The problem with this is that a shared tab with a friend will likely contain multiple items of different categories. Marking it as multiple categories then applies money back to more categories than spent. This doesn’t really work ![]()

This

Doesn’t it pay back each one in the feed as appropriate if settling the tab? I’m sure it used to.

So much this! I’ve had another go, because I can see potential. It’s got some really great elements but it doesn’t work at all (for me).

I think for me it boils down to three things.

It needs a per category budget line

It’s no good having a single figure and going out spending if I haven’t filled my 4x4 up twice since Payday. Seeing that I haven’t means i need to spend less on eating out because that expense will come and I need to account for it.

Swipeable graphs would make it next level

I’m not sure how three category areas that tell you the same thing are all that useful. It would be cool if you could just swipe across the graphs and the data below adjusted as needed

It needs to handle special purchases better

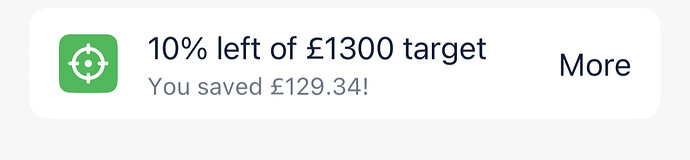

The thing is I haven’t saved that money. It’s accounted for elsewhere.

So, I can either do one of two things currently with planned for large purchases.

I can chose to include it, but then my target for the month is adversely effected. Or, I can put it in an excluded transaction, so it’s accounted for but then target says I’ve saved the money.

It would be better if it either worked out that this was accounted for elsewhere and therefore knocked it off or it said you could’ve saved this amount except you spend it on x instead.

Until these things are resolved for me personally it’s unusable. I would say that I do like the direction, and this is meant as constructive feedback to aid any development.

Unless I’ve missed it, I can’t scroll back. So I’m just going to edit my target on a per month basis.

I’ve just restarted for the period so we’ll see how I get on with it

Unless I’m mistaken (it’s possible!) once you set the target it applies for all months. At least on iOS.

Either I’m doing it wrong or you can’t tweak it month by month.

That’s what I mean, but I can’t see what I set it as for November, so it doesn’t really matter.

I’d like to see

Nov - Target £800 - Spent £792

Dec - Target £1000 - Spent £1092

Etc etc

But if I change it and it changes overall, but I can’t scroll back then it doesn’t really matter to me. I’ll just adjust it on a per month basis for when I have big expenditure.

Oh I get you now. Yeah that would work for a month to month basis I guess ![]()

Are you on android. Because on iOS you can swipe the graph back over time as you can with the other graphs meaning that while this solution will work for the current month it’ll throw historical data out of whack.

Which is either a problem or not one at all depending on how you use it.

I totally get the problem with not having budgets by category. But I haven’t quite wrapped my head around needing to recategorise to have it work like Summary. Can you give an example at all? ![]()

Same behaviour on Android.

My understanding is that on trends you exclude categories, not transactions.

On the current summary if I exclude a transaction it does not appear in the spending section, but rather the excluded section towards the bottom.

So if I go for a meal out, that we put the money aside for over the course of the year for example, I wouldn’t want to include that in my ‘target’ for the month as its a one off cost. So I would need to put this in a category such as bills for it to be excluded in targets as I don’t want to fully exclude the eating out category

I didn’t realise I could do that

So now the budget either needs to stick to that period because I’ve decreased mine from Dec to Jan, so when I swipe back, Dec is even further out.

Thank you for putting my thoughts into better words than I could. I hope Monzo see this and action each of these points.

Sheesh, this isn’t proper budgeting, Monzo please bring zero based envelope budgeting to the app.

As one of the other commenters mentioned, we need to be able see that although we might have x amount left, we still have essential variables such as fuel that need to be accounted for…

The problem with this at the moment with Goals is that when you withdrae that ‘meal out money’ from your pot it will be classed as a transfer which is automatically excluded from your goal. Then you spend it at your meal so you have to recatagorise that also to a category you’ve excluded from your goals. Then as you say, you also had to exclude each deposit into a pot in previous months otherwise your money would be unaccounted for.

It is a headache.

It does work fine. I have a shared tab with my partner for a range of bills and they are all different categories. When he pays me back it’s automatically categorised as ‘General’ and I change it to whatever category the original payment was for.

You don’t have a problem based on what you’ve said as you can change each transaction in the tab differently.

My problem with the Shared Tab (the very first time I used it with my wife) was that there were a few requests from me, and then a request from her, resulting in a small balance I had to send her.

The only thing showing in my Trends is that small payment from me to her, which of course is absolutely useless in terms of tracking my spend. The real transactions don’t show anywhere, so while I have technically spent money on X, Y and Z, this is not reflected anywhere in Trends… unless I am missing something?

Ah I see your issue. If it’s a bulk payment then you need to split the transactions.

As much as a pain it might seem, paying the tab off item by item allows you to categorise each item individually

Sure, but that defeats the purpose of a shared tab, we might as well go back to sending each other individual requests.

This can’t work either because the payment is a settlement resulting from subtracting my requests from hers (or the other way round), so the settlement amount doesn’t “mean” anything in terms of what category it should be assigned to.

I do see your issue; I just manage shared tabs a little differently… not sure if yours can be solved without the ability to edit transactions manually.