If you have the Reward silver account or above, foreign transactions are free, FYI.

I only use Chase for the cash back also so will probably do the same now.

You have all these issues and wouldn’t use Chase as main/sole, but you’re willing you spend £1500 a month with your card with a bank you have issues with for £15?

Yes.

Well it lasted while it lasted.

I’ll genuinely have to have a think about this one now.

The only thing would be that Santander charge £3 a month for (now) broadly similar account. I still want a main current account with free overseas spending.

Call me old fashioned, but I really do not like being bribed and taken for granted by any company. Or person, or party, come to that.

'Heres some short term perks to tempt you in. Once we’ve got you, we gradually phase them out, and rely on inertia to keep you. Oh, and if you ever leave, you can never come back, and you MAY lose out on some mega offers. Cheers, suckers.

Unfortunately I think most users on here are far too savvy for that. They realise that it is all a game, and that real loyalty is at a premium in this world, and is a 2 way street. Remaining focused and able to make rational financial decisions, including downsizing or leaving, is where it is at.

I won’t be using Chase debit card again then by the looks of it as still spending on my credit card atm.

I’ll keep the account open but it’ll probably stay dormant, unless I have a change of heart in a month or so.

That’s really sad. Think the only other Cashback debit card (other than curve and maybe revolut) is Santander? But that has a fee ![]()

It’s quite easy to make it back as you get cashback on utility bill DDs as well. You can also get access to the Edge saver which is about the best rate easy access at the moment.

Last month I cleared about £7.50 after the fee, not including interest on the Edge saver, just with council tax, water and electric bills plus some EV charging (with the debit card set as my Octopus payment method).

They really have gutted their offering. Went from one of the best savings rates to sub-par. Introduced minimum deposit for the cashback, limits on the cashback, and now limits to where you can earn cashback.

Couple that with it being an incomplete banking offering (no overdrafts, no joint accounts, limited access to a not very competitive credit product), it’s not looking too attractive these days in my opinion.

Well it was fun while it lasted. I marginally made more having Chase as my main account but now even with the fee I’ll make more via Santander all-in:

(Yes I have another Chase CA that I’ll keep dormant)

Trading212 is still 0.5% cash back, although not something I’ve personally used.

But apart from those shortcomings…

To be fair, it’s not just Chase. Seen it all before, eventually they just can’t help themselves.

Even after 10 years I still do not have the confidence to go all in with a fintech bank. They are useful for short term benefit, or a temporary alternative or in an emergency.

Having said that, the legacy banks do not cover themselves in glory these days, seemingly having regular outages, especially on week and month ends.

I think they are a function of the volume of transactions all at once at a period end, and bolted -on barely compatible IT systems, due to mergers and takeovers in the sector.

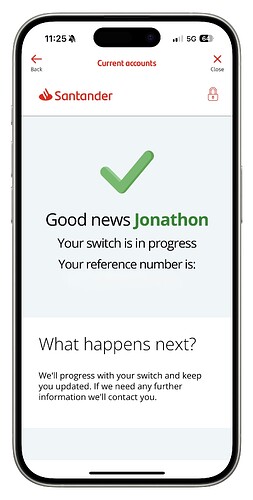

I ditched Chase last week, the party is well and truly over with them and it’s difficult to see what they offer over other banks now.

So, who’s everyone switching to?

Yeah I’ve messed up NatWest premier black because their systems see I had an account years ago and now won’t let me back in properly.

Wonder if RBS would be any different or it’s just all the same back end.

Oh nice will give them a try. Thanks!

Based on our supermarket, Spar and fuel spend, we will keep using Chase for that spending as we’ll still get a few quid per month, and it’s not difficult to keep a couple of hundred pounds in Chase and swipe to the right card on Google Pay.

The money dance at the start of the month equally only takes seconds as I can do both send and receive inside Monzo.

I can’t remember what the outcome was on this (and I’ve not been offered to apply for it yet) but does the Credit Card offer cashback at all? Or was it just a long 0% period on spend?

(trying to second guess - is the change to cash back next month because the Credit Card is rolling out fully instead?)

No cashback. Standard 0% on purchases for 18 months card. Added benefit of no FX fees abroad I suppose but it’s pretty meh.