I’ve been hanging onto Agile for the API and for the in-depth transparency of costs, but with an EV arriving on Wednesday, it’s definitely switch-to-Go time!

I don’t have an EV (yet) but how does that compare with this

Between midnight and 4am you’ll only pay 4p per kWh

I’ve not heard of either of Indra, Rolex, Keba or Innogy companies before, but I guess many wont unless they are in the EV game.

Probably similar.

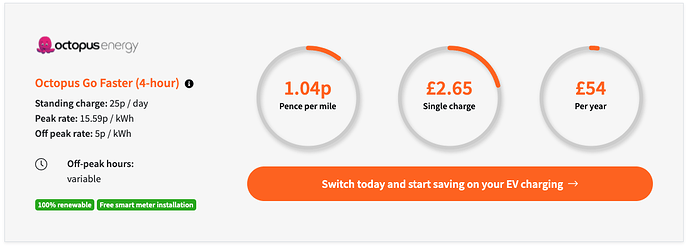

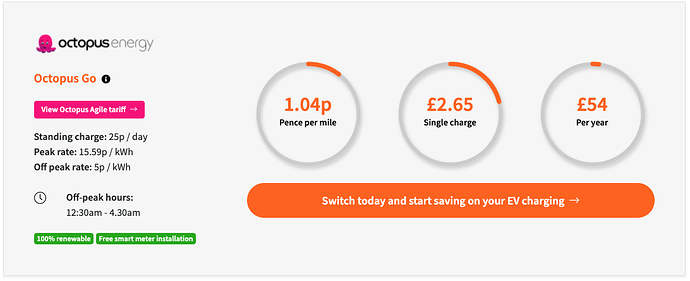

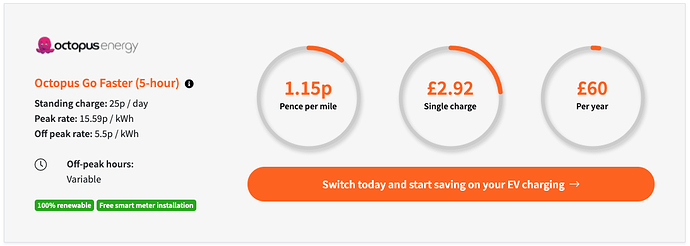

My specific-area rates for Octopus smart/EV tariffs would be:

Octopus Go

Unit rate (04:30 - 00:30): 15.78p / kWh

Unit rate (00:30 - 04:30):5.00p / kWh

Standing Charge: 25.00p / day

Octopus Go Faster (5H from 00:30)

Unit rate (05:30 - 00:30): 15.78p / kWh

Unit rate (00:30 - 05:30):5.00p / kWh

Standing Charge: 25.00p / day

Intelligent Octopus - new beta tariff, I can’t use this as an iOS device is needed

Unit rate (05:30 - 23:30): 15.78p / kWh

Unit rate (00:30 - 05:30):5.00p / kWh

Standing Charge: 25.00p / day

(inc VAT)

I switched from Agile to Go Faster (5 hours from 20:30) back in April when it was only 13.45p/kWh outside the cheap period. My bills average out at 11.9p/kWh and it’s fixed until April. Who knows what will happen then…

Are these common chargers? Hard to tell what makes one better than the other ![]()

Looks like the last gets rebranded if you buy via EON £799

Yeah its less about brexit and more about the ineptitude of our gov. I read they closed a large gas storage facility in 2017 because of fears of leaks/maintenance and never replaced it. They figured gas coming from Quatar etc would deal with price/supply problems cause by russian politics where as a lot of europe has large gas storage facilities to ride out supply issues for a lot longer and prevent what we are going through.

I reckon the other problem is energy companies trying to eek out a profit from razor thing margins not understanding how macro economic systems work(or being fooled into thinking that volatile economic systems are not volatile in this current world climate)

Offering low 12 month fixed tariffs in a volatile market is playing russian roulette… if the wholesale price goes up too much, suddenly you’re running at a loss with no chance of getting that back.

I reckon the only ones that will survive this are those with their own generation capacity so gaining on the supply side to offset the losses.

I’m not sure that message is getting through - just today I saw on a forum someone saying ‘join xxx energy instead, they’re really cheap’. Aside from switching right now being a bad idea (if either end goes titsup during the switch it’s another complication) it’s exactly those kind of providers (small, reseller only) who are most vulnerable.

Is Green Supply Limited meant to be “Green Supplier Limited” AKA Green?

Edit: yeah so well done ofgem using the former name in the description and newer in the video.

![]()

Igloo Energy desperately trying to restructure before the money runs out. Clock is ticking.

Just had a wall of text sent to me by email

Hello ,

When we launched Green in 2019, our goal was to modernise the UK energy market by bringing low-cost renewable energy to all of our members.

It is with great regret that we are writing to inform you that Green is ceasing to trade, and that another supplier will be appointed by Ofgem to take over supply of our members.

The current market conditions are unprecedented, with record wholesale energy prices pushing the cost of energy above the price cap. The fire at the National Grid interconnector site in Sellindge on 15th September led to wholesale electricity and gas prices reaching new record highs. Beyond the fire, 2021 has seen incidents at other production sites, unplanned outages, high demand for Liquefied Natural Gas (LNG) tankers, Brexit, the Suez Canal incident, and the Beast from the East II to name but a few.

This means that Green, like all other energy suppliers, are selling energy to customers at a loss. The price cap is calculated based upon a historic observation period, which means that it does not accurately reflect current market conditions.

Over the past week, we have been vocal in calling out Ofgem and the Government for creating a regulatory environment which has led to five energy suppliers collapsing in the last six weeks.

We wrote to Ofgem, the Prime Minister, the Business Secretary, and the Chancellor of the Exchequer, together with 14 other suppliers asking for the energy price cap methodology to be reviewed and for an immediate support package to be assembled. Combined, the signatories account for over 1m customers and 2,000 staff. The letter accuses Ofgem of being unfit to regulate the industry, and of overseeing a return to a monopoly and a reduction in competition.

Although Green, like many other small suppliers, have been accused by the Business Secretary of bad business practices, the reality is that the soaring energy prices are due to a global gas shortage. This global gas shortage has a significant impact on the United Kingdom due to low capacity and was predicted by the Energy & Utilities Alliance (EUA) in 2017 upon the closure of the Rough gas storage facility by Centrica.

Additionally, there have been several other factors outside of Green’s control which have had a significant impact. Although much has been written in recent days about hedging positions, there seems to have been little discussion of the impact of government lockdowns, which changed customers usage patterns and led to greater domestic usage than anticipated. As a result, Green was forced to purchase additional energy at the prevailing market rate.

During the pandemic, Ofgem also mandated that energy suppliers must provide payment holidays for customers and a relaxation of credit control - while still requiring that energy suppliers meet all of their payments. We have supported our members throughout these difficult times, providing payment holidays and being understanding of individual circumstances. Unfortunately, Ofgem’s ruling led to an increase in debit positions while Green still had to meet its industry obligations.

Ofgem amended the balancing mechanism in 2015 through the P305 modification. The balancing mechanism manages imbalance prices, which is the difference faced by energy suppliers between the amount of electricity they buy and the amount of electricity they sell. The changes made to Ofgem - based upon their own analysis - led to energy suppliers facing higher average imbalance costs, and being more exposed to large spikes in electricity wholesale prices. The events of 2021 have led to many such spikes, which have further impacted upon Green.

Finally, we would like to note that the Business Secretary was made aware of the threat to energy suppliers in March 2020 by Ofgem. We are now 18 months on from this letter, and to date no tangible action has been taken by the Business Secretary despite Ofgem stating that a ‘shock of this magnitude could mean that significant numbers of suppliers who have otherwise good business models may fail. To be clear, we are concerned that this may be significantly bigger in scale than recent failures and could involve larger, as well as small, suppliers. If the costs of any supplier failures are mutualised, this would also add to the pressure on suppliers remaining in the market’.

We fear that smaller energy suppliers are being left behind by the Government, with rescue packages being put in place for larger suppliers and for private discussions to be held with the Business Secretary. There is a position in Government and Ofgem that smaller suppliers should be left to fail, despite the unprecedented increases in wholesale electricity and gas, the cost of failed suppliers being mutualised across the industry, and an outdated price cap methodology forcing smaller suppliers to sell at a loss.

Our voice is not being heard - Ofgem and the Government seem intent on returning the market to the pre-deregulation state with only British Gas, EDF, E.On (including npower), OVO (SSE), and ScottishPower controlling the bulk of the customer base. With the exception of OVO who acquired SSE, the other suppliers have maintained a monopoly since the 1990s - which makes it difficult for any new entrants to thrive without having significant financial backing (e.g. Octopus Energy, Bulb).

We would like to reassure you that your energy supply is secure and any credit balances on your account will be protected for domestic customers. Ofgem, the energy regulator, will be appointing a new supplier for all of our customers and their advice is to not switch until a new supplier has been appointed.

I would like to personally thank each Green member for their support in realising our vision.

I would also like to thank our staff for their efforts, and to wish them every success in their future endeavours.

Kind regards,

Peter McGirr

Chief Executive Officer

I’m with Avro. Or was

The guy at Green was on news other day, he didn’t sound very credible to be fair, other than to point the blame at the market.

He is right about the gas storage capabilities of the UK though.

Our fixed renewal is looking like it’ll go from £52 a month to £138… £124 if I change suppliers. We’re in for a fun winter!

The problem is not the UK’s physical supply of gas, about half of which comes from its own production sites with the rest piped in from Europe or shipped in as LNG from the US, Qatar and Russia. The issue is the price the UK has to pay to continue receiving these supplies.

The pandemic caused gas demand to plummet in spring 2020, resulting in low gas prices, reduced UK production and delayed maintenance work and investment along global supply chains. Then in early 2021, a very cold winter in Asia prompted a dramatic spike in LNG spot prices. A hot summer followed, increasing electricity demand for cooling. Resulting high LNG prices limited deliveries to Europe, but lockdowns were lifting and economies recovering. Energy demand shot up.

So yeah basically cold winter in Europe and then Asia. Supply is low, demand is up, prices through the roof.

BBC chart

Another chart from MSE showing why smaller energy providers are going bust. They simply don’t have the cash reserves to be able to take the hit of buying energy for more than they are charging.

So the cap is protecting the general person on the street who doesn’t bother switching. And the people that fix are also currently protected.

Funny enough some energy providers are offering fixes above the cap which is outrageous and desperate tactics.