I’ve not tried closing it, I’m just leaving it empty.

Don’t quote me, but I believe you can open as many ISA accounts as you want, just don’t deposit any money.

I’ve not deposited any money in my Monzo ISA

I think I opened mine with a quid

Vanguard global all cap is all you need.

Hello everyone ![]()

I’m Tinashe, a backend engineer working on Investments. Just wanted to say a huge thank you for all your feedback so far.

We’ve been listening and that’s why today I’m excited to announce a highly requested feature - fund switching!

![]() You can now change the fund your Investment Pot invests in

You can now change the fund your Investment Pot invests in

Picked the Careful fund but now feeling more Adventurous? You can switch from one fund to another in just a few taps.

How to switch fund

You’ll need to be on at least Android app version 5.46.0 or iOS app version 5.47.0.

Once you’re on the correct app version, head over to your Investment Pot and scroll down to the fund details section where you’ll see a ‘Switch fund’ button.

The value of your investments could go up or down and you could get back less than you put in.

UK residents only, Ts&Cs apply. You need a Monzo current account to use Investments.

Hey @tinashe … That’s great and the process looks really smooth…

I note it says a switch can take up to 8 days to complete… Can you elaborate on the background processes involved in switching funds? I guess it involves selling units in the existing funds and when that settles, buying units in the new fund? I’m interested in knowing how long each step takes to get to 8 days…

It’s not something I intend doing, but I anticipate a fair few customers flip flopping around ![]()

Hey @caribo, glad you found the process smooth! ![]()

Yes that’s correct, the current fund is sold first and then the new fund is bought. It can take up to 8 days due to weekends and bank holidays, but it should typically be quicker than that.

I cant see why, you can do it on Vanguard or AJ Bell as much as you like. Its your money. The issue comes down to timing. You can miss out on some rises (or falls) with that delay in sale.

@WhyAydan ![]() There are no penalties or limits to the amount of switches you can do

There are no penalties or limits to the amount of switches you can do ![]()

Here are how the funds have performed over the last 5 years. None of them matching a typical ‘all world’ index (that said the market has been good).

Holy contrast Batman!

Hi @tinashe, are there any requirements for someone to open an investment account?

Do you have to be full in Monzo or have your salary coming in or anything like that?

I’m currently being shown that an Investment Pot can’t be opened, I’m seeing this screen since Investments were launched.

p.s.

I don’t use Monzo as my main account (salary account) but do use it to make some payments to my credit cards and transfer money to friends (for things like lunch, birthdays etc)

I can’t seem to get an answer on why this is not working for me ![]()

Because they don’t think you can afford to invest.

It will be this and that they don’t know or can’t find enough information about you.

If you used Monzo as your main account they’d understand more about how much you get paid, expenses like bills and mortgage - and in general your overall affordability.

Oh interesting so they treat it like a credit/loan etc I assumed if I have money to invest, I should be fine, but if that’s the case it make sense I why I’m not currently eligible, as I have several 0% purchase credit cards that I use to over 50% and keep I my cash in saving accounts and ride the high interest rate wave ![]()

I have my mortgage linked already, so I would assume they already get that information from the credit agencies etc and that i have 0 missed payments etc but indeed my credit score is not that great now.

Well in that case I’ll continue to invest with HSBC, and hopefully in the future once I pay the 0% credit cards they might let me open one here as well, I’d rather have my investments spread over different providers etc

Thanks all for the replies

I was able to open a GIA when I was barely using Monzo for anything.

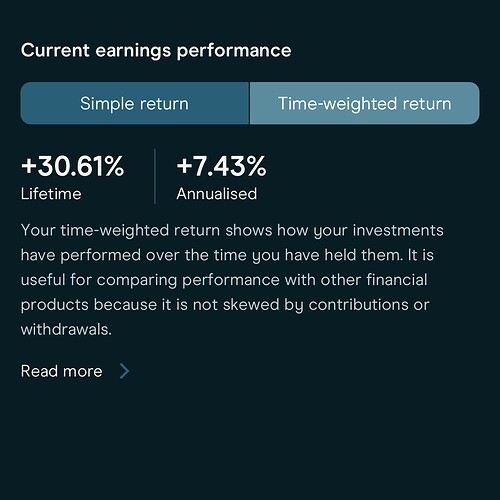

What you’re looking for is what’s called the Time Weighted Rate of Return (TWRR). Very few platforms offer it unfortunately.

These graphs are fairly pointless for men. I invest irregular months but just about monthly. This looks like my investments have grown hugely which they have in monetary value but only because of continued investment. I’d like to see a graph showing the performance over time. So they could just graph the gain amount, not the total value.