I suspect that this is why they don’t. from the bank’s perspective, it works quite well the way it is.

The Mirror have decided they don’t like large preauthorised amounts for pay at the pump

Without reading the full article, I think we should boycott those merchants. There is no reason not to update the transaction within minutes of the sale completing, other than laziness. And this practise needs to stop. It certainly makes pay at pump very unattractive for many (if not most) debit card users.

They’re saying it’s an industry wide policy change from Visa and MasterCard

It is

I agree

Yes it is. But it’s part of the same policy that the pre authorisation needs to be adjusted to the final amount within 20 min. So it’s certainly selective reading by the petrol station operators…

I agree. Just saying what their excuse was. And that they don’t take the money so it’s immediately made available to the customer again, which is very disingenuous of them.

Does anyone know a fuel station brand that does follow the MasterCard rules and update the transaction amount within 20 minutes? I know some in France do but I haven’t driven in the UK so not sure how bad the situation is in here.

I am unaware of any. They usually take a few days to settle lol

EDIT: Although I’ve not actually used pay at pump since switching to Monzo for exactly the reason this thread exists

This issue is getting some national press coverage, so, hopefully the situation will improve in the next few months.

Tesco pay at pump is usually the next day.  ️

️

Asda has suspended a controversial £99 petrol pump deposit trial after an outcry from customers. BBC

So much for that.

In a statement, Asda said […] and the £99 would be immediately released back to customers by their bank.

Assuming the pump notifies the bank immediately which they don’t just like any legacy pay at pump merchant.

“Whilst we have received very few complaints about this process, until we can be given assurance that all banks are able to comply with the Visa and MasterCard rule change, we cannot continue to implement this change and risk harming our customers’ trust in us.”

What a load of BS, they’re putting the fault on banks but even legacy banks handle authorisation request updates just fine and reflect it on your available balance immediately.

In any case I’m curious to see what MasterCard will say, as they’re now willfully breaching their rules and even being public about it.

I can tell you:

bad, bad Asda! You shouldn’t do this!

This makes me wonder though: if asda insists it’s the bank’s fault, maybe it actually is? Is it possible that asda adjusted the pre auth as required and the bank didn’t reflect this? I have always assumed it was the merchant’s fault, ut maybe it isn’t?

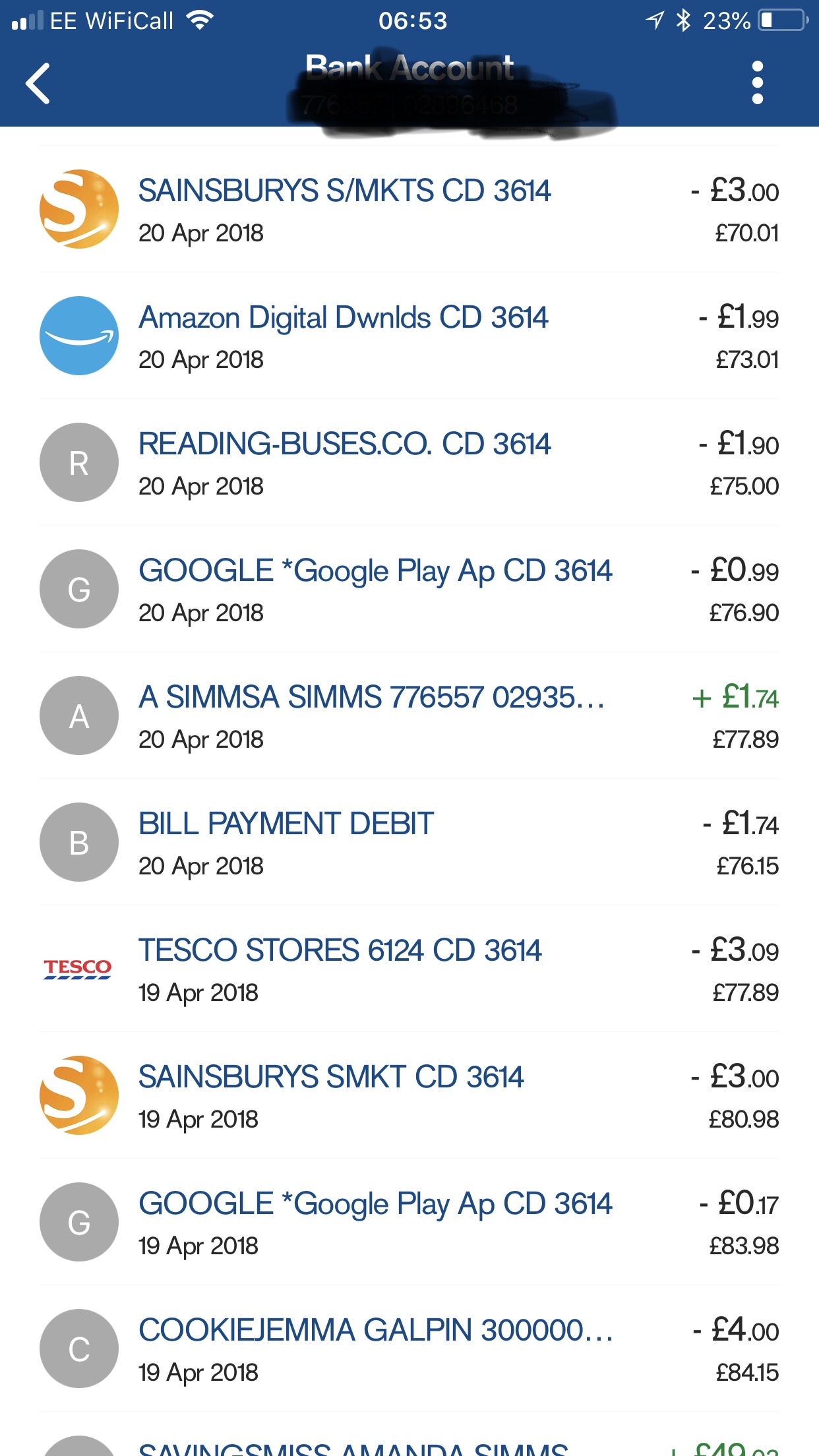

Does someone recognise the bank from the screenshot, by the way?

@nanos looks like Tsb with the logos and pending.

Really? On iOS, maybe? I haven’t been able to get into my TSB app for weeks, so maybe I’ve just forgotten what it looks like, but I think the android app looks quite different…

If it really is TSB, though, then I think it’s safe to assume it actually is the bank’s fault

Yes here’s a screenshot from my iOS app

Oh wow, that’s awful. After a year of Monzo usage I completely forgot how bad the legacy bank app experience is.