What is the requirement though. Presumably it is switching your main account where you have your salary paid in order to qualify for the £125. With the Chase 1% you don’t need to make it your main account, just a spend account

Sometimes. Sometimes it’s just two direct debits, and if you’re gaming the system then there are easy ways to set up £1 direct debits.

Truth is that there will be many banks paying vast sums to people who don’t stay with them ultimately.

At least this way you are forced to use the bank, it costs them less but probably brings in more money from transactions alone, and after a year you’re more likely to remain a customer.

Just returned from work to a lovely blue envelope, card looks really good

True, but it would be neater in the feeds to move the transaction itself

I feel like 1% cashback is a cheap customer acquisition platform. They did one off PR to all the consumer banking news outlets. And now the cashback reward is a dynamic customer acquisition cost that rewards more active customers.

Even if one puts single customer acquisition cost at £75, then one has to spend more than a grand a month on the card before it starts costing Chase above the acquisition cost target. But also makes such person suitable to be offered future Chase products (CC, mortgage, loans, etc).

- 1% cashback, sans 0.3% interchange, to get to £75 is like over £10,000 of spend, which is edging towards a grand a month average cause some transactions will be excluded etc.

When do you see the cash back? Is it instant?

Interesting that they don’t make you get the card sent to your home address.

They never insist you switch your main account because there is no standard definition of “main account”. Where your salary is paid into might not be the same as the one where your bills are paid from (mine isn’t).

Also a salary isn’t marked a such when it comes in, it’s just shown as a direct credit, or a Bank Giro Credit, or even, these days, maybe a faster payment. The bank might guess it’s your salary from the name and the amount, but they couldn’t say for certain.

Switch terms differ, but typically you have to switch an account with two direct debits on it, it’s as simple as that. I’ve switched about eight times for a bonus/bribe and only once switched the account with all my direct debits and I’ve never switched the account my salary is paid into. Switching bonuses are easy money.

It tracks in the reward section straight away but clears at the end of the following working day.

Clearly the transaction was excluded.

If you read the FAQ, but how many people actually read the FAQs and just click on agree/ok?

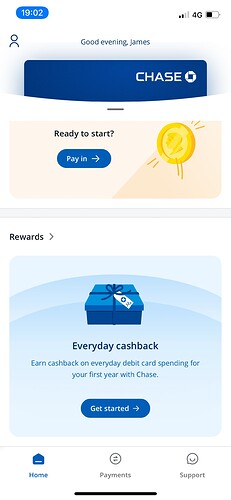

But read the wording on the second pic, clearly says first year

The pic after that says for a year with the OK button, so you naturally presume that it is for the first year and click ok

Then the FAQ contradicts the second pic

I’ve got a pending transaction that I think (very sure) should get cashback, but it’s not showing yet… Hmm

U will see cashback once it clears.

That’s what I thought. Would be a bit more fintech to show it instantly, but maybe pending

If you head to rewards at the bottom of the accounts main page, then scroll down you’ll see the list of eligible transactions.

If the transaction is not listed there it’s not eligible, but if you tap those transactions in the rewards section it tells you how much is pending for cashback.

Oddly it doesn’t tell you from the main account activity (would prefer if it did).

Ah, I hadn’t seen that! They could have tried a bit harder to hide it NOT

Yeah, a simple pending balance on the main screen would be much better

Once you open a few accounts especially, the cashback section gets pushed right down the page and it’s easy to forget it’s there. Even with just one account, it’s below everything else.

It would probably make more sense if it had it’s own tab in-app. That would really highlight the feature and help to “sell” Chase as well.

Once it’s activated, I’m quite happy for it to stay out of sight.

A bit like my hidden Save The Change pot on Monzo.