This is brilliant. (thanks Dan)

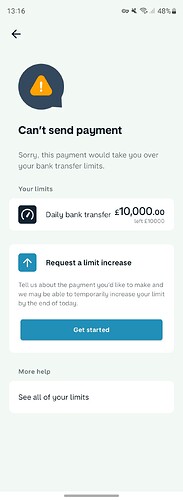

Here’s what happens:

It’s not really a different flow, but more an invitation to start a new one. But better than nothing!

Yes, currently the easiest way to find it is to try and send a large payment - and it works well. But finding a way to signpost this to users who aren’t on the forum and don’t make regular payments over £10,000 (most people) would be good.

A hard balance to strike as to how visible it is, I know. I’ll never use split tabs, but I accept that probably more Monzo users will split a tab then make a £10,001 payment…

It’s also an option at the bottom of the limits screen, which makes sense to me ![]()

Starling has a dlow for this that was very easy to use.

Request the payment, answer 6 or 7 questions about.

True, if you know its there and can find it. I only found out about the £10,000 limit the first time I tried to make a payment over that amount (admittedly only a few days after I opened the account).

And I still have to go through the help screens to find the link to the limits screen.

What do other banks do? I always check what the limits are for a bank account, so I wouldn’t know how it works elsewhere ![]()

I don’t know @Dan5 - only other account I have where I’ve come across this is with Smile. When I came up against their individual transaction limit (by trying to make a payment which exceeded it) I was able to simply split the transaction into multiple smaller ones. If they have a daily limit I didn’t reach it.

A friend today had the same problem with Barclays, but one of the split payments was then held up by the fraud team.

The new Monzo limit increase flow is great, with a big “however”.

That being, Monzo has a daily limit not an individual transaction limit. So you can’t circumvent it by splitting the transaction into 2 or more. You can’t reliably phone Monzo (and if you did, Monzo still requires the selfie). And the limit increase request workflow can take up to 24 hours to complete.

So to avoid frustration by people finding this out the hard way, I think it would be great to make this more visible - so that even if people don’t need it now, they’re being made aware of it, and thus when they do need to make a large payment they know to ask at least a day in advance.

Edit - you always check the limits because you work in banking and you know limits exist. I suspect most customers won’t have a clue that there are limits until they run up against them.

Edit 2 - and I really do mean that I think the new workflow is great in Monzo. I was really impressed when I used it.

I made a large transfer recently with Santander. It took about twenty minutes and two calls (one from me, then one from them). All told I found the process quick and effective.

I don’t know if it’s a coincidence, but since then they’ve imposed a payment limit of £5,000 for in app transfers. I can change this up to £25,000 and if I need more I have to call them.

I think Monzo ought to increase the daily limit to say £25k or have a Transaction limit rather than a daily limit. This puts me off from using Monzo as my main bank.

You don’t need to do a large transfer often but when you do it can be a hassle, e.g. paying the solicitor for a house deposit or buying a car.

This ought to be changed.

The thing is the Monzo flow works well, and will get your money out, other banks with bigger notional limits will get trigger happy at pretty low levels.

Spent quite a bit of time with companies and PISP around open banking payments, and yes, a bank has a £250k daily limit, but will come down on the payment like a ton of bricks and block it. It’s a real issue for Open Banking payment adoption.

I do think Monzo’s limits are exceptionally low compared to most mainstream banks; plus the friction in getting it increased - makes it a much more painful process than it seems like it needs to be.

Be curious what “industry best practice” is in this arena, as this feels like a lot:

What’s the gold standard other banks do for these requests?

I had a quick google at other limits from main uk banks, as a quick rundown:

Monzo - £10k

Starling - £10k

Natwest - £20k

RBS - £20k

Nationwide - £25k

HSBC - £25k

First Direct - £50k (note they also don’t have branches, and were telephone only for a while, so they must have had a non selfie solution)

Natwest - £50k

Santander - £100k (25k per transaction)

I appreciate different levels of risk / appetite to risk and all that - but feels like Monzo have landed on the combo of lowest payment amount + highest friction.

I have a feeling the lower limits are something related to how easy it is to set up an account? Hence Starling and Monzo being lower, they know the customer less so there’s a barrier later when you need to send large amounts.

One thing is with a lot of banks you actually can’t raise the limit, after the limit you have to go to the branch and pay for a CHAPS payment.

This is for debit card payments. I can’t find any reference to bank transfer limits other than FP’s own £1m limit. I recently made a £30k FP without having to contact them first.

I had the exact same issue a few months ago, I wasn’t offered any financial retribution (haha) but it was one of the most stressful times I’ve had with Monzo. I’ve mentioned it before that literally a few years ago I would message on the chat (when you could talk to someone directly) and ask for an increase and it was done. I lost a little bit of faith in Monzo which then made me think about the services I was paying for (Heart over head).

^ this. Monzo has made stuff like this considerably worse. People don’t care about the method of increasing their money, they just want to get it done and not be a PITA. It’s an improvement allowing you to schedule in the future but it was at the expense of cutting customer support and outsourcing it…

Is that just your theory?

No. it isn’t

So what is it based on?

Through the grape vines, i’m sure if you speak to the many Monzo colleagues on here, one of them will be happy to confirm it.