You can do this with IFTTT

This suggestion also sounds similar to what you would like:

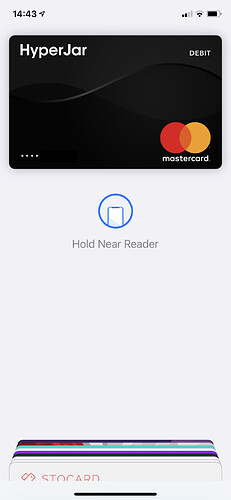

Just came across this thread, and I agree it’d be a really nice feature for Monzo to implement into the app. In the meantime, you might find HyperJar useful? You add money to your HyperJar account (it has an account number and sort code) and then can move money to different ‘Jars’ (essentially pots), and through the app select which Jar to link your HyperJar Mastercard to. Basically the exact functionality you’re describing @trevwmitchell.

You can create shared Jars with up to 30 people for pooling and spending funds. Also some retailers offer 4.8% interest if you add money to a Jar for that shop (like Lidl, Shell, Dyson, Megabus, Hive…), which basically means you’ve committed to spending that money with that merchant - with these, the money is automatically taken from that Jar when you use your card there. Pretty nice if you know you’ll be spending a significant amount with a merchant in the future.

There’s no account fee and no foreign transaction fees, but you can’t withdraw cash from an ATM.

Edit: I’ve just received my card today! Supports Apple Pay too…

I have a hyperjar account and in honesty while I do like it I have found that being with Monzo has improved my banking so much that I no longer need multiple accounts (apart from my starling account which I use solely for paying in checks cos Monzo canni be bothered to incorporate this function)

The kids accounts with hyperjar is a big bonus but not enough to lure me away from Monzo.

That’s really great!

It’s certainly not one or the other - HyperJar isn’t meant to be a bank account replacement. You can get a HyperJar Kids Card and manage their spending through that, and keep your own finances with Monzo.

I have the HyperJar card and kids cards.

Llidl is no longer a partner. Ceased 31 Dec 2020.

The account has its uses.

Absence of an app (under development) for the kids cards is a minor hindrance when your kids are young. More of an issue in teens imo.

My kids love their cards and deciding whether to spend or save their allocated funds.

Ah, thank you for pointing that out, I wasn’t aware!

As a parent, how do you feel about HyperJar Kids vs a traditional children’s savings + current account combo (which I had growing up) vs Starling Kite or Revolut Kids? Is there a lower age requirement for a HyperJar Kids card (I know it’s 11 for a current account and debit card with a normal bank)?

I think that once they bring out their Kids app, it’ll be a really solid product, but the lack of ATM withdrawals could easily be an issue if a child needs access to cash.

HyperJar kids cards are from age 6. Up to two per adult card, in app, but you can call to request extra.

I got them for mine as they live with their mom, and she has not yet been able to (or desired to) visit a local bank yet to open conventional bank accounts for them. She will do so, when she feels it safe and prudent do so.

My workaround was to get them the HyperJar Kids cards so I could fund them from my end, for them to be able to learn to budget and spend at their end, without bugging their mom all the time for cash.

The inability to even check your balance at an ATM is a downer, especially as no app, cos it means they either have to keep a note of their balance every time they spend, or contact me for it.

Successfully persuaded my ex to open a HyperJar account herself, so could “share jars” allocated to the kids. This means she can now also see how they are spending the money and their balance.

The kids cards are supposed to have no back up source jar. I toggled it off anyway just to make sure. They cannot spend what’s not in their jar. I have also created “reserve jars” for each of them. Purpose of these is to store excess savings over £50 (if they ever lucky enough to achieve that). My concern was them losing their cards and a finder/thief enjoying a Contactless spend. Not sure on HyperJar refunding any money taken this way.

The absence of ATM cash withdrawals is okay with me, for now, but may not be for older children.

No service fees is what drew me to this card for them over Starling Kite, GoHenry, etc.

Thank you for the explanation, very interesting.

(You sound like an awesome parent, by the way, as someone who went through similar things as a child)

I think this is a great idea!

I’ve booked a ski trip to France for Jan 2022, do you think Monzo will have launched this feature by then?

I’d bet a cautious yes (for paying customers).

(By which I mean, probably via a virtual card that you can hook to a pot and Google Pay. I don’t see it working with a physical card).

Also: what is this “trip” and “France” of which you speak?

Do you think France will let us Brits in by then?

I very much hope France will be letting us in, my trip was suppose to be this year but obviously a no go so we pushed if forward 1 year, the girl who owns the ski chalet is a friend of mine, she just bought the chalet business in June 2019 after working for the company for 5 years, a bumpy start is certainly not what she wished for.

I suppose a little promo on here would help her so

There’s no benefit for me but I’d love it if you mention my name, it’ll be good for brownie points if nothing else.

Also my group is a group of 3 currently so if anyone fancies joining us as I have 1 space, currently it’s 3 guys Aging from 46 - 57 and flying from Glasgow.

Revolut already introduced “Spending Pockets” (I have Android beta, so not sure if everyone got it already, but I did) what is like attaching card transactions to pots

Awesome, I just clicked the beta upgrade.

Much as this will be perfect I could simply move all my holiday budget to revolut or starling etc and use that card for my holiday spend, my end goal is to go against the old saying off having all your eggs in 1 basket, I’d love to have my banking life handled solely by Monzo without the need to go else where to solve these little problems.

This is a very interesting revenue idea. Although, I think there might be the same issues as there were with the initial implementation of locked pots.

Money placed with partners for the 4.8% interest return, cannot be withdrawn back into the wallet.

It is gone in as much as you can only spend it with that retailer/partner.

I had a Lidl one. When I shopped at Lidl, I linked my card to that Lidl Jar and my spend was taken from that Jar. When the partnership ended, HyperJar returned the Lidl funds to my wallet, plus all interest that it would have earned up to 31 March 2021. I could not add extra to the Jar when it was announced though (to try and earn extra interest), I tried

They have one for ATG, however, I can get better returns (cashback) elsewhere.

An amazing idea! Better than having a separate card. Just clicking a box to say card payments come from this pot, could have a 24hr time renewal or default to main money if there wasn’t the funds in it. Incredible feature if it happened!

I’m hoping this is ready for action by July 2022.