Yeah I do agree there. There’s plenty of other colours to choose from, it should never have been this similar.

I find it much easier reading off a white background than a coral background.

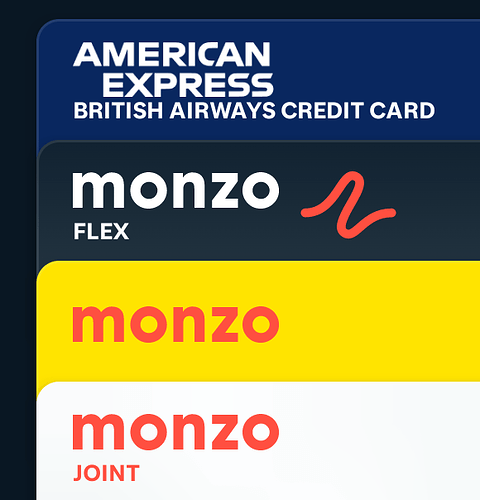

That’s how to do a suite of cards while keeping consistency, the new ones do look nice

I might check when I’m back at my computer tomorrow, but white on coral probably scores fairly low on the contrast checker for accessibility. Definitely compared to black on white

Isn’t this essentially the same as your problem though?

- Nationwide = blue cards with small colour/text differentiators

- Monzo = white cards with small colour/text differentiators

Damn, I saw 15 new messages in the joint thread and thought “wow there must be a new joint feature out!” ![]()

Honestly yes it’s close, except I think there’s differentiations. The Nationwide cards have a strip of colour all the way across which is slightly more helpful. I’m not sure how it pulls into Monzo but their cards are designed so that the differentiating colour exists in every single corner, be it the logo change, the pill with text in or the strip of solid colour. It’s not massive but it makes a difference.

I think my annoyance comes from the fact that Monzo chose to fix one problem, by passing a very similar problem on to another set of users and stated this to be the sole reason for the change. Nationwide have chosen to create a suite of easily recognisable cards so the intention to me is different.

Anyway I think this may just be a me issue so I will park it. I was just quite pissed logging into Monzo today

All makes sense ![]()

No, this is in the Monzo app that the card image has switched to the new card design. In Wallet it still matches my physical hot coral card.

Regardless of people’s opinion on the new joint account card design, it’s less confusing for the app and wallet images to match the actual card you have. This used to be the case. I wonder why earlier this week Monzo decided to break that link.

I hadn’t even noticed this and probably wasn’t clear enough in my initial post but yes my card in Monzo is white but in wallet it’s still coral. I assume if I removed it from wallet and re-added it’d become white but it being coral in wallet helps me quickly pick it out from other cards when paying so won’t be doing that in a hurry ![]()

Thanks Georgia. I really need custom categories and virtual cards to aid budgeting.

Am I right in thinking to pull spend from pots (that’s not a dd), you need a virtual card?

Can you assign spend from retailers to come from pots? IE all spend from Tesco could come from a groceries pot?

Yes, or set up a scheduled withdrawal the day it’s due from Pot to balance.

No it’s not possible.

PLease excuse me if I’ve missed something obvious about the question I’m about to ask.

Is it possible to open a Joint Account with a family member who lives at a different address?

My daughter and I both have Monzo accounts. For an event coming up in a couple of years time, it would be amazing if we could open and operate a JA

On the introductory information page, it is stated: that you can open a JA with ’ … A partner, spouse or someone who lives in your house.’

When I delve a bit deeper I can’t locate any specific restriction about this, but … I could quite easily have missed something.

Does anyone have any experience and/or knowledge on this please?

Thanks for reading

You can but you shouldn’t.

While you probably “could”, I would recommend against it, especially if it’s just for an event/something one off.

Opening a joint account with someone links you both financially, impacting both your credit files, not just within Monzo, but for all credit. So by setting up a joint account between you and your daughter, loan applications, credit cards, mortgages, etc, will impact you both and providers will see the association when applying.

If this is solely for the purpose of event planning, and you both need to make payments towards it, then maybe look into using the “Shared Tab” functionality instead to see if this suits your needs.

You could also look at adding your daughter as a 2nd card holder on a Credit Card but do check with the providers to see if:

a) you can add someone not at your address

b) they report the 2nd card holder to credit agencies

as it differs from provider to provider. (Monzo doesn’t allow 2nd card holders for Flex), but do check to see if it suits your needs first, and the implications of having someone use YOUR credit.

Additional card holders aren’t scored nor reported, as the responsibility remains solely on the account holder.

So if additional card holder spends erratically on the card there are no consequences to them other than a telling off from the account holder, and a lovely debt for them to resolve.

Some companies may be able to set a limit of how much be spent on said card though.

That!

In the past I would’ve recommended a Monese joint account, but these are now reported to Credit Reference Agencies, and the product has gone downhill anyway.

Does anyone know if Revolut reports its joint account? The help page is ambiguous.

Revolut doesn’t report in the UK.

Thank you all for your time in replying - it is appreciated.

Having looked at things over the course of the day and taking into consideration your comments and remarks, I think it’s unwise to look into proceeding as I had initially thought we might.

so, time to think again and think differently - at least I have the luxury of a relatively long lead-in to do our planning.

Thank you for being a sounding-board for me