In the account summary it tells me I’ll have £x left to spend, presumably because it knows what payments and spending is likely to happen before my next salary payment comes in. If so, then why not show it? I’m suggesting a breakdown of the items the system is using to base its conclusion on.

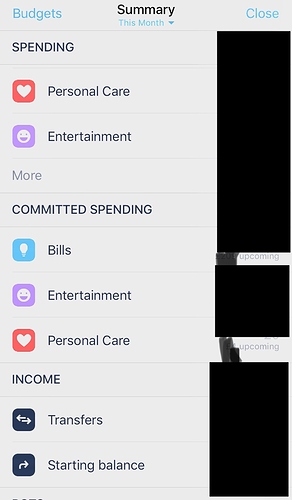

Do you mean the committed spending? That’s at the bottom of the summary page. If you’ve created a budget it’s based on that

It’s not at the bottom of my page. I’ve not created a budget, but the app is telling be how much I’ve got to spend until the end of the month. However it’s not telling me what that is based on. I want to see the break down. The specifics.

The specifics on the new nav in app are on payments (middle tab at the bottom) and then payments (middle tab at the top)

The general committed spending is in summary but that gives you the category only and the amount upcoming

If you have no recurring payments then it’s just based on how much you have in your account

There are in app help articles

Thanks for that. In that doc it says that the amount is based on your current balance minus upcoming payments. If it knows what those payments are, then specify them on this page. That’s all I’m asking for.

But they are specified, on the payments tab.

Or by tapping the bills or other categoriesin the committed spending section of the summary.

Are you seeing something different in your app?

That’s a different tab though, no? My suggestion is to see them in the same place that it is giving me the advice about how much money I have left.

I do appreciate the suggestions and workarounds, but if it amounts to ‘do something different’ then it’s not really helpful to me. When I’m in the place where it’s giving me an approximation of how much money I’ll have left, them give me the specifics there as well.

It’s on the summary tab, where the left to spend figure is. All the transactions on that page both spent and left to spend are behind the categories they belong to, otherwise you’d just have a huge list of hundreds of transactions and upcoming committed spending.

It’s not on mine. On that page I see a number of things, but none of them add up to the amount it’s telling me it knows I’ll be spending. I’m on the Android app. Perhaps it’s different for you, but for me the number I’m expecting to see isn’t there.

Do you have any committed spending that you’ve marked as recurring?

In that case it works out what you’ve send and assumes you keep spending at the same rate. If you spend £1500 in the first week it will assume you’ll keep on that spending that much. It’ll adjust as the month goes on

In your case it’s divided the start balance by 31 days, giving you an average per day. If you don’t spend it then it’s set to be left over

In the case of this account I don’t spend anything that isn’t a recurring expense, so it’ll be calculated based on what I did other months plus the scheduled things like direct debits and subscriptions. Is it really too much to ask for those things to be detailed on the page where it’s telling me the estimate of how much money will be left?

I was under the impression that this forum was to suggest changes and improvements, but if all doing that causes is members to suggest why things can stay as they are, I’m not seeing the use.

The forum is there to discuss ideas, in part, I agree. That’s what’s happening here.

But have you marked them as recurring or are you assuming it’ll just know?

I’m trying to explain that what I believe you are requesting is there if you have marked them as recurring. If you’ve done that and it’s not showing then there’s a bug

But have you marked them as recurring or are you assuming it’ll just know?

Does that matter? The summary is giving me a figure based on some calculations. All I’m suggesting is for the transactions it’s basing the figure on to be listed without me leaving that area of the app.

It’s not listing them as you haven’t told it what to count. I explained earlier how it’s working it out since you haven’t done that

I also did explain that I am suggesting that it changes how and what is displayed. Can I not do that here?

There’s two ways summary can work:

- The left to spend figure is your total balance minus your committed spend (which should be at the bottom of your summary page when you scroll down) and your transactions to date

- If you’ve set an explicit budget, the left to spend figure will be that budget minus your transactions. Committed spend is not taken into account.

The problem with the latter approach is that if you’ve less money in your account than budget you’ve set you can go into your overdraft without realising

No, that’s not correct either. I could go through all the figures here with you all, but take it from me. It’s not showing what the calculation is based on. That’s all I want to be able to see and the app isn’t showing it

Yeah, it’s not that intuitive I agree.

It took me a couple of months to get my head around what’s included etc. I can go into more explicit detail.

If you’ve set a monthly budget, it just takes your transactions that are not committed spend away from the monthly total.

If you’ve not set a monthly budget, that figure will be your balance at the start of the budgeting period, minus committed spends, minus transactions to date.

I am indeed saying that this not my balance.

I am quite aware of what people are trying to do and add I said I do appreciate it BUT I didn’t post this on the help section.

I posted it on the suggestions area because I want it to be a suggestion. Can you let it be that and stop trying to tell me how to work how the app currently works?