Ermh… Monzo completed launching Flex and added Tap cap. Where is Starling’s credit card that was teased for years?!

This is about Monzo though, not about what other banks haven’t done to justify Monzo not doing something else. Also Tap to cap is what we are talking about in this thread.

Have a pop at Starling for taking their time on their credit card. Unless Monzo beats them to the punch then the same could be said about the Monzo credit card.

With the introduction of flex, is a credit card due any time soon do you think?

Even with Flex with Monzo  it could be in the next day or five years.

it could be in the next day or five years.

Where’s that 2030 thread

Is that the dark mode thread? ![]()

This is any business. If Starling or any other business is slacking on something that’s important to you then let them know.

You might like what they do but nobody should be defending a business unless it’s theirs or they are a shareholder imo.

Making excuses that they aren’t that late (again March 2021 the increase was announced, contactless has been around a decade), or trying to point out things other businesses haven’t done to justify seems weird to me. ![]()

I’ll happily give Starling both barrels in the same breath. I’m quite happy with Amex so a CC isn’t a deal breaker personally whilst disabling contactless is.

I think they did beat them, Monzo flex is revolving credit line with Section 75 protection with a credit card number and Google/Apple pay, which to me is a credit card. With added benefit allowing to revolve debit card transactions as well.

I might be wrong but you don’t get a physical card and a billing cycle like a CC. Flex is essentially just a BNPL disguised as a new product. It’s more aimed at buy a high priced item now and aim to pay it off in 3/6/12 installments later. It’s like a short term loan for a particular purchase(s). Similar but it’s not a credit card in comparison to say Amex with the membership perks and cashback you get, and aiming to clear the billing cycle each month.

Those are not things unique to credit cards. With one of my bank accounts I don’t have a card so does that mean they’re not a bank?

Which is what people use credit cards for isn’t it?

Either way, this whole debate / discussion / feedback (whatever you want to call it) is getting a bit monotonous.

You call it monotonous and quote with some dull questions that really don’t need answers. ![]()

I’ve said above it’s similar as in its a credit product, and the two can be used for similar purposes, but a BNPL product != credit card.

Anyway I agree this thread was about Monzo and them giving the ability to control contactless limits not about Flex or Starling.

@Ordog something to liven the thread up

Fair enough, I was just putting some context around it with my comments on that earlier.

I do agree that, personally, I would like Monzo to have a full set of customisable card controls - but I do also realise that most customers probably aren’t bothered, so I don’t expect it to be a huge priority to Monzo.

I agree, it’s not a credit card in the normal/traditional sense.

I would say it’s a credit product.

Anyway, that video is pretty cool - thanks for posting it!

Going back to the original point of this…

I wonder if, when most/all of the bank actually introduce this functionality, do you think they’ll be tempted to increase the ‘default’ contactless limit further (or remove it completely) and also remove the protection that banks have to offer if their fraudulent usage of the card.

They’ll just say that if contactless is used fraudulently, it’s up to the account holder to set the limit their comfortable with and if you’ve set it high, it’s your own fault if there’s a problem…

Interesting points.

Personally, I hope that doesn’t happen and I doubt it will. It’s a bit like how some banks have customisable cash machine limits. You can set it lower, if you are particularly concerned, but the “default” is the high limit. A presumption in favour of “guilt” as being responsible for the fraudulent use, just because you have a high limit, would be unfair.

Contactless is currently regarded in the same way and I think it will continue to be, fraud protection from banks is key to consumer confidence in the system and the whole idea of contactless promotes using cards where cash might have been used in the past, by making cards more convenient. The fraud burden on banks is the “price to pay” for that.

With (nearly) all contactless transactions now being online, fraud after the card is cancelled is close to impossible so losses are limited as long as a customer reports it in a timely manner. The existing rules already allow banks to deny a refund for fraudulent activity if the customer was negligent or failed to report it in a timely manner. Essentially, banks are liable for fraud in most causes but a customer has a duty not to leave the banks (or themselves) at undue risk. That’s fair and a decent balance.

Long term, authenticated contactless via devices (using CDCVM) will probably replace cards and contactless as it’s often used now (via cards unauthenticated) will probably become authenticated via biometric cards so this will be less of an issue.

However, I do think SCA is an annoyance currently so it would be better if either 1) the U.K. switched to online PIN, and you could authorise with a PIN after tapping without a need to insert the card or 2) the limit was more than doubled again, to £250 and the SCA limit became £500 (two “maximum taps” in a row, like now). I accept that suggestion is more controversial, but due to the reasons I have already outlined I don’t think it should result in a huge increase in fraud (especially if all banks use location-based anti-fraud technology, like Monzo), although it would be good if all banks allowed customers to set a lower limit if they wanted before the limit is increased again.

I do expect this to be like card freezing, where eventually it is an “expected feature”, so even banks which still don’t have it now introduce it eventually to fall into line with those that do.

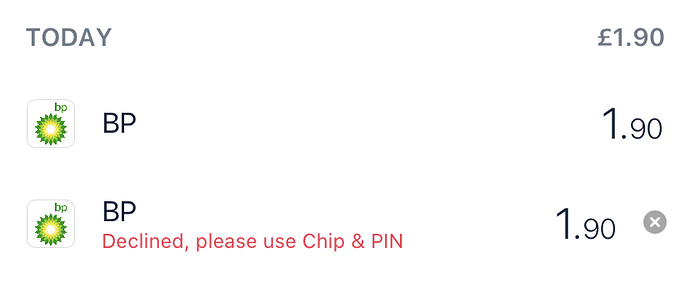

Well, after completely forgetting I’d set a limit of zero, I can confirm that it’s all very graceful. After trying contactless, payment terminal simply asked me to insert my card and enter the PIN, and a helpful reminder appeared in my feed:

This topic was automatically closed 180 days after the last reply. New replies are no longer allowed.