Splitting spending from bills actually works cause you can’t accidentally spend money you can’t as it’s needed for bills and if you have it separate and you see you have an amount for spending you can decide if you can afford to do a thing or not

Until it launches, no-one here knows for sure what features will and won’t be available with committed bills pot(s)

I get paid weekly my account says I have zero left for committed spending it doesn’t take in to effect that I get paid weekly and only goes on the balance today

Out of interest what would happen if you assign a DD to a locked pot?

Could the payment still successfully be removed from the locked pot, even though manual withdrawals are blocked?

Whilst there is little friction left on locked pots these days, this could be a nice way to help people avoid dipping into bill money.

Even more so if using that locked pot to save for an annual bill.

Hence my caveat of fully released and functional and I only mentioned DDs - if what we’ve been shown is brought forward then what I described is possible? The pot would sort out all the DDs and would leave your Current Account to be used for day to day spending?

My Monzo tells me what I have left to spend after committed spending - so I just go off that number and don’t need to split the two - but I do understand why you’d want to. As I say, it appears for you, and your preferred method of budgeting/ finance would be two accounts.

I would not have two accounts if card spending was separated off from the main part of the account or the income and bills went in to a pot straight away then main part of account was for your card spending only so all in one account not two

The problem is for Monzo currently, this isn’t something that is possible, you can’t choose which pot to pay out (even if Committed Spending Pots come to fruition).

You say you have a variable income so you wouldn’t be able to automate the process I outlined above completely, there would be an element of manual transfers.

Scheduled withdrawals are blocked so I can’t see how it would be different

Couldn’t you just set your ‘Overall Budget’ to £35 per week? ‘Overall Budget’ excludes your committed spending like bills, so your ‘Left to Spend’ figure would then represent your spending money.

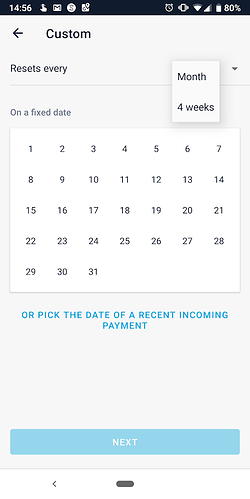

The Monzo Summary feature has no concept of weeks.

Oh yeah, well you’d set it to 4 weeks worth of spending money.

Four months out of the twelve have five ‘weeks’.

Yep, that’s another one of the parity things, the Android app is marginal better and more featured.

I have both types of phones, so I’ve tried, I use iOS for my daily driver.

Wait, Monzo staff don’t use Octopus but use Bulb?! INTERESTING

I’m not sure that Simon’s employer can specify his electricity supplier!

Could go one step further and make it a button, where you click it and can setup an amount to automatically transfer each payday (with the ability to manually edit the total to cover any ± fluctuation)

Plus it’s not even my screenshot! ![]() It was provided by the most excellent @anon59758512

It was provided by the most excellent @anon59758512

@anon59758512 At the Manchester Show and Tell event last night screenshots showed the UI flow from a specific direct debit to allowing you to choose an existing pot for the direct debit to be allocated to. Could we have the option of creating a new regular pot at that point as well?

Will it be possible to pay Standing Orders from a committed pot in much the same way? I feel this would be useful for situations where DD are not available.