I tried some of the Starling integrations previously and really didn’t like how they showed, and often struggled to connect them.

iZettle has now joined the Starling marketplace as well. I can see that being a very popular partnership with their Business accounts.

I find it’s easier to open PensionBee than to go open Starling, go to market place, and click on PensionBee.

I don’t really see the point of the PensionBee integration at starling

Actually their whole integration system seems a bit like that. Once you’ve got an integration it’d be nice if it’d show up somewhere a bit more prominently. If you’ve linked an account it can be assumed you’d want easy access to it.

And…

As well as iZettle, SumUp is also joining the Starling Marketplace today.

There’s also another one joining - but the hint is

and I can’t work that out…

and I can’t work that out…

It’s Dinghy Insurance ; insurance for Freelancers

Better for them than for yachtsmen…

anyone seen this https://www.starlingbank.com/blog/improving-app-navigation/

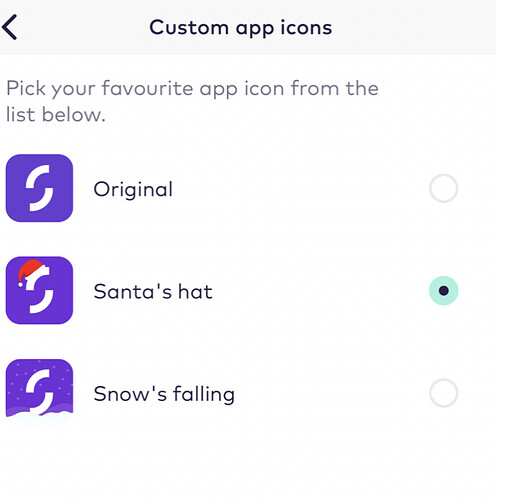

I only spotted in app today by chance along with the xmas icon changer option.

Not sure how I feel about the new UI. Feels like they where inspired by the iOS system settings layout but missed the mark somehow

I have just spent 10 minutes trying to find that option in the app. Unsuccessfully.

Am I just too stupid? (please don’t answer that)

Silly question I am sure but are you on the latest version of the app?

I went to the account switcher > user settings > and it was there above the icon changer

Wonder if Starling are doing some kind of a/b testing ?

*sigh*

I updated my apps this morning, but clearly a fresh batch were approved this afternoon, including Starling and Revolut. I can’t believe I was caught out by an update!!

Oh well, at least now I have access to a festive icon. That’s the important thing!

Thank you.

There is a competition within this month’s Murmur but, if like me you do not use social media accounts, Facebook, Instagram, or Twitter, you have no chance of entering

Oh, if you update to the latest app, you can shake your phone and turn the Pulse circle into a snow globe

Starling have just announced they’ve now got over 2 million open account. Of course ‘open’ doesn’t necessarily mean regularly used (or primary account).

Still, that’s quite an achievement.

I’ve joined the dark side ![]()

You’re not the only one with both, so don’t worry

Active customers was covered in the 2020 CEO Report in August:

Active customers

We live in an age of multi-banking. When they start using us as their main account, people don’t always want to close the account they may have held with a legacy bank for years. We find that customers sometimes want to make the transition over time as they start using their Starling account more and more. Between the end of 2019 and July 2020, the number of customers using their account daily grew by more than 60%. Typical active retail customers credit and debit their accounts by more than £1,500 per month; while for typical active SME customers, the figure is over £6,500.

I hate this abuse of statistics.

Grew by more than 60% from what?

It doesn’t really matter. It suggests to me that Starling isn’t competing with any other bank but itself.

Only Starling knows if converting a further 60% of total daily users is hitting a target. But it shows a trend upwards.