Yeah, I doubt this is going to happen: It’s one of their main selling points after all.

One last thing on this: it would be nice to have either a toggle, or even just hidden in one of the menus, an actual “here is your transient balance that overdrafts take into account” somewhere in the app, just for peace of mind. In the meantime, I’ll be supplementing the Monzo app with an MS Office Excel spreadsheet to keep track of these unusual pre-auth’d transactions.

Thanks to everyone for chiming in by the way.

They could at least display it in the Account tab, similar to how Starling does it (though it’s not very intuitive, as it’s hidden in the interest section of the app). At least then it can be viewed if necessary.

Given the importance of the actual balance for overdraft charges (and the amount of fuss they make about transparent charges, and helping us avoid charges) I’d argue they absolutely should make the actual balance easily accessible to us - but who listens to me

Just realised if you click on the transaction it says pending in grey at the bottom. Never noticed that before

Yes, that has always been the case

If a transaction is authorised but not settled you don’t own that money. It’s gone from your account - the bank holds it until the other party requests it but it’s not reachable.

This confusion where people think they still have money they have already spent is why lots of people spend so much time in overdraft (and it’s very common to hear of people cursing supermarkets etc. for taking the money ‘late’ and causing them to not have enough money).

The key here is to make sure you have enough money before buying things.

Agree with most of your post - except that for determining overdraft charges, the cleared balance, being the sum of the available balance and pending transactions. The same applies to in-credit interest, as the money is held in a “reserve account” (and is still yours, despite not being available to spend, until the bank receives the presentment).

That’s just not true. And if you have read this thread then it’s astonishing to me that that’s not obvious:

This is a very clear example where the merchant has no intention at all of collecting the money until apparently weeks later. For these weeks the money is still mine (or was mine, if I was the op).

Another example is where a pay at pump machine authorises £99, or a hotel puts a hold on your deposit, which they are never going to collect: that money always stays mine, it never goes to the hotel or petrol station. The bank will ringfence it, and it will not be available to me for spending, but it’s still mine.

Of course, I shouldn’t “double spend” it. But saying its no longer mine, the moment the merchant ran the auth, is like saying that money is no longer mine the moment I write a cheque: it is mine, until the cheque clears. But I obviously still shouldn’t spend it twice in the meantime. Or like saying that if I promise my buddy “I’ll pay you 100 quid next week”, that money isn’t mine the moment I made that promise: it’s gonna be mine until next week.

If the money wasn’t mine between auth and settlement, why do banks not charge overdraft fees from the day of auth? Why do banks still pay in credit interest until the day the payment settles? It’s not out of the goodness of their heart. It’s because the money is still mine.

I’m not disagreeing with the rest of your post, but it is entirely clear and unquestionable, that the money only ceases to be mine at settlement, not at authorisation.

I thought Monzo moved the money from your account to their holding account between authorisation and presentment. Meaning, it’s not in your account and not ‘yours’.

It may well be, that they’d do that. But which account the money is in, doesn’t matter: it’s still mine

Let’s not forget that no money is actually moved: it’s just numbers on some spreadsheet, so “moving money to holding account” is just a method of ringfencing. It doesn’t indicate ownership.

Or are you suggesting that the money is the bank’s between auth and settlement?

Going back to your original point, and genuine question, why use Monzo then? Why don’t you use a high street bank, which gives you two balances. What’s Monzo’s USP for you?

Oh, well, I don’t really use monzo

I know I’m a bit of a weirdo for still posting here so extensively, but hey

I use Monzo for the immediate notifications (3 days for a contactless transaction? seriously Natwest), no foreign transaction fees, my friends can pay me with just a debit/credit card without needing to mess with awkward online banking websites and an app that allows me to keep track of my money better (except for what this thread is about).

There’s a lot of reasons to use Monzo over traditional banks aside from “the balance updates immediately regardless of whether the transaction is still pending”.

I guess the reason banks are reluctant to show immediate notifications, and preferring to show 2 balances is to avoid thousands of conversations like this every week.

Imagine if everyone who used pay at pump for £20 was ‘charged’ £200. How many people would be calling the bank?

The pump issue can be solved; authorise the max amount, then amend the authorisation as soon as the fuel has been dispensed. No reason to leave the authorisation hanging there for a week.

MasterCard should really crack down on those stupid merchants that can’t be bothered to use the system correctly; unless the machine is truly offline, it should be forbidden to wait until presentment to set the proper amount; the amount should be set as soon as the machine knows it on the original authorisation.

Give them a deadline to upgrade their legacy rust, and afterwards kick them out if they still don’t comply (sure, technically they could stop accepting MasterCard, but no merchant in their right mind would refuse taking ~50% of all cards).

This would fix the pump preauth amount issue on both legacy and modern banks.

Do you mean something like this:

In the Europe Region, the Acquirer of a Merchant having an unattended POS Terminal at a

petrol station (MCC 5542) must process POS Transactions as follows.

[…]

3. The Acquirer must inform the Issuer of the final Transaction amount via an advice

message, which must be sent to the Issuer within 20 minutes of the authorization

response message.

Source: Mastercard Transaction Processing Rules, Dec 2017, p. 124 - this must be one of the most ignored rulebook in the world …

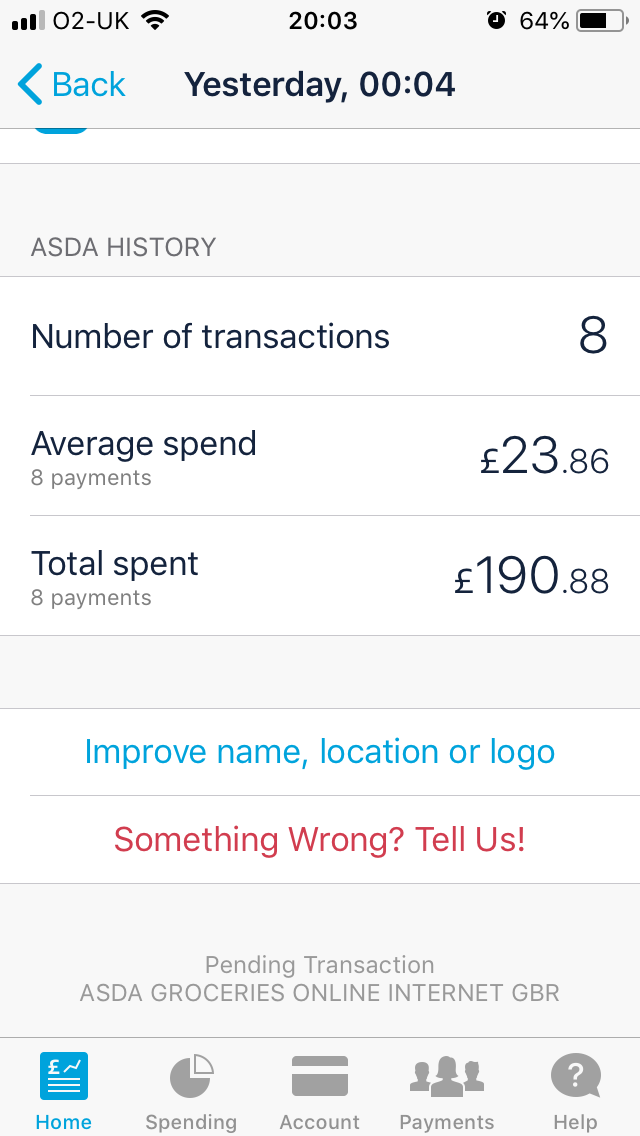

So, I did some experimenting. I remembered that when using an ATM with a card from a traditional bank, it shows both types of balances. So, I went over to an ATM and tried it with my Monzo card. Sadly, both balances were the same and set to the same as the app’s one. It would’ve been quite funny if I kept using ATMs to find out my real balance when close to overdraft. Monzo might have even paid attention to this since ATMs cost them so much

What I’ve done instead is update the Excel spreadsheet I used to use with my old bank with all upcoming or pre-authorised transactions in, in order to get a more accurate balance. I copy over the Monzo balance, then have the pre-authorised payments as adding to the balance instead of taking away. it also means I see my balance after all direct debits come in. I appreciate this is an upcoming feature as part of the new summary tab, so my spreadsheet will be used less and less, so eventually it’ll just be to keep track of pre-authorised payments.

They are, technically. If they have a low balance the pump will refuse them even if they only want £5 of fuel.

I wish this was more visible. It’d create a lot more noise and companies would be incentivised to sort it out. There’s really no reason for this kind of thing to be taking weeks any more.