Hey everyone, I’m Law! ![]()

I’ve been building something I think some of you might find genuinely useful.

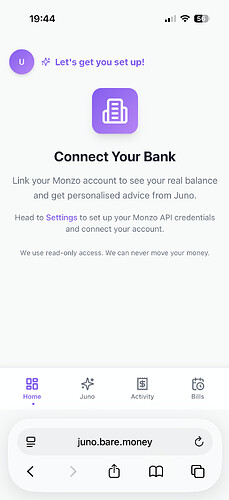

It’s called Juno, a privacy-first budgeting companion that plugs into your Monzo account and tells you the actual amount you can safely spend today, not just your balance.

![]() Try it here: https://juno.bare.money

Try it here: https://juno.bare.money

What Juno does

What Juno does

Juno calculates your Safe to Spend using:

• your current balance

• all bills due before your next payday

• any expected shortfalls

• your personal buffer

No more trying to mentally subtract bills every time you look at your balance.

Other features

![]() Bill detection

Bill detection

Spots upcoming recurring payments.

![]() Income detection

Income detection

Identifies your salary pattern, whether monthly or weekly.

![]() AI money coach

AI money coach

Personality modes: Brutal, Balanced, and Gentle. Straight talking by design.

![]() Privacy-first

Privacy-first

You use your own Monzo developer credentials.

Everything is read-only.

Tokens are encrypted at rest with AES-256.

![]() Works as a PWA

Works as a PWA

Installable, mobile-friendly, and fast.

Why I built it

Why I built it

I was frustrated by budgeting apps that show your balance but not your situation.

£500 looks fine… until £450 of bills drop tomorrow.

Juno gives you the truth.

Feedback I’m looking for

Feedback I’m looking for

• Is Safe to Spend actually useful for you?

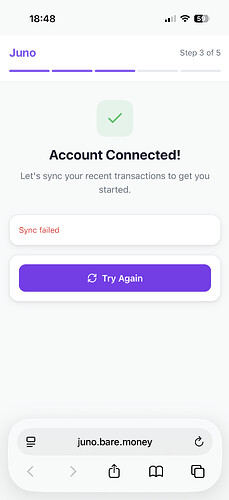

• Any confusing or rough parts in onboarding?

• Anything you’d expect in a tool like this that is missing?

• Anything that instantly put you off?

• Does the AI coach feel helpful or gimmicky?

I’m genuinely looking for honest feedback, even the harsh stuff.

For the tech-curious

For the tech-curious

• Next.js

• React

• Prisma

• PostgreSQL

• AES-256 token encryption

• Anthropic Claude

• PWA with Capacitor

Fun little extra

Fun little extra

As a small thank you, the first 10 people who try it and share feedback will get a tiny Beta Tester badge in their Juno profile.

Nothing fancy, just a fun nod that you were here at the start.

Would love your thoughts

Would love your thoughts

![]() Try it here: https://juno.bare.money

Try it here: https://juno.bare.money

Roast it, break it, tell me what sucks. Everything helps.

If you want to read the privacy or security details first, the info site is here:

https://bare.money

I originally built this for myself, but figured it might help others too, It’s very much work in progress, so don’t be too harsh on me! ![]()

🔧 Quick Juno Update! 30/11/2025

A bunch of improvements have just gone live to make the Monzo connection much smoother and more reliable:

• OAuth approval is now handled properly, so setup works without timing issues

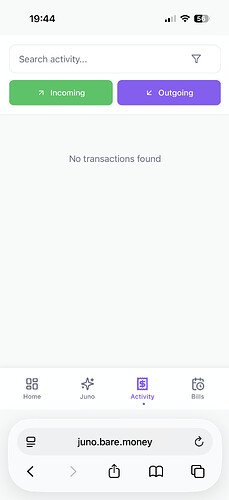

• Activity page now loads your transactions correctly

• Recent transactions always appear (newest-first sync, with better history backfill)

• Initial sync now fetches a much more complete history

• Faster updates thanks to transaction notifications

• Overall Monzo connection flow is more stable and consistent

If anything gets stuck, a quick disconnect and reconnect in Settings will refresh everything.

Thanks again to everyone testing and sending feedback — it’s been incredibly helpful!