You might remember this post. I wanted to buy a house, contacted Monzo in the chat so I could make a large payment to pay my deposit and was muted for hours until they raised my limit. I spent 25 hours just trying to raise my balance both via chat and phone.

Well the outcome of that was that Monzo ended up sending me an apology as well as some compensation, yipee! And it looks like they’ve changed the way large payments work on the back of that by adding a permanent flow, Yay, I thought. But no…

So on Saturday I went car shopping, I hadn’t realised I wanted to buy a car but finally after months of looking and searching I finally finally found a car that I wanted, right there on the forecourt I decided to buy it! I was so excited.

I did a test drive, checked the whole car and decided today’s the day I spend my hard earned dosh on a Ford Fiesta!

Went in, tried to pay, realised the car was above my limit. I was like okay! Sounds good, I’ll get my partner on the joint account to call to get the allowance raised, 10 minutes of going through a billion layers of redirection to try to request a limit raise, and finally… “We can’t help you on the phone, you MUST use the app”

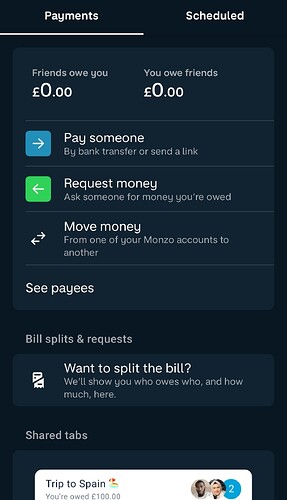

surely this can’t be I thought, I did this the last time and they raised it while I was on the phone, so I called and went through the layers of options on her phone and again… ". “We can’t help you on the phone, you MUST use the app”… okay, let’s try the app. I went into the app, tried to speak with them on live chat to get my limit raised, and again was met with several barriers that prevented me from speaking to an actual person, I had to use their new large payments flow! Hazaaa I thought, it looks like it’ll just ask for some information and be done instantly, she did a short video to identify herself, scanned her license and entered how much she needed and what for, great… Welp at the end of the flow I was greeted with “this can take up to 24 hours”…

Welp 20 something hours later, finally got my limit increase with anger, frustration and disappointment. This is the second time I’ve had issues with Monzo and I’m honestly so disappointed in them.

How has Monzo, my favourite bank, gone so budget to save money, I can’t even speak to someone on the phone, I can’t go into a branch because they don’t have any, my only option is to wait up to 24 hours to get my limit increase… I’m honestly shocked it’s gone from, a fixable solution to something where I can’t even reach anyone on the phone.

The new flow is fantastic but it hasn’t fixed the underlying problem of taking 24 bloody hours. Life isn’t all planned out, sometimes you need to pay bills unexpectedly and sometimes you just want to buy a car.

Honestly i’m just so disappointed.