I don’t know where the idea is coming from that you need a selfie? I just used in app provisioning without any selfie. Works very neatly…

Yes that’s what I mean. I would like someone e from Monzo to clear this up please @anon77734705 can you please check this why I have been able to use Google Pay without any extra verification and @chistery can’t…

From Monzo telling me. I added my card, it said to phone Monzo, they told me to take a selfie whilst holding the card showing the last 4 digits, and upload to chat.

I didn’t have to do that the first time I added my card

It would have been additional verification put in place by Google. Recent number change or something not quite matching the account details we hold  ️

️

Thanks, but it’s Monzo only allowing verification of a selfie I don’t like. I have no problem with extra verification.

I’m really sorry about that @chistery, but this is so we can verify it is you trying to add your card to Google Pay.

How did you open your account then as you had to do a video for that?

Why have you used a partial quote? You’ve missed the “in-app provisioning to our Android app”.

You appear to be saying they are claiming to be the first with google pay?

you’re right it does appear like that doesnt it

I presumed in google pay in app provisioning was already part of Monzo since it is with Apple Pay

No, not yet unfortunately.

Sure

Correct me if I’m wrong @simonb but I don’t think Monzo offers overdrafts over £1000, in terms of APR borrowing the full £1000 would be 18% over the year (this is pretty reasonable IMO), if you had a £500 overdraft it’s around 37% and £100 overdraft 183%, hypothetically for £21 it would be an eye watering 869% which is extremely expensive compared to Starling’s 15% which is better in every of these cases, although pretty insignificant for the case you’re borrowing the full £1000.

I totally agree with you that per day fee in real terms of pounds and pence is emotionally and logically much easier to comprehend, but this seems punitive for borrowing relatively small amounts of money e.g. when you’re £21 overdrawn, or if you’re in a situation where you cannot get approved for an overdraft over £100 and have to pay the same amount of fees as someone borrowing 10x the amount.

My personal suggestion would be to have a personalised charge based on how much the customer asks for, if you have a £100 authorised overdraft 10p per day, £500 - 25p, £1000 - 50p (all of which equate to 18.25% APR). I don’t believe there’s any additional complexity here bar saying “check the app” to see how much you’re charged per day, but this is far far better for a customer who can only be approved for £100 and more importantly makes an overdraft much more affordable at a rate that Monzo are already happy with (18.25%).

The overdraft price decisioning is based on it’s ability to scale. Whilst it’s true that we’re only offering overdrafts up to £1000 right now, that won’t always be the case.

If we’re talking a hypothetical £21 overdraft, do you expect that the person would only be £21 overdrawn for an entire 31 days in a month and therefore be charged £15.50 for a £21 overdraft? That seems quite unlikely!

Those rates you mentioned - are they based on the assumption that the person would be using the overdraft for all days in the month? We feel that’s significantly less likely on a £100 overdraft than it is for a £1000 one.

The fees are based on the length of time that you use the overdraft, and not the amount. Can you clarify why the amount difference makes it punitive? I believe that it is quite simple - we charge you a fee to use the overdraft. That’s as easy as we can make it, and it means that people know what they will be charged at all times.

It may not be the cheapest all the time and in every circumstance, but it is certainly always the easiest to understand, and we felt that was paramount.

Fair comment, I think it’s one where we disagree. I love how easy Monzo makes banking, but I don’t think in this case that simplifying it down to a flat overdraft usage fee is better than paying for what you use as I believe it’s advantageous to those who borrow larger amounts.

IMO it seems punitive as it’s allowing some people to borrow large amounts of money for the same fee as people who borrow small amounts of money, if it’s an overdraft usage fee why not make it the same overdraft for everyone? (I understand this isn’t practically possible, but tiered pricing could be a happy medium of easy to understand and not overly expensive for small amounts). As an example, if I went £200 overdrawn for 2 weeks (I think a reasonable example) on Starling it would cost me just over £1, on Monzo it’d cost me £7, this seems punitive as there’s minimal difference between the two where the amount is high, such as £1000, but a pretty big difference when it’s smaller amounts. I appreciate you can draw comparisons like £7 is lunch in a London Pret, but for those on lower incomes, particularly those who are approved for a smaller overdraft (e.g. students, those on lower incomes etc) that £6 difference is pretty drastic and feels pretty unfair.

(edit) I totally get where you’re coming from with easiest to understand but personally I think there’s better ways to price at the bottom end that don’t increase the complexity a great deal.

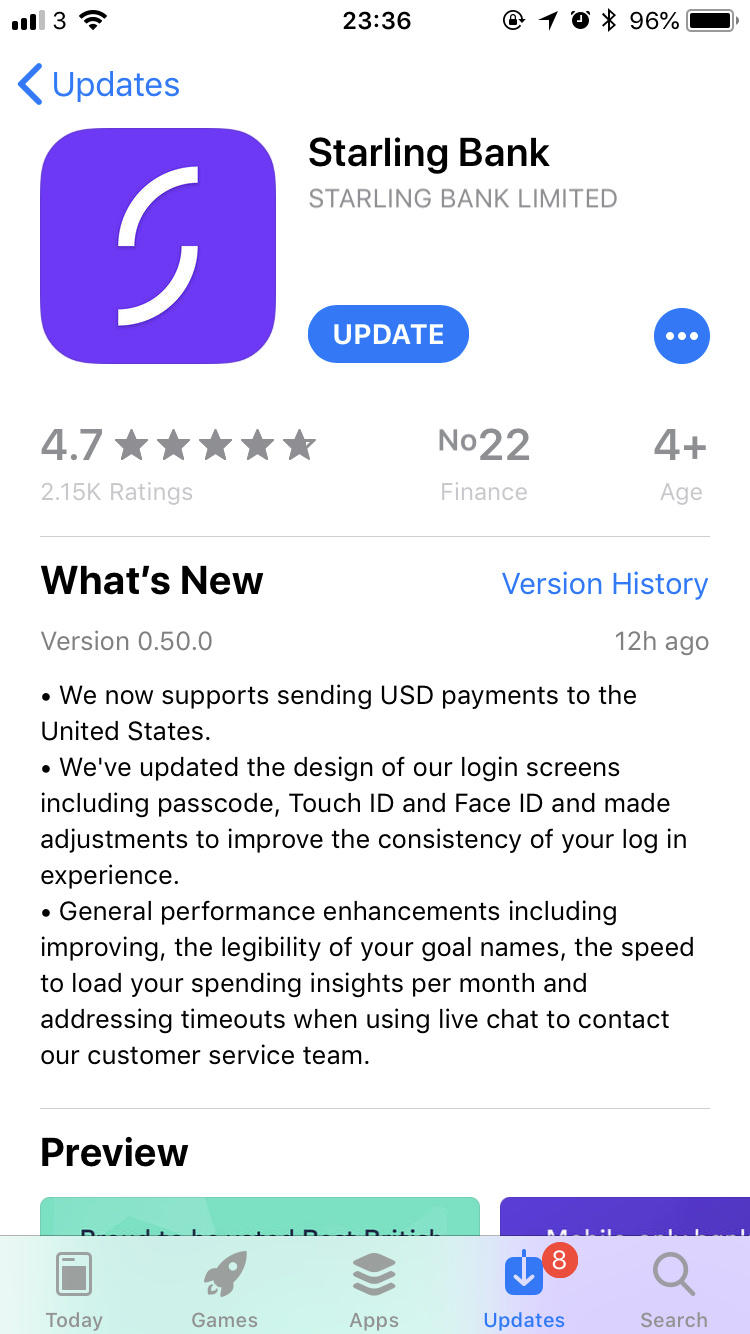

You can now make USD payments

Being in a larger overdraft is also often a sign of someone who is struggling financially.

We don’t feel it’s fair to charge them a higher amount based on that overdraft being larger - this isn’t going to help them get out of debt.

Definitely appreciate your feedback through - we’re constantly reviewing all options on pricing, so all feedback is important to us! ![]()

If we look at the £1722 average figure that @j06 posted previously, that’s a £20 fee with Starling.

In fact, once you’re above £1291 with Starling, you’re above the maximum £15 fee that we’d charge in a 30 day month.

This is a great post, and is borne out by the popularity of fixed rate mortgages. People hate gambling with their regular finances.

I feel the current Monzo fee structure discourages people from using the overdraft at all for anything but a very short term buffer (preferably paid off the same day). I think that’s a good thing

But it’s fair to charge them a significantly higher amount for lower overdraft usage? Even if they are in credit balance on their account (including pots, which seem to be held in the same account)?

No one calls Wonga fair because they say for every £100 you will pay £25 or whatever.