On another note, why do I keep getting offers with Krispy bloody Kreme? Am I the only person who refuses to buy their over-priced American sugary heart disease bombs? If I wanted doughnuts I could get a bag of 5 (which I’d eat in one sitting) from my local Tesco, and it’d only cost me £1.10!

I’m very happy to report that this is now fixed*

*No, not because Monzo have made the icons update, but because I now have the Currys offer so I have all three.

Got my other half to check his cashback offers and they are also poor. He wanted to opt out but he doesn’t have an option to…

I am also disappointed with the renewal of last month’s offers, which are of little practical use to me. And again, I think ‘terminology’ will prove to be an awkward issue here.

On a day-to-day basis I use either Algbra or Chase for ‘cashback’ - genuine across the board, no matter what, cashback (with a tiny number of exceptions). Easily understood, easy operation for the user.

I have accounts with Santander and Lloyds from both of which I get a (limited) range of ‘customer offers’, which involve me receiving ‘cashback’.

The Monzo scheme - even when funded from its own coffers - has never been the former, although a (very welcome and much appreciated) straight 2% Supermarket ‘boost’ came close and gave the offer a kind of hybrid feel.

But the scheme is now very much the latter - a range of ‘offers’ (through an aggregator), some of which I’d not previously even heard of.

And that’s the problem - it’s labelled ‘cashback’, which raises expectations.

But really it’s a customer add-on/perk/offer/facility/whatever which is offered to us as Monzo customers which gives us a small-ish discount with those providers by way of getting some money back.

Being labelled ‘cashback’, expectation management is now going tp be very difficult. I’m afraid I don’t have a suggested answer to the problem but the genie isn’t going back in the bottle.

I disagree. I feel that “cashback” is the correct terminolgy. We are not getting a “discount” or any “exclusive” offers. Yes, there are some exclusions and the amounts vary by merchant but we are getting some ‘cash back’ after spending with said merchant (if you find one that suits you). There are no other offer types as part of the scheme.

I’ve also been thinking a lot about this, and I do really think that there should be two ways of banks doing cashback:

-

Cashback for retailers you’ve never been to. This benefits the retailer, so they are happy to give away a bit of their profit to potentially gain a customer. Nobody really gets to see your banking history in this instance because it’s really more for the retailer. Most banks appear to do it this way (I could be wrong)

-

Cashback for retailers you frequent. This is more of a benefit to the customer, but perhaps the retailer gets information on your spending habits in return which they can potentially use in their own marketing/business.

Monzo appear to have taken the worst from Option 1 and the worst from Option 2: cashback for places you don’t really go and your banking transactions given away. I’m not seeing much in the way of benefit for the customer.

I agree, there should be the standard cashback that other companies offer for a wide range of merchants and then personal custom boosted offers.

Hey everyone![]() I wanted to jump in, have been reading the thread over the last weeks and we hear you loud and clear. Firstly thanks for all your feedback over the last couple of months and for always engaging with us

I wanted to jump in, have been reading the thread over the last weeks and we hear you loud and clear. Firstly thanks for all your feedback over the last couple of months and for always engaging with us ![]()

We’ve been super focused on rolling out cashback safely to as many customers as we can, but we’ve heard your feedback on offer quality and missing cashback. We came to market fast and we’re iterating, if the feedback isn’t actioned in the next months (read: ~3 months) it will be hugely disappointing. However we did complete rollout 1 month ago, and had holiday season in between. I’m a customer too, I want results not rationale but I want to align on expectations that we’re going to need a few months to action, test and implement the iterations. We’re listening we’re planning and we’re going to ship. We couldn’t do that fast feedback loop without you ![]() .

.

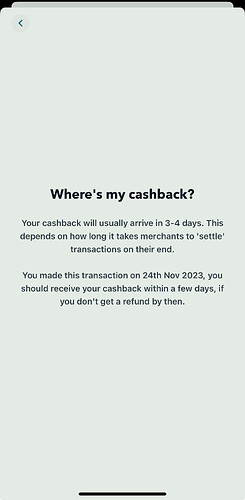

It’s been nearly 1 month now since I reported missing cashback

We know there’s been a bit of friction with missing cashback reports - we made the process as smooth as we could before we launched, but it’s only by scaling up that we begin to see all of the edge cases. We’re making improvements to the missing cashback flow and our internal processes to handle these cases better.

We review every missing cashback report, and we’re actively monitoring missing cashback reports particularly where they’re taking longer to resolve than we’d have liked - we haven’t forgotten about them.

I’ve stopped seeing offers that feel relevant to me

We hear your feedback about the quality of offers available to some customers and there is a lot of room for improvement. Both non-pilot customers and merchants are new to the platform meaning we’re still learning with our aggregator partner about optimising offer placement. That’s not to excuse the repeat offers from merchants you might not care about immediately but explaining what’s happening behind the scenes. We’re taking a few key actions to improve this over the next months which are

-

Expanding the range of offers via additional aggregator partners (see here)

-

Constant feedback loop on the availability of offers via partners. We have relevant merchants joining the platform, but it’s obvious you’re not seeing them and we need to work better with them via our partners to bring the right merchants to the right customers

-

Working on the boost strategy and implementation for retailers you frequent already

We appreciate all of the feedback you’re sharing and discuss it at every planning session on what we focus on next.

We’re committed to constant improvements, we’ll check back in when we are putting out some of the builds related to the bulk of feedback here and hope to see you back on the program and continuing to give your feedback ![]()

Thanks for the update and transparency ![]()

It’s easy to forget there is bigger picture.

Really appreciate the engagement!

Thanks for the update. Really hoping this works for us all!

Slightly like comparing apples and pears, but I saw the same Footlocker, Deliver, Trainline and Disney+ with slightly better cashback rates too on my Amex this AM.

Just opted out. Every time it’s the same offers which I will never use. Much prefer Chase’s across the board 1% cashback.

Thanks for taking the time to write this @veronique_barbosa, it’s definitely appreciated.

I’ve not said anything about the offer quality recently, but it has been a little disheartening to see how it was working in pilot to the quality coming through the aggregator.

One thing that I thought of the other day, and I’ve been reminded today about, it would be good from a customer perspective to be able to ‘dismiss’ a merchant as ‘I don’t want to see this offer/merchant again’. That might also help in targeting the right offers at the right people.

Just a thought, and thanks again for the post

I think a very important consideration for this to work properly would be if you can take that data from our connected accounts (subject to the privacy agreement including this etc). A lot of people spend from cards other than Monzo (see Chase, Barclaycard, Amex, all sorts of reward cards), so basing the ‘retailers we frequent already’ only on Monzo card spend will probably not yield the best data for a lot of people.

Thanks for the update Veronique.

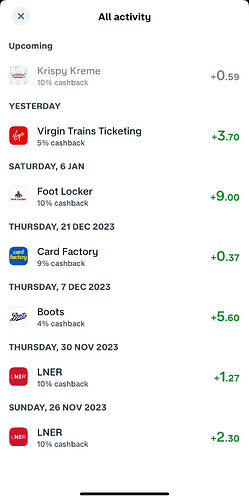

I’ve got £0.59p of Cashback from Krispy Kreme which tracked, but has not been paid since November 24th. There doesn’t seem to be a way to report this in the app because it has technically tracked.

Can you reach out to us via chat so that we can take a look at what’s gone wrong here ![]()

Monzo: 5% cashback at LNER, multi-use, £70 minimum spend, excludes season tickets. Expires 24th Jan.

Amex: 10% statement credit at LNER, multi-use, no restrictions. Expires 7th Feb.

These offers really need to start being more competitive if Monzo want my spending.

Will do

I’ve just opted out, same old offers being churned out each time. No point being part of it.

Which AMEX card is offering this, or is it all of them please? Thank you

Also, are there any other good credits AMEX offers for tickets such as virgin trains ticketing, Trainline, Avanti etc. too?