They offered energy switching it the past as well. I think removed due to energy crisis.

Credit card purchases verifications via SMS only…

You won’t be able to transfer credit card balance to another lender… as transfers not supported. So be aware ![]()

Maybe a silly question, but how long do you have to add money to a boosted pot, or can you keep adding for the whole period?

From a deposit point of view it’s just like an easy access account. You can keep adding money indefinitely or you can add no money (beyond the initial deposit). It’s up to you. The only difference to an easy access account is you need to give notice to convert the account from a boosted pot to a regular pot before you can withdraw.

It’s not like a fixed term account or regular saver where there are restrictions on when you can deposit funds.

There is however a £50k deposit limit across your smart saver account.

Yes, I was mixing these up. Interesting. So, you could make a deposit and then immediately give notice, then open another when that ends and immediately give notice… Rinse and repeat, at least if you expect rates to keep going up

Indeed. I have pots for various terms running concurrently, and switch or give notice as they become more or less competitive.

Exactly what I am doing. I have Boosted 31 and Boosted 95 pots.

Customer service and response time does not seem to be great though, as I am now discovering. Certainly not the advertised ‘few minutes’.

So seems like everything is fine, as long as it is completely straightforward. However, queries are problematic. Seems familiar…

Not needed it yet.

As you say, it’s when you need CS that you find out just how a good a “deal” some rates are.

How instant are bank transfers to/from the EA account?

Not super instant like some. Minutes rather than seconds, but certainly not slow enough to be an issue in my experience.

Also notice pot maturity is effected very quickly. Funds available early the same day, if you want to look in the wee small hours. i.e. a couple of hours after midnight, or earlier.

Other accounts are sometimes not available until much later the day AFTER maturity.

Good to know, thanks. I’ve already split my savings between the various notice pots with some left easy access, just in case.

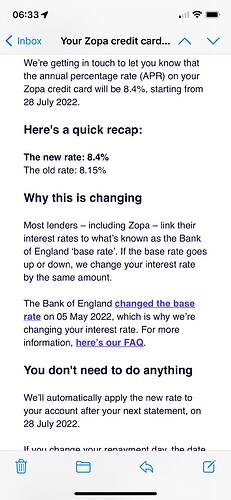

Zopa now showing in app

Primary 1.81%

7 notice 1.85%

31 day notice 1.95%

95 day notice 2.05%

Chase destroyed now

Using them for the final few weeks for the 1% cash back and then I’ll have no need.

Recently transfer my savings out to VM… might need to look again ![]()

Same

I have now put all my savings in Zopa

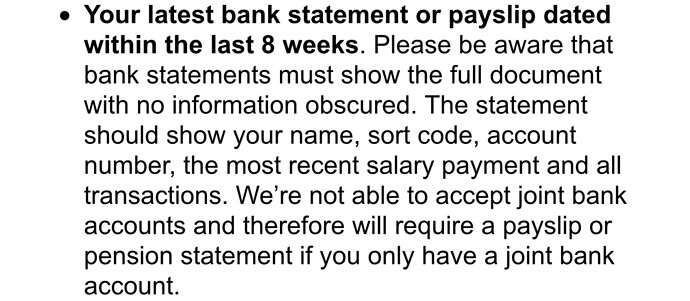

One thing I dislike about them however is being unable to even redact things on your bank statement. Frankly all they need to see is that salary going in is XYZ:

Before it’s said, they also accept just a payslip so they don’t need to see outgoings, just the income.

I guess because maybe your partner could have higher income and you could “pretend” that is your income.

Oh I think this is only for their lending - loans/credit card etc.