Christmas is closer than last Christmas, so you’ve missed the chance for me to remove it!

I sure do, Gromit.

We use Rooster ourselves as I found Kite really missing features for younger kids. Last time I looked at kite it seemed so so basic over rooster.

I also get rooster free as I have an RBS account.

This has been available for a long while.

Man I would be so nervous putting any money in it if that was happening to me.

I cant believe they cant stop it.

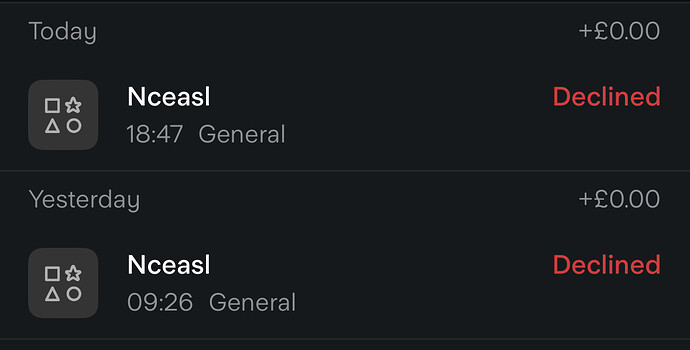

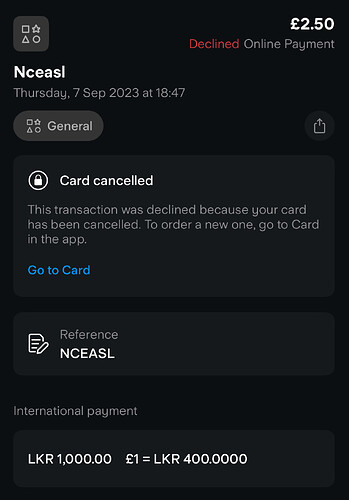

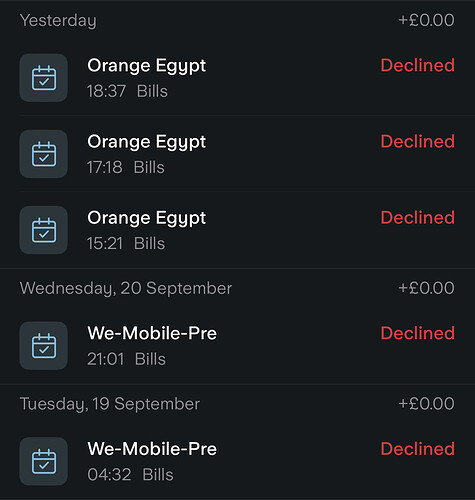

It’s to my old card:

I had a replacement soon after the initial transactions months ago but Starling replaced that one.

I’ve gone and ordered my own as lost and stolen tonight so I wonder if that resolves anything.

It’s my sole frustration with them, liking everything else.

Should be a system adjustment for cards reported stolen to just decline to Starling, not tell me about it.

At my work, staff can see the declines in the transaction history, but customers don’t see them from what they tell me, same goes for active card checks.

Being foreign countries, I’d guess the merchants I get aren’t going through SCA therefore aren’t stopped by Mastercard due to reporting the card number stolen.

My fraud declines started 24th April and have continued up until yesterday. ![]()

Looks as if Starlings COVID Bounce back loans are the worst performing by quite a margin.

I’ve had Starling in a past life, and then managed to open another after 12 months.

I seen some on Reddit also getting the same thing, one person within 6 hours of creating their account, not even using it within that time ![]()

Touch wood I’ve never had this on my starling account and I’ve had one since the beta days there must be something they can do on the backend to stop transactions from a blocked card appearing in the feed I remember that declined transaction never use to appear at one time

3.25% ![]()

Well they do, for decent interest ![]()

it’s pretty decent amount for a current account tbf, I don’t think any sane person would use it as a savings account, but a bit of interest on your floating balance is pretty decent and you don’t need a special account to get it

Yeah - this is probably the ‘closest’ Starling are going to get (at least in the medium term’) to any sort of ‘High-ish Instant Access Savings Account’ where you can just create a Saving Space and dump money in there and get some interest on it.

It’s not comparable to ‘dedicated’ Savings Accounts but it be enough for some people to keep a small amount of savings in there (up to £5k) and was probably a fairly ‘easy’ option to implement by just applying it to the whole account rather than having to re-engineer Spaces to have different interest rates on different spaces depending on if it’s ‘Savings’ space or something else.

It’s free money for no effort. No transfers, worrying about what’s in a space, what I need to move etc etc.

I’d rather 3.25% for my bills/all different types of savings than 4.1% for one pot.

This is great from Starling. Between this, easy access savings, and fixed term savings, I won’t have a penny that isn’t earning reasonable interest. I just wish they’d refresh the front page of their app (Pulse is worse than useless), but Starling have the strongest current account offer around now, IMHO

I’m a bit confused why they say they can’t do anything about it - can’t they just block the merchant(s)? For that matter, can YOU block the merchant using the new tools, or perhaps it still appears in the feed if you do that? Surely it is something you send to TS as the CEO for his exec team to kick some ass about if support won’t or can’t do anything?