Thanks

Disclaimer: I’m currently a free user and have no plans to upgrade.

I think you can stop the notifications and emails using one of the privacy settings in the app. Personally, I’m not particularly bothered by the blue upgrade card, but I can definitely see how it might be annoying for some

I agree that Monzo need to focus on improving the basics (payments, user experience, basic budgeting, customer support) as well as improving their paid offerings and business banking.

And to be fair to Monzo, they do seem to be doing just that - there’s now a Core App team that focuses solely on improving the basics and that team is currently doing excellent work on the Payments tab. I also think the app’s general UX and speed has improved over the last 6 months or so, along with customer support.

I think stuff like advanced budgeting features makes loads of sense in paid tiers.

I’ve thought about this a lot recently, but I really think Monzo comes out top for me still.

In my opinion, the only accounts that come close are Starling and Revolut (I know they’re not a bank yet, but they effectively work like one).

I suppose Starling comes out top for “basic” banking feature with its free cash deposits at the Post Office and its cheque imaging. However, both of these are features I rarely use - I only ever get cheques maybe once or twice a year (I put them into my Monzo via Starling), and if I get given cash I use it on the Tesco self-service checkouts then pay any remainder using my card (highly recommend this as a way of getting rid of loose change btw).

Revolut has loads of features behind a paywall and so suffers from the same issues as Monzo. Although I do think that Revolut’s paid offering is better than Monzo’s paid offering, I think Monzo is better at basic banking than Revolut.

The main reason I choose to stay with Monzo is because I think Monzo is much better at ‘basic banking +’ than other accounts. This is stuff like decent basic budgeting, easy ways to pay (Monzo-to-Monzo via phone number, share a link so you can’t screw up putting someone’s bank detail in) or be paid (Bill Splits, money requests, monzo.me), pots, bills pots, instant notifications, card freezing, zero foreign interchange, notes on transactions, being able to easily download statements, and most importantly a brilliant UX. Some of these `basic banking +’ features are also done by traditional banks, some are also done by Starling and/or Revolut, however, Monzo does all of them and does them with a much, much better UX.

So that’s why I still bank with Monzo.

Funnily enough, all of that list is why I like to use Monzo as a daily spending account. Other banks score better for me in terms of cashback on direct debits, and credit cards are better for those transactions where Section 75 protection might come in handy.

This is in-app now. Downloaded statements are already digitally watermarked.

Yeah the Starling ones are great, noticed the option in December for them up be watermarked. Hopefully one day Monzo will crack on with that.

I have to say I do understand what the OP is saying. I don’t think I’d use the same emotive language e.g “second class citizen”. it is what it is but I do feel like a bit of a ‘dormant’ user.

I haven’t thought much about this until the topic here arose but I did see an email at the turn of the year which gave me the impression there were new features for me. Subject was “New Features to Kickstart Your Money goals”. I was momentarily as excited as banking features can make you  Instead it was a pitch for Plus.

Instead it was a pitch for Plus.

I didn’t see much new and I already decided last year that neither account had enough to get me over the line.

I wouldn’t say this is a problem but I think you would want engaged customers across all tiers, as the poster said. Bound to be some simple psychology behind all this

I agree with @anon72467941. Presumably the in-app setting for opting out of marketing stops the emails. Monzo could improve the experience for people by making in-app marketing something that can also be switched off by a toggle.

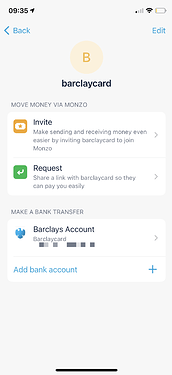

The most pointless adverts I’ve seen in Monzo is where my credit card bank transfer is asking me to invite barclaycard to join Monzo. It should be disabled on business links etc.

Even a toggle to disable it in labs would be nice.

Not sure it’s pointless - it’s certainly presumptuous… and intrusive.

I do wish they would make the big plus and premium card dismisable.

It isn’t too in the way or anything but obviously is noticeable enough to annoy me

I’ve literally never seen this advertising people are so upset about.

I have ‘your year in monzo is ready’ which presumably will go away at some point. I had an email about plus last year… that’s hardly excessive.

You haven’t had any pop up about plus of premium or a big plus or premium side if you swipe left?

My original post stated:

to join Monzo.

![]()

Nope… I tried swiping left and nothing happened (don’t know why I would do that without prompting though… it would be a wierd way to advertise… the navigation is up/down unless you’re on the cards screen, and I never use that as the home button suffices to switch between main/joint account).

While, as I said before, I can see how the upgrade card could be annoying, I do think Monzo’s ads are less intrusive than say, Revolut (who seem to send me a notification every other day) or Barclays (who have sent me numerous emails and letters about getting a credit card).

Overall, I find Monzo’s upgrade ads pretty unintrusive:

-

The upgrade card is probably the most intrusive but I don’t really mind it now since I just never swipe in that direction.

-

The ‘UPGRADE ACCOUNT’ button under the name in the profile screen is small and unintrusive in my opinion. However, I can also see why people might find this annoying.

-

The `Do more with Monzo’ is at the bottom of the profile screen and so if out of the way.

-

I don’t remember receiving any upgrade notifications since I toggled off “Personalised marketing” in the Privacy & Security settings.

-

I think I’ve received three emails ever about upgrading (from a quick count) and I have ‘News and updates’ toggled on.

-

The ‘Invite friends’ in the payments tab doesn’t take up much space and is at the bottom under Frequent and Recent.

-

The ‘Sent from Monzo’ auto-filled reference for Faster Payments is also fine with me since a reference is required to send money via Faster Payments anyway. There is an issue with UI here that makes it difficult to spot that you can change the reference, but it looks like that will be fixed.

-

The ‘Invite’ in non-Monzo payees doesn’t take up much space. However, I do agree with @Chapuys’s point that the logic behind showing it could be improved. Perhaps the ‘Invite’ bar could be removed if all the accounts in a Payee are marked as “business accounts”?

I think that’s all of the places where Monzo have upgrade ads?

If so, I think they’re pretty unintrusive. The only ones which I think could be considered intrusive are numbers 1 and 2 (although 7 needs to be fixed and 8 would be a nice touch).

I’ve found some of the pushing slightly intrusive, particularly when I was already on Monzo Plus yet had a constant button telling me about Monzo Premium.

Having said that, I recently upgraded to Premium so maybe it had the desired effect?

I’m surprised they haven’t expanded their credit offerings, it feels like a one trick pony relying on paid accounts predominantly. Maybe offering integration with Freetrade and inviting non-users to join where Monzo make a small fee when a new customer signs up. The portfolios could be integrated into a section alongside existing open banking accounts.

This is exactly why the button is there.