Makes sense. Thanks  Still, I don’t know the last time in the UK I needed to use the magstripe so would gladly have it disabled most the time if that’s a risk.

Still, I don’t know the last time in the UK I needed to use the magstripe so would gladly have it disabled most the time if that’s a risk.

A tab for months of spending would be good

I agree a pin would be good

This is great feedback ![]() I should have got back to you sooner…

I should have got back to you sooner…

anyway

that sounds good to me!

Monzo has this already ![]() it’s opt in & if you don’t have a data connection, Monzo is smart enough to check other indicators too (much smarter than your legacy bank anyway) -

it’s opt in & if you don’t have a data connection, Monzo is smart enough to check other indicators too (much smarter than your legacy bank anyway) -

Monzo disables Magstripe withdrawals by default but they can be temporarily enabled.

Some of the other community members have already followed up on this point but since you mentioned it -

Text from this blog post.

The magnetic stripe on the back of your card contains information about your card, including the long number on the front (your ‘Primary Account Number’) and your card verification code (CVC). Because this isn’t encrypted, fraudsters can easily steal it by using ‘skimmers’ attached to legitimate ATMs or payment terminals and print it onto the magnetic stripe of a blank card to make a counterfeit.

This is an interesting one - am I right in thinking that you’re worried about card clash here? Users have requested a setting to disable contactless for this reason before, does Revolut’s work for this? I’m not 100% sure that a setting that’s controlled by the issuer would work for this - I genuinely don’t know.

same here ![]()

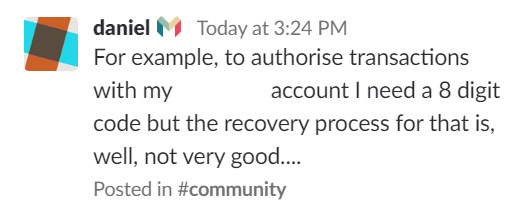

I don’t think it is, the problem is the added friction & the fact that it could actually make the app less secure, if it’s relied upon to protect features within the app - funnily enough, this came up today in the developer’s Slack channel & Daniel (one of the Monzo team), pointed out that it’s the recovery process, if the user forgets their PIN, that’s likely to be the weak spot…

Even I’m surprised that Monzo’s beating Amex in this area - that’s great to hear!

Fair enough…it’s worth remembering that Monzo has a Holiday category that you can automatically assign your transactions to, to separate them from the rest of your spending too though…[quote=“mk1, post:16, topic:7427”]

Just want to give feedback to help.

Hope that helps clarify

[/quote]

As I said, this was great feedback, thanks for putting so much thought into it ![]()

I’m guessing you’re on Android ![]() (iOS users have this feature) & it’s in the works for Android -

(iOS users have this feature) & it’s in the works for Android -

To avoid card clash on contactless, you’d have to actually disable the contactless mode on the cards you don’t want to use. It’s unlikely an app switch would do that - it’s more likely to simply deny the transaction when presented for authentication, and so useless for preventing card clash.

As a moderately paranoid user, I actually have an RFID shielded wallet - what I’d love is a pocket on the outside of it that isn’t shielded so I can put the card I typically use for everyday transactions in there and just wave my wallet.

At least until my kerv gets here… if it ever does.

Was it called Kerv when it was on Kickstarter?

I believe so.

Just been told mine will be shipped in the next 2 weeks. I’m not holding my breath!

It looks like a similar thing to the bpay stuff from Barclays.

I used that for a time but their app was rubbish.

Hmmmm I can’t seem to find it on Kickstarter.

In any case let us know, if or when it ever arrives and your first

impressions of it. (After you have used it of course.)

Probably why?

Kerv – the world’s first contactless payment ring is the subject of an intellectual property dispute and is currently unavailable.

@anon95535793 There was discussion around the changing of the PIN in app somewhere and the reply from Monzo was that it wasn’t working in the best way.

When you change your PIN, it needs to be written to the chip. For this to happen, it needs to be entered into a physical device, connected to a network. So the workflow would be something like this…

Current PIN 1234

Change PIN in app to 4321

Enter card info Chip & PIN terminal

Enter 4321

PIN incorrect, try again

Enter 4321

PIN correct

It’s not ideal, and would lead to confusion was the main takeaway from it I believe. I’m not sure how Revolt have managed to get around this problem (assuming they have).

I cannot remember who or where this discssion was, but if anyone finds it feel free to connect the posts up.

Ok at least I now know why I couldn’t find it.

Hey, sorry for the delay in my reply. Glad it was helpful. As I said, it is really a first impressions thing and I wouldn’t say that the title of this thread matches my thoughts - otherwise I wouldn’t bother sticking around

Interesting about the location based security. I thought I’d heard that but can’t find the option in the app.

Ah the contactless point is interesting. I only really use Revolut abroad so haven’t actually tested the card clash issue, I just saw the option and thought “great idea”!.. but perhaps it is not as useful as I thought then… (if the issue with card clash is the interference between two cards in close proximity whereas all this prevents is the authorisation… maybe I should test this!

As far as beating AmEx, I’m testing it as an experiment to get some insight. We’ll see how it lives up. I must say that I hope to see some advances in the spend tracking in the future as it’s a bit limited right now. Main points here:

- be able to assign money given to/received from friends to a category - even if this means having to fudge it with cash withdrawals/top ups since I can’t do the money transfer through the app. But since top ups can’t be assigned, this breaks the whole workflow

- custom categories. For example, I’d like to have a category for a couple of hobbies to track them. I get that you probably want to discourage lots of fine grained categories as these can be harder to use, but some level of customisation would be great

interesting thanks, yeah I’m pretty sure I didn’t have that issue with Revolut, I wonder how they solved it. I’ll try to remember to check! I can understand that they would prefer to avoid that if seen as too confusing for some.

Glad to hear it ![]()

I’m not sure about the Android app but the option’s here in the settings menu for iOS users ![]()

Please do! I’d be interested to hear how you get on.

Both are popular requests & Monzo are working on solutions to these problems, although it sounds like the team’s struggled to agree on a version / alternative to custom categories so far…

FYI, I tried this and indeed it does still clash - so not as important as I thought ![]()

I agree with you that be cool

agree. Scrolling thru is a pain and will get worse when the current account history lasts a few years. Better to ditch material design and create something more user friendly, scrolling accross rather than down

I’ve got a Revolut and Monzo card. Monzo is playing catch up on two things for me (and perhaps this is just me and what I end up using the app for)

- I don’t like in Monzo how you can’t top up in precise amounts. Instead it has to be on increments of ten.

- i can pay my bank account or other people’s bank account directly from the app on Revolut. Can’t do this in Monzo.

Otherwise so far so good