Was the Revolut Visa?

Just curious… if you take Revolut metal and cancel after a year. You will get downgraded to standard plan but what happens to the metal card? can you still use it with a standard plan just without the perks?

Oh I read it “I absolutely hate crime” and I was trying to figure out what crime!

This was Mastercard, I do have a visa so will try that but I think it’s something to do with LINK machines as I’ve seen it before.

I am a free user and yes you can cancel and keep the cards, there used to be a way to downgrade to free after 14-16 days without the card fees being applied but not sure if it works any more.

I did upgrade to Ultra then downgrade but was charged the fee, however the card still works.

Having said that, I cannot find my Ultra card anywhere ![]()

![]()

![]()

Funnily enough, I was in the UK a few weeks back and also found that ‘Free Cash’ ATMs were applying a £3.99 charge to my Revolut card - in machines I had used previously at no charge.

I have a € - area BIN Revolut Visa card, and I’d just assumed it was down to the ‘B’-word - the ATM was applying the fee as a non-UK card because they could (remember the mobile operators ‘we won’t reintroduce roaming charges? ![]() )

)

Card was fine in the actual bank-operated ATMs though - I think it was just the Link machines.

I’ve found Co-op Bank cash machines seem to have their own rules on what they work with/charge etc more than any brand. I’ve had them in the past flatly refuse to work with Monzo/Starling - I think they really do NOT like dealing with non-Link network cards.

I just completely avoid them now.

US tech investor TriplePoint Venture Growth slashed the value of its stake by 18pc at the end of last year, accounts show. The reduction implies the company is worth $23bn, down from $28bn a year ago.

It marks the second time TriplePoint has slashed its internal valuation of Revolut, which was worth $33bn at its peak.

Last year, fellow investors Schroders and Molten Ventures wrote down the values of their stakes, cutting them by 46pc and 54pc respectively.

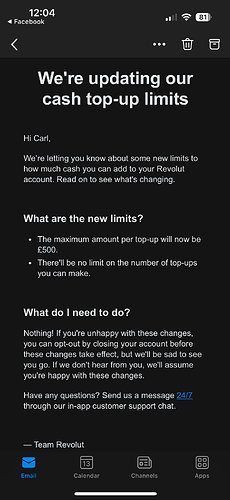

Didn’t even know cash top ups were a thing until I got an email about them just now.

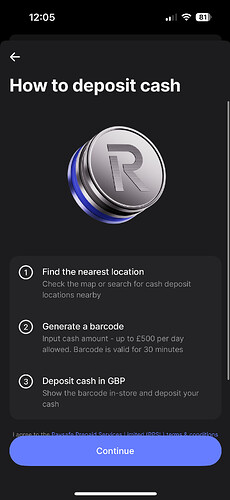

Go to Add money - tap change - then deposit cash.

Looks to be handled by paysafe

How’d you get that?!

Ah just seen there was a promo for it, specific chose folks ![]()

![]()

Interesting - and it looks like that service doesn’t have any charges to the customers (unlike Monzo with PayPoint).

Looking at the Paysafecash website, the same local shop that does Monzo Paypoint is also setup with Paysafecash and is much closer than the Post Office (although that’s only a 5 mins walk - the local corner shop is a 30 sec walk!).

I can’t pay cash in yet - but once they unlock it for me, definitely be tempted to use that as my route to converting cash into real money.

Wonder what the % is, ie scaled or fixed.

Interesting, it appears to be POS ‘as a service’ rather than buying a hardware solution.

It may make the Revolut Reader a bit more useful too - I have paid at a couple of businesses using them, and so far they have to open the app and request a payment to enable the reader.

The POS / Reader solution may be of use to small cafes, independent pubs etc…

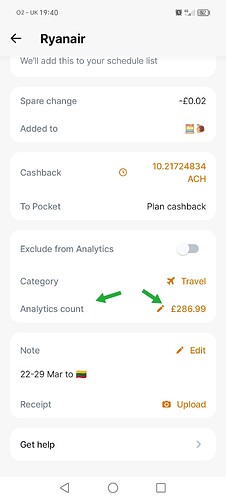

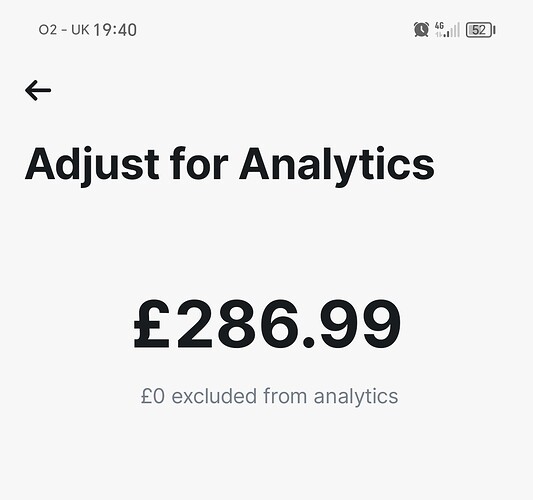

Latest revolut TestFlight app you can head to analytics and then ‘Adjust for analytics’ for your actual spend in said purchase.

Why they couldn’t just allow the merge of inbound payments like they used to, who knows.

Complex solution to a problem some face.

There is also now a ‘Income’ tab in analytics to allow you to do the same thing. ![]()

Edit: not a terrible UI overall but could be akin to monzo, when tagging the inbound category the same as the spend it just automatically balances.

There’s no way to merge the two as I’d like, but I guess if you receive variable types of income it could be helpful for someone.

I am not on Test mode, but today’s v10.21 already has this adjust option ![]()

Sadly, my Insights does not show income, Spending only ![]()

![]()

Ah I didn’t notice in the transaction screen, easily missed.

I don’t split payments with anyone any more, nobody to split them with ![]()

Just reopened my Revolut (realised how useful it could be as a backup spending card in the Eurozone) and got a 3% supermarket spend cash back offer for the next month. Don’t mind if I do

Well that’s a new layout.

Is monzo going the same way, being hosted by the same platform (I think)?