I have a Monzo account. I am buying a flat. There is a management company that does the repairs. They have said I need a Bank Reference to approve me to be able to proceed with the property purchase. I contacted Monzo and they sent me a letter stating my account details and when i joined the bank. This was not accepted, the property management company said this was not a bank reference letter. A bank reference letter will give an opinion as to wherther, in their opinion that you will be able to pay the service charges. I can see other high street banks do provide these bank references, i called Monzo and i have been unabel to find anyone that says that they do this. I dont even mind of there is a change, help…

Ask in app for a bespoke letter clarifying the above, if it’s plausible for them to do so.

Sounds like the management company being awkward for no reason.

thanks, I did try though the app, but was sent the standard ’ have have an account letter’ i went back many times to explain this was in sufficient, but had to give up due to what seemed like lack of understanding on their part.

This seems nonsensical. A management company should have no influence on your purchase of a property; if you decide to not pay their service charge for whatever reason then they will have a process to handle that. They shouldn’t be demanding proof you can pay!

According to my solicitor its quite common practise in central london

I’ve never known us do this - I’m not sure who, on our side, would be qualified to judge that you’d be able to make the payments ![]()

Surely payslips would be better to judge if you can afford something? Seems a bizarre of a request.

thanks for the responses, they are insisting on a Bank Reference. @Monzo - can you provide this ?

Well having never heard of one a quick Google shows this is obviously a thing banks know how to provide:

Nationwide do it themselves not the customer:

Though other banks don’t seem to have much information online.

All main high street banks provide this type of service, its been around for many years.

Interesting - I’ve never been asked to provide this to any sort of agency so my personal experience is zero.

I’ve checked internally, and this isn’t something that we can provide at Monzo.

Speaking as the PSC with operational responsibility for the management company of our small private estate, it’s only necessary to ensure that a sale cannot proceed when there are service charge arrears - thus making sure that the seller pays any outstanding service charge arrears before or upon completion of the sale. We would do this in the first instance by withholding the issue of sales information pack that is needed by the conveyancer until payment of any arrears is made or a signed agreement is made to settle out of completion funds. We do not seek bank references for a purchaser, but a purchaser must enter into a deed of covenant with us that is effectively a promise to pay. If they don’t pay, we could pursue legal action but preventing a sale seems like a more powerful tool!

Never heard of this in banking until today.

It’s in some way, asking the bank to take responsibility if the customer doesn’t pay. Blame game. “Monzo said you’d pay”.

It’s ridiculous and the whole concept of it should be scrapped.

A Banker’s Reference did used to be a bit of a thing back in the day (I’m thinking back to the mid to late 1970s when my first job was as a bank clerk at Modland Bank!). But I don’t recall it being a BIG thing back then. Certainly not for personal customers anyway. My recollection was that it was more of a B2B thing.

I would have thought nowadays for any business that wants to get assurance about a customer’s creditworthiness (either a business or a personal customer) that there might be a way to get a proper CRA credit check done? I dunno if that’s possible via a 3rd party?

The other thing to note of course is that a banker’s reference of creditworthiness was only based on past performance and not a guarantee of future performance! As with investments, events can make life can go down as well as up…

Or needs to be changed.

This is the way.

Sounds like the management company is stuck in the old times and needs a shift to come up to scratch.

In fairness, if their mortgage application approval wasn’t enough to give them confidence on the buyers ability to pay their bills, not sure how a letter (that won’t stand in any court of law) will make them feel better?

Exactly. Or, as I posted earlier, do what we do: effectively deal with service charge arrears by

- either taking legal action against an owner to recover the debt,

- or by preventing a sale until service charge arrears are settled.

Pointless to bankers reference or credit check buyers - they may be of good standing today but nothing guarantees they will be tomorrow!

Suggesting it needs changing, not forcing other banks to make up letters with zero enforcement, is a response to “Monzo needs to change their ways and follow the other banks”.

It can’t be fixed in an instant, it would take years and people just refusing to buy to make them reconsider. Management/Service charges and such, also shouldn’t exist but that’s another matter.

The customer involved will need to ask their other bank (if applicable) to write it for them, or whatever other approach, but monzo isn’t the one.

I understand (barely) a management company withholding consent to a sale because of unpaid service charge fees. But withholding consent because they want to conduct their own financial checks on the buyer separate to those conducted by the mortgage provider and solicitors is surely outrageous! If I was the seller and I lost a sale because of this (especially in this market) I’d be fuming.

Not that this solves anyone here’s problem. If they have that right and they won’t approve the sale, and Monzo won’t issue the reference (which they should but for some reason can’t) it’s lose-lose for everyone with a stake in the transaction.

See also the existing conditions health insurance thread, and various others. None of these things inspire confidence to completely ditch the high street banks.

Sometimes it feels like you’re choosing an unbranded but of electronic equipment from eBay rather than the real thing from Amazon: shiny, lots of features that perhaps you don’t really need, cheaper, but lacking when you try to use it day to day.

If it helps, appears even some high street banks don’t provide these:

I’d be curious who does in this case. There must be ways around it or the landlord/agency is severely limiting those who can move in.

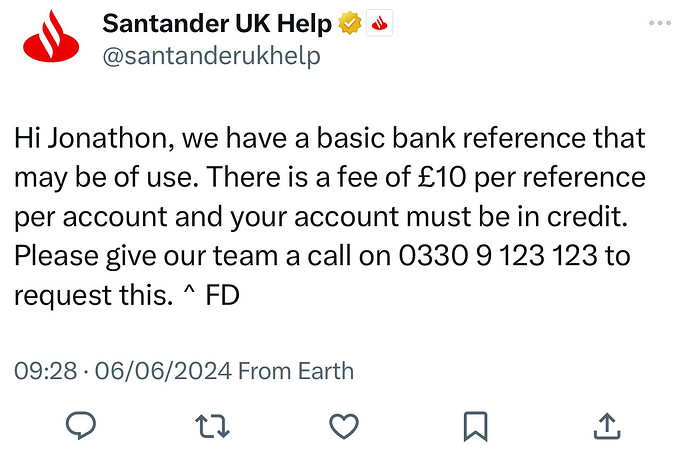

Update: seems there is something they do; the fact there was a delay makes me think someone spoke to someone about this unknown “bank reference” and someone somewhere said “oh I think I’ve heard of something like that”: