lot of Monzo pots and the number of statements needed to understand what is going on is too many. I think it’s an area that Monzo could look at Starling to improve upon.

I would make a suggestion to starling based on what you’d like to see and maybe they will oblige. They unfortunately no longer have a forum, so you can’t make suggestions in that manner.

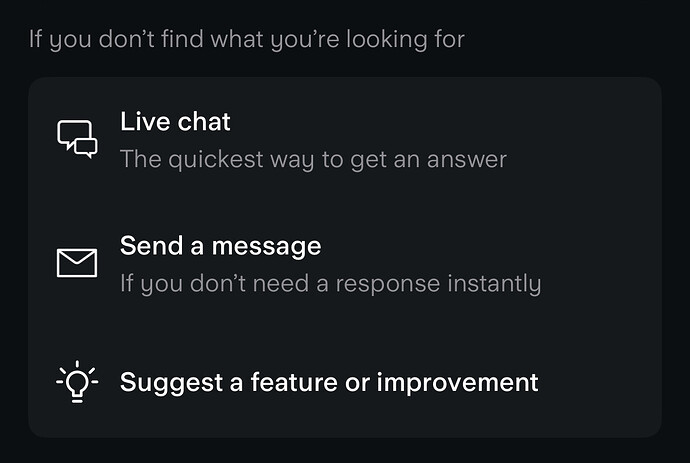

You can do it from the help section.

Help - talk to starling - new conversation - I need to get in touch - submit a feature or improvement

It’s going, I just need to wait for some bills to leave the additional account on Monday.

Tried to CASS to monzo but they rejected it because the additional account was still open.

The additional accounts have been free some time now.

They don’t work as a normal account for part, can’t cass for example.

Also doesn’t have its own debit card nor virtual card which is frustrating, have to link your physical.

They’ve opportunity to be able to link the connected card to it, or even a virtual card.

But yeah, waiting to cass to monzo then it’ll be revolut and monzo for the bulk.

Trialling Chase for a bit but can’t imagine it’ll last long.

Partly this.

I like the app, it’s slick, I like the spending tab too, and the fact you can exclude transactions there.

I really dislike Pulse.

Having said that, they have now actually amended Pulse by excluding categories you have in Spending, making them align finally.

Shame they can’t stop all the fraud txns though.

Monzo is getting better slowly. I just configured the Spotlight to how I’d personally utilise it to my needs. Upcoming, Left to Spend and Target will be useful.

Shame Revolut broke their analytics by removing the linking of inbound payments to spends, messed my spends up.

Yeah I been debating to open a starling for the post office deposits and cheques . We shall see. At the moment Monzo does everything I want. I have a current account which is very informative of all my bills etc. a joint account for our bills and an overdraft. Plus flex. Have everything I need all in one bank lol

Do you use Monzo for savings, for the simplicity?

Oh yeah. I have one of the pots for a savings account. Starling rates are poor. So monzo is better in the savings too.

Yeah, I’m currently on the fence between both of them. Monzo seems like the best place for an AIO setup, but it’s the little things like charging for virtual cards and Starling’s better (IMO) customer service that are holding me back from fully jumping ship.

I’m currently using Starling as my spending account, with bills coming out of a space. Monzo does all the money moving (& some cashback).

What do you think they’re falling behind on?

We’ve just started using Monzo again for our everyday spending. But it still doesn’t cut it as a regular bank account for our needs.

Among the things that we’d miss:

- iPad app

- cheque imaging

- free virtual cards

- free post office withdrawals and deposits

- a kite card equivalent