Hey everyone ![]()

I’m Liz from the Subscriptions team, and I’ve got some exciting news about Monzo’s Saving Challenge. It’s back, and it’s bigger and better than ever.

After the overwhelming love we saw for the 1p Saving Challenge in 2025, we knew we had to bring it back – but with some shiny new upgrades ![]()

How the Saving Challenge works

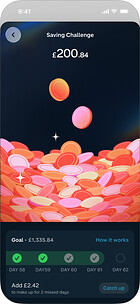

Join the challenge and we’ll move 1p from your personal account to your Challenge Pot on day one. Then 2p on day two, 3p on day three, and so on. On day 30, you’ll have £4.65. Halfway through, you’ll have £168.36.

Make it to day 365 of your challenge and you’ll have saved £667.95 and be in with a chance to win £10,000. You can find the full prize draw rules below.

Your challenge will last for 365 days from the day you save your first penny. You can withdraw your savings, pause or stop your challenge anytime.

If you’ve still got a Saving Challenge running from 2025, you can start the 2026 challenge alongside it, or end it early and dive into the 2026 challenge for a fresh start.

New year, new levels – plus a new rate for Extra, Perks and Max customers

This year, you get even more as a Monzo Extra, Perks and Max customer:

A new rate for your Challenge Pot:

Earn 5.0% AER (variable) interest on Challenge Pot savings (paid monthly into your Challenge Pot). That’s higher than your existing boosted rate of 3.50% AER (variable), which is still the rate on our Instant Access Savings Pots and an Instant Access Cash ISA.

More monthly prizes:

Get the chance to win one of one hundred £100 prizes every month (that’s 10x more prizes than 2025, and on top of the £10,000 prize draw).You can find the full prize draw rules below.

2x or 4x your challenge:

You can 2x your daily savings to reach £1,334.90. Or 4x your daily savings to reach a huge £2,671.80.

You can switch levels at any time and your new level will start from the next day. So if you switch to the 2x level on day 10, you’ll save 22p on day 11.

Prize draw rules:

For a chance to win £10,000, start by 11:59:59pm on 31 January 2026. You’ll need to have at least £667.95 (excluding interest) in your Challenge Pot and have caught up on all your daily savings at 11:59pm on day 365 of your challenge. If you’re saving 2x or 4x, your saving goal will be higher. The prize draw will be on 1 Feb 2027.

For a chance to win the monthly prize draw, start by 11:59:59pm on 31 January 2026. You must have Monzo Extra, Perks or Max (excluding free trials). No matter your saving level, you’ll need to have caught up on all your daily savings by the end of the month.

For both draws: UK residents • Aged 18+ • One entry per person • You must have a Monzo personal account • Paid plans from £3 a month • Challenge and prize Ts&Cs apply

We’d love to hear your thoughts! If you’ll be taking part this year, what are you saving up for?

Happy Saving,

Liz