It did pop up for me yesterday when confirming adding a Monzo card to Apple Pay, which seems sensible.

I suspect that this measure is coming in because they are soon to be offering a savings account.

Think it’s just easy access 4% space coming at the end of the month.

They’ve probably done a cost analysis and spotted an easy access would be cheaper for them.

“Move to another bank”

They’ll say nothing. Ringing them won’t change it.

Kroo are paying 3.85% at the moment and has most of the Starling functionality for personal use (no business account, no Euro account).

And that’s why they will hint at “being competitive” and won’t care.

Probably a good habit for you is to put savings where savings need to be, instead of relying on one pot.

What for? What are you expecting them to say that hasn’t already been said here?

You are going to go bonkers opening accounts when you hit 18 ![]()

Da fuq is trello?

Trello = Kanban style planner. Monzo (UK) used it in the early days to present what was being worked on and what projected timescales were involved with them.

Imagine that now!

Monzo US may have a Trello board, not sure.

EDIT: Monzo US does have a development board (not a Trello one though):

Well I hope I’m still around to watch it all happen ![]() 2 years seems forever away but in reality, it’ll feel like this convo was yesterday.

2 years seems forever away but in reality, it’ll feel like this convo was yesterday.

Just space them out.

If you enroll in uni, you can add a student credit card and overdraft from the August before the course starts. UCAS give you a code to validate your student status. Usually only one student account (sometimes more if you get the application sequence correct).

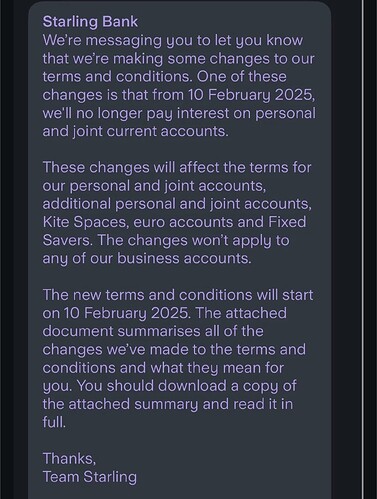

Very disappointing. We’d moved all our joint banking over to Starling 12 months ago so we didn’t have to worry about missing out on interest with money sitting in the main current account. I can’t see how it could make sense to announce this just before announcing a new high interest savings product as they’ll now be losing customers they didn’t need to should they have announced the new savings product first.

They have announced the new Instead Access Savers account though. We know it’ll be 4% interest and it’ll almost definitely be launched on or before the 10th Feb. I would hope Starling would be forward thinking enough to launch it quite a bit before the 10th Feb to allow people who have been ‘storing’ money in their current accounts Spaces time to setup the new Savings Account and transfer it over into there. Or else they might have a capacity problem if they make everyone wait until the 10th and then get them all to move over at once…

Although - has anyone else actually had that notification from Starling yet about the removal of interest from the current account? I’ve not received it yet

Yes. At least when I was a student. It was many moons ago mind you but they were specific about only one student account being allowed. If you had one elsewhere you were not eligible for theirs.

Another organisation ordering people to work in an office despite not having sufficient space for them.

But the bank, which operates online only, admitted that some of its offices would not be equipped to handle the influx.

I’m glad I don’t have to put up with management like that any more.

The staff shouldn’t resign, they should organise so that they all turn up on the same days.

When I was as young as @jo, the loss of interest would have got me switching away instantly.

It has been nice to get something on our small current account balance, but its not ulitmately the reason I use Starling as my main account.

They still have a great banking product which I still think meets our needs better than anyone else.