This is great feedback ![]() I should have got back to you sooner…

I should have got back to you sooner…

anyway

that sounds good to me!

Monzo has this already ![]() it’s opt in & if you don’t have a data connection, Monzo is smart enough to check other indicators too (much smarter than your legacy bank anyway) -

it’s opt in & if you don’t have a data connection, Monzo is smart enough to check other indicators too (much smarter than your legacy bank anyway) -

Monzo disables Magstripe withdrawals by default but they can be temporarily enabled.

Some of the other community members have already followed up on this point but since you mentioned it -

Text from this blog post.

The magnetic stripe on the back of your card contains information about your card, including the long number on the front (your ‘Primary Account Number’) and your card verification code (CVC). Because this isn’t encrypted, fraudsters can easily steal it by using ‘skimmers’ attached to legitimate ATMs or payment terminals and print it onto the magnetic stripe of a blank card to make a counterfeit.

This is an interesting one - am I right in thinking that you’re worried about card clash here? Users have requested a setting to disable contactless for this reason before, does Revolut’s work for this? I’m not 100% sure that a setting that’s controlled by the issuer would work for this - I genuinely don’t know.

same here ![]()

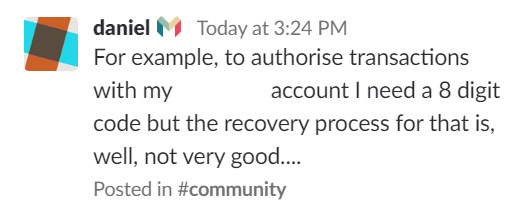

I don’t think it is, the problem is the added friction & the fact that it could actually make the app less secure, if it’s relied upon to protect features within the app - funnily enough, this came up today in the developer’s Slack channel & Daniel (one of the Monzo team), pointed out that it’s the recovery process, if the user forgets their PIN, that’s likely to be the weak spot…

Even I’m surprised that Monzo’s beating Amex in this area - that’s great to hear!

Fair enough…it’s worth remembering that Monzo has a Holiday category that you can automatically assign your transactions to, to separate them from the rest of your spending too though…[quote=“mk1, post:16, topic:7427”]

Just want to give feedback to help.

Hope that helps clarify

[/quote]

As I said, this was great feedback, thanks for putting so much thought into it ![]()