Been mentioned before but connect via OB to suck in all the old transactions before the CASS runs it’s course

Astute observations as ever, thank you!

This is all helpful, thank you. Keep it coming.

I’d love to hear more about people’s misconceptions of CASS if anyone has thoughts on that.

Ability to cancel it in the app!

Also it would be nice if we could see what things have been redirected

I CASSed ![]() my bill paying acc from Barclays, end 2020.

my bill paying acc from Barclays, end 2020.

It went smoothly and I liked to see the progress of switching over ![]()

Still, Barclays offers a “partial switch” which is handy if you DON’T want to close your old acc ![]()

I recently heard (again) that some people are not ready to give up on their long lasting High Street Bank account only because of “app based account” ![]()

![]()

Nor I would ![]() . I kept my Lloyds account in case

. I kept my Lloyds account in case ![]() will go “funny” on my account

will go “funny” on my account ![]()

Translation:

I CASSed my bill paying acc from Barclays, end 2020.

It went smoothly and I liked to see the progress of switching over. Still, Barclays offers a “partial switch” which is handy if you DON’T want to close your old acc.

I recently heard (again) that some people are not ready to give up on their long lasting High Street Bank account only because of “app based account”

I kept my Lloyds account in case monzo will go “funny” on my account

Hello! I completed a switch with CASS last month.

Actually I thought the experience was good, I don’t think there was anything I was particularly yearning for or missing. One improvement I would recommend though, as a ‘nice to have’:

For me and I imagine many others, I had my account with Barclays for over 12 years. Over the course of that time, my payee / direct debit list became a complete mess. There were a bunch of payees that I made one-off payments to 6 years ago and then never again, direct debits that had become inactive without being cancelled down, etc. The app experience for cleaning up payees with Barclays is horrific, so I never did it when I was with them.

So what would have been great is perhaps an opt-in ‘would you like to do some spring cleaning on your payees / direct debits now that they have been transferred over?’ Maybe even with some data intelligence (I’m not sure if you get access to information like, when a payee or direct debit was last paid but if so you could do something like 'you haven’t paid this payee in 6 years. Would you like to delete them?). Simply a way to clean up.

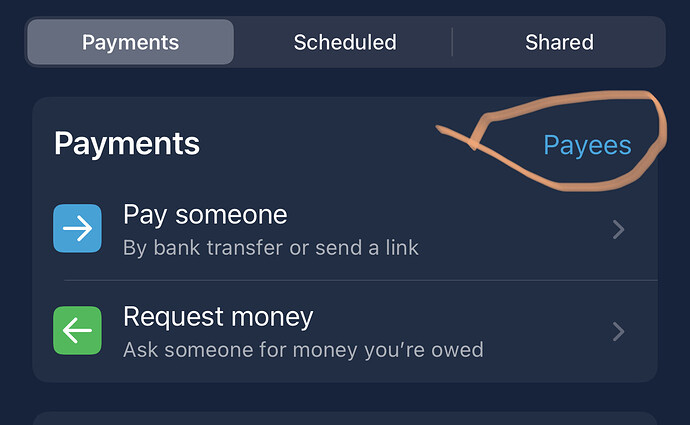

Have removed the 2nd suggestion below as the feature is already available. Thanks @JoeT!

One other thing although it might be more for the payments team - I like many others have a number of savings accounts with different providers, and the only recognisable difference between them is the reference. But on the main payments page, you don’t see the reference, so if I want to transfer some money to my Marcus account, I have to scroll through 5 payees, all with my name, and pass 2-3 screens as if I’m going to make a payment, to see which bank it is with. Perhaps this could be integrated into CASS by allowing me to ‘tag’ or ‘label’ specific payees after the switch has completed, so this is more recognisable.

Just my two cents - but a great experience already nonetheless!

I think you can create nicknames

When I’ve talked to folk about switching, these seem to be the things they say the most:

- They need a “real” bank account (Monzo not seen as a substitute)

- They think their credit score will be impacted or that unspecified bad things will happen

- They have an emotional attachment to their bank

- They want all their back data

- They don’t want the hassle of changing pay details with their employer

- They worry that things will go wrong and they won’t have their money, or will end up getting charged for missing direct debits.

On the plus side, though, get paid early is a massive Monzo bonus. I know folk who get paid into Monzo just for that!

Is it possible to CASS into a monzo joint account?

I don’t think it is!

There are no references on the Payments/Scheduled tab, and the payee name doesn’t change when you alter it in Payees.

If you’ve found out how to make it work, please share!

A big one for me was that I didn’t know:

-

Any payment/refunds made to my old bank account would be fully supported/diverted for several years

-

I don’t even need to let my employer/others know about the account change before switching, as it will be forwarded

Had I known the above, I would have switched much, much sooner. I just had this anxiety that I would miss updating my details somewhere, or that there was a refund that I’d been waiting for which I’d lose or have to go through some long manual process to recover.

Financial systems, especially legacy ones are notorious for being completely rigid and not able to adapt to change, so it didn’t even cross my mind that this sort of thing would be possible.

I know none of this is strictly related to Monzo, but as a consumer I would never have gone to actively seek out that information, I just assumed my understanding was correct. So maybe pushing the ease of use more might help!

Ah yeah to be fair it’s not super intuitive or possible to get to this screen from every payment/payee view, which I think is why I didn’t know the feature existed!

Here’s how I managed to do it:

-

On the payments tab

-

Find the payee and edit

-

Voila

Oh wait, just re-read what you’re saying… so I changed the nickname there, but are you saying it doesn’t actually show up anywhere meaningful to be useful? I haven’t made a payment since editing!

Exactly that!

Changing the name doesn’t affect the feed. And in Scheduled Payments I just get a list of transfers to different accounts all with my full name as payee, even if I try and give them different nicknames.

Apparently it is. But only from another joint account - which makes sense.

You can switch two personal accounts (or a joint account) into a new joint, but you’re not allowed to switch a joint account into a sole personal account.

Which makes even more sense.

For @maxwhite it might be worth taking a look at this topic:

Thank you!