good to see some improvements - I’d like to see dark mode & an option to dismiss the chat feature

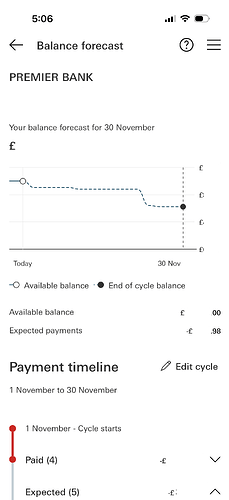

Quite a nice implementation.

Another reason I mostly regret moving away from HSBC, really like that implementation.

Could you not return to HSBC?

Well, I could. I just can’t be bothered moving banks again, I was with them for 2.5 years before the premier changes tempted me to move to Lloyds.

Lloyds do a decent enough job also to be fair.

I tried to get HSBC Expat when I lived in Jersey but getting an account felt like a police investigation and also found out they don’t give out Debit Cards anymore.

I might give HSBC a go again but a proper UK account not the Expat one.

How does that work out if you open an account?

You have to open a Global Money Account for debit card access with HSBC Expat. They have an auto-topup option (for only one currency though). So it’s quite possible to spend with a debit card from Expat but it’s technically through a separate account to the current account you also have to open.

I also noticed that the FX rates for the Expat Global Money Account are actually worse than the standard UK Global Money Account rates, suggesting that getting the Expat card is ultimately pointless.

That kind of extends to everything between HSBC UK and Expat in my experience. Expat is usually more expensive/worse value than the UK version. There are of course some things Expat does that UK doesn’t offer, like interest-earning foreign currency savings, which is what I use them for.

As for being pointless, the point is to be able to spend/withdraw directly from Expat. I don’t do it routinely but I like having the option.

But yes, if you just want a “HSBC Global Money Account”, the UK version has much better rates.

So if you’re actually living abroad, can you just carry on using HSBC UK and (for me soon) HSBC Australia, and not bother with expat?

HSBC are one of the more friendly groups to allow multi product in different countries.

Regarding the EUR Expat account, I’m encountering a frustrating issue with transfers. Neither of the banks I tried (Revolut, Starling and two German banks) could successfully send a transfer to the provided IBAN details (and I checked the details together with expat customer service); the transfers were instantly rejected with a ‘details incorrect’ error message. To bypass this, I had to open a standard EUR currency account with HSBC UK and then make an internal transfer to the HSBC Expat account. Are you experiencing the same difficulty?

I haven’t used Expat for Euro, so I don’t know, sorry. I recall researching options when I needed to receive a euro transfer though and I don’t think Jersey/Expat is in SEPA so that might have something to do with it?

Perhaps it’s a SEPA problem then, never thought about it.

Yes, no need for an Expat account.

How are the HSBC transition notifications these days? I’ve been looking at changing my “legacy” bank away from Santander as it feels like it’ll never implement transaction notifications. First Direct was hit and miss but mostly seems to work now, I’d heard HSBC had notifications for a while but no-one talks about them so presumably… that’s a good sign?

HSBC notifications work well. I have a new account and they worked on activation, used to take a few days.