I’ve still not seen it in my App to apply for and I’ve got 2 Debit Mastercards with RBS

Me either.

Anyone know if I order a Replacement card for my account that is linked to the Child & Co Sort Code it will be a replacement Child & Co Card?

My Child & Co Card is becoming a bit beaten up. Using it on the underground daily has its downsides

If you had to choose a favourite?

RBS Card Design

- Child & Co Mastercard

- Child & Co Visa

- Drummonds Mastercard

- Drummonds Visa

- Holt’s Mastercard

- RBS Shed

- RBS Premier Shed

Contacted RBS via Cora and chatted with an agent and queried why I couldn’t see the tile to apply for the travel account and they did confirm that I would be eligible so it has been referred to RBS Technical to investigate.

Got confirmation today from the Tech Team that they are looking into this

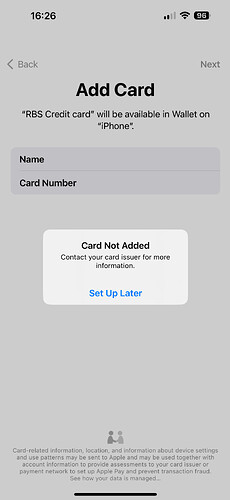

Has anyone encountered problems adding their RBS cards to Apple Pay? I had my cards on Apple Pay and connected them all through the RBS app so I could see my balances. I can’t remember the exact sequence but then I deleted them and now can’t re-add them. I get the error shown.

I also get the same error when I try and add a NatWest card or an Ulster Bank card. Credit or debit. I get the same message whether I scan the card or try to add through the app. I can add cards from other banks without any error.

I’ve been through several restarts and resetting my iPhone completely. I’ve gone through the Apple support forum too. All to no avail. I’ve used Cora to tell the bank about the problem and they are going to look at it.

Just wondering if anyone else has had a similar issue?

Trying either way results in the error message above unfortunately. I can add the cards to my watch without issue.

This was a weird anomaly I could never work out.

Usually, the bank can remove the tokens fully for the device, and then have the customer add the cards again no problem.

If said customer had previously had another persons card on their device (any bank), and that other person ever reported fraud (to whatever bank, not referring to fraud activity on the device in question), then Apple could block them adding cards for the same bank, even if it’s their own cards (that’s what previous employer explained, probably comes more technical).

But if the above doesn’t apply then who knows what’s going on ![]()

Thanks for replies. I might have to ask customer support about “tokens” specifically then. The person I was speaking to through Cora said there were no blocks on the card but didn’t say much more before referring escalating it.

Good to know. I’ve had both an email advert and an in-app notification saying that I can apply but there’s still no tile.

That’s not what I meant.

Example:

Daughter has mums bank card on their iPhone.

Mum calls the bank because someone in X country attempted $xxx.xx.

Daughter didn’t do this.

Bank blocks mums card and removes card from all linked devices.

Daughter gets own debit card and tried to add to Apple Pay.

Apple blocks this because of the fraud trigger on mums account caused by external third party.

Never got down to the specifics why it happens, but used to see it a lot at Barclays, and the common trend was customer A had someone else’s bank card on their device (genuinely authorised by card owner though we know that’s not allowed), and the OG card owner would report fraud (not by customer A, just external fraud) but that trickles down to customer As device to block and prevent further card tokens being applied to As device.

Complex, not sure how else I can explain it.

Barclays explained the block comes from Apple. Apple reject the request, Barclays cannot override.

Tell customer they can never use Barclays Apple Pay on that device again.

End of story.

As I said, I never fully got to the bottom of it but that’s what it was.

It was all baffling but that’s what those beyond management explained ![]()

Nice new LNER-themed avatar!

Nope, because the bank hadn’t done anything wrong.

Basically a final response no action. Go to the ombudsman who, at a guess, know the score and agree there’s nothing the bank can do.

Halifax was like that… everything little complaint £30, upheld or not, £30 had to be given. lol

LBG went from £25 to £30 cuz who knows why ![]()

Even though I did not make a complaint, I was directed to provide ‘feedback’, RBS contacted me yesterday to apologise for the travel money account issue and gave me £30 for my ‘troubles’.

They’re unable to offer a solution to the issue ‘as the bank does not choose the card you are issued’ therefore gaining this account feature is purely pot luck. ![]()

I was in Branch, before I left branch network they then wanted everything handed over to PAF.