Hey everyone, this is new feature we’re building to protect customers from scams. We’re still in the process of fine tuning the decision engine for this, our false positive rates are pretty low, but there’s still some low hanging fruit for us to get. Well known account numbers and sort codes are one of them.

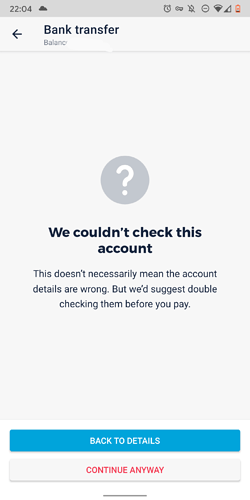

We’ve actually rolled out two linked, but very distinct things at the same thing. One is Confirmation of Payee where you’ll get warnings like this:

Confirmation of Payee rules prevent us from hiding those screen for well known account numbers and sort codes. It’s up to the receiving bank to provide the correct details to their customers and send us a proper response. It seems lots of banks are still in the process of updating their systems for credit card payments etc. Confirmation of Payee is still a pretty new thing.

The second system we’ve rolled out is a set of specific warning that we display if we believe a payment you’re about to make could be a scam, and look like this:

We use lots different bits of data to figure this out, and I’m not going to go into the details of how that works for obvious reasons. Most people should never see these warning unless they’re actually about to be scammed, but as I said above, we’re in the process of tuning and tweaking this system.