when will capital one be added?

As above. Once APIs become available from the individual companies, Monzo will start to look at them.

Don’t expect anything in the next few months would be my advice.

The app is currently reporting my Lloyds account balance as my credit card balance. Almost had a heart attack this morning when I saw it.

Not sure what details you need from me to diagnose this.

Hey Adam, sorry for the shock!

This is an issue TrueLayer are working to investigate currently, it is something that can happen very occasionally when using screen scraping. It will usually fix itself with the next automatic refresh.

No need to send anything over, but thanks for reporting.

Not a problem. Thanks for the quick reply.

Just added the Halifax card but can’t see any balance anywhere. if it’s supposed to be under Accounts it hasn’t worked. It did say account added.

My mistake: I was under my joint account. Switched to personal and Halifax appears perfectly! Thanks Monzo

Also hoping MBNA will be added soon. Massive client base.

To be clear, no-one will be added unless TrueLayer write a new access routine for a new provided. This seems unlikely considering where we are with the mandatory API requirement this September.

Never say never, but…

I’ve already had issues with Tesco on Emma_finance. I removed them due to their security procedures as I had to request the OTA code every refresh of Emma. Could this be the same with Monzo etc if they want to add Tesco? Will this flow down to other credit cards/banks using fintech apps?

In theory this is what the proper API driven open banking approach will solve. As there isn’t any screen scraping you should just have to authenticate once (although you might need to refresh every 90 days or so).

I cannot see the option in Monzo Labs, am I missing something. I reinstalled the app…

It’s not in labs anymore so the advice above is the only way to ‘jump the queue’.

Apologies - I’m sure this has been discussed above but are we looking at Sept for Amex integration? I use an Amex Plat for most of my expenses and given I’m getting their metal card next week, I imagine I will be pushing more expenses on to it.

Yes - September is the deadline for Card Providers to offer APIs.

Amex may release theirs sooner than that - but it’s not something we can speed up on our side really.

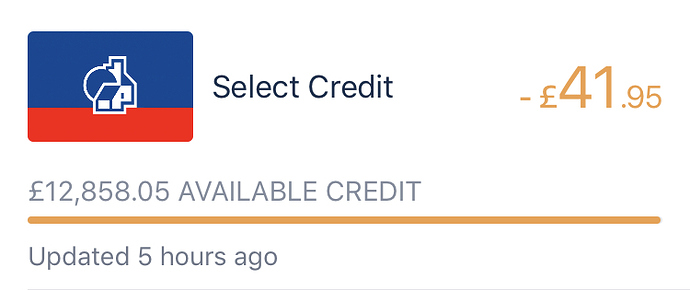

@anon41842569 might just be me but the bar showing available balance seems to be the wrong way round. To me I’d expect to see the bar moving up based on the balance not the amount available.

This was all discussed above a week or three ago.

For the moment, it works as a ‘fuel guage’ type thing where “full” means “your entire balance is available” and it slowly “empties” as the balance is used up.

I get the logic. Visually my eyes don’t match what my brain tells me (which isn’t difficult

)

)

Needless to say, there were people who supported both interpretations as far as I remember. I’m used to this now and think of it as an indication of my ‘available credit’ rather than of ‘outstanding debt’.

Just out of curiosity, is there any reason you’ve not opened up Amex through Truelayer after the blip they had? I know 1 sample isn’t a good data set but my integration with Amex has been fine through Truelayer since then.