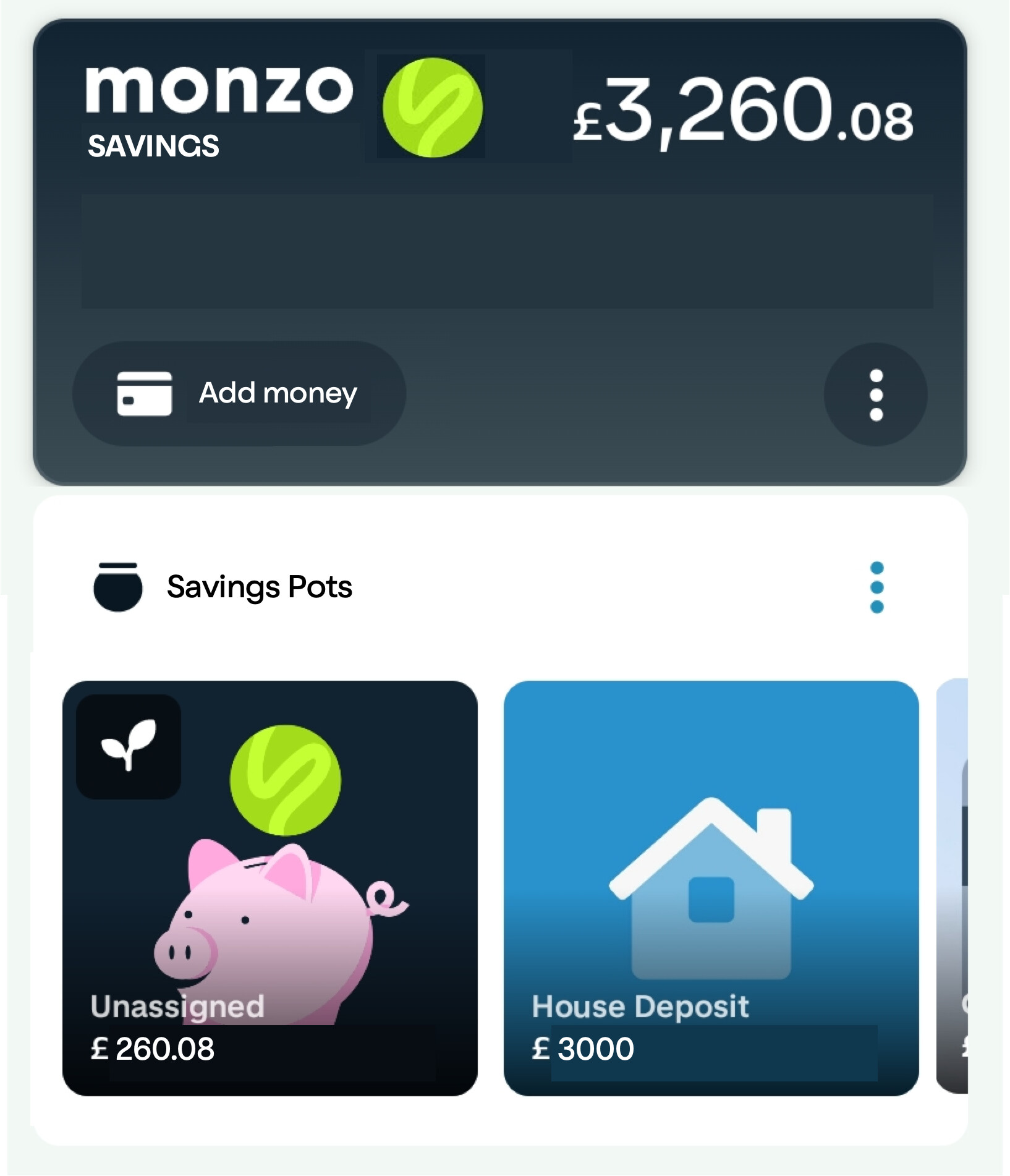

I have the same thing: no Provided by Monzo and no little leaf icon to indicate it’s an interest-bearing pot like I had with the Shawbrook one previously.

I’ve just rechecked and mine says 2:01 - could have sworn that time wasn’t there earlier. Post above edited…

The ‘little leaf’ icon is missing for me too on the full-sized image of the pot, however, on the Home Page it does appear on the Thumbnail for the pot in the Pots section.

Mine was just after 12pm today ![]()

So having used this for a bit, I wanted to offer @andys and team some reflections.

Tl;Dr: Perhaps counterintuitively I’m now keeping less money with Monzo and I’m feeling underwhelmed.

The full version:

I thought this was great. I was very excited to see a competitive Monzo savings product.

I wanted to use it as my main savings account and to replace some of my pots I use for monthly and especially yearly bills.

So I opened the pot and was disappointed that you could neither schedule withdrawals or have multiple versions of the pot.

But by this time I’d thought through my basic pots situation and realised that I was losing money. So I created a whole bunch of Oaknorth pots to replace them.

Then I looked at my savings schedule and realised that I was keeping money in a standard Monzo pot to be paid out at different times of the month to regular savers. I was losing interest on those, so realised I could do the same from Chase at the same rate as the Monzo pot but with the bells and whistles you usually associate with Monzo.

So I’ve ended up in a position where I’m actually keeping less money in Monzo-backed accounts and therefore generating less revenue for Monzo because of what seem to be “big bank” style restrictions on the account.

There’s also something psychological for me seeing my savings as a pot. I’m trying to pin it down, but I think I see pots as a subset of the current account, so seeing large amounts of money in one feels not only dissonant but somehow like it’s mine to spend. I don’t know how to explain more than that but it feels weird.

I’m still using the pot though as a small buffer fund. And it’s better than nothing. But I’m very south of the whelm I’m afraid.

I think maybe the metaphor of a pot breaks down when the values involved are large. Some people maybe see these savings pots as house plant size. Maybe a vault or safe or something is a better suited metaphor for large savings values.

I think something might be needed to make the savings pot feel a bit special and different compared to other pots. There is value in having a consistent model for partitioning money for different purposes. But as a consequence, the money you set aside for bills feels similar to your long term savings pot. Maybe long terms savings don’t fit in a plant pot.

I can’t find the post now, but there was someone asking about being able to hide and/or lock the savings away which I think is a response to the same problem.

Love this analogy, and agree totally.

My pots are for bills, new pairs of trainers, gig tickets and holidays. My ‘vault’ (3% pot) is for my deposit for a property. *Well aware this is probably better placed elsewhere but for now I want easy access. *

Maybe the vault concept could be applied to notice accounts if Monzo ever decide to launch those in-house?

While I think the pot metaphor is a reason some people feel uneasy about using it for their long-term savings, I want to be clear that its not just the name of the product. Just renaming it a vault won’t change how people feel about it. It can probably still be called a pot, but Monzo need to treat larger sums of money in a meaningfully different way to help people feel like that money is being taken seriously.

I put up a shelf in my living room last weekend for my partner’s growing house plant collection. I wouldn’t expect that same shelf to hold a massive dragon blood tree…

I think I return to this idea:

It just feels much better to have a savings account that you can then subdivide into pots or goals.

This ![]()

Totally agree. Especially if the interest applied gets divided up among pots properly ![]()

Agreed, would love to see this and would add some Monzo magic to the savings world.

'shopped I’m afraid. Was trying to illustrate how unrealistic it would be to expect to grow a large tree from a small pot ![]()

The one-pot restriction is so bloody annoying! ![]() I hope it’s just there whilst they do the initial roll-out and not a permanent thing.

I hope it’s just there whilst they do the initial roll-out and not a permanent thing.

I’m pretty happy with the savings pot as is - I wanted more interest and fast access and that’s what it delivers. I moved savings from chase as a result. If I could have the same for the business account I’d also move money back there.

Personally I dislike that pots are like sub accounts sometimes and would rather they be full accounts, but to each their own and monzo have made this rod for their own back by portraying pots as special in some way and attached to something else though they now encompass bill pots, savings, external savings accounts and external isas, which really have nothing to do with the current account.

Not sure I buy that pots are necessarily small - people save large amounts in isas.

I see no problem with multiple savings accounts though and suspect monzo will get there eventually - there are no fundamental barriers to multiple savings pots IMHO but it’s natural to start small and simple.

Need the consistency of the sapling/leaf for all savings pots ![]() , provided by monzo would also be nice. I changed the picture but can’t remember if it was there before.

, provided by monzo would also be nice. I changed the picture but can’t remember if it was there before.

It’s interesting because I don’t think I’ve ever come across a saving product that will show you the interest you’ve accumulated daily. I feel like I’ve got a good handle on rates etc. but it’s quite eye opening to actually see the money mounting up daily vs monthly.

It’s really making me reconsider my position and my financial planning for the next few months. I’m around 5 months away from paying off my student loan. The interest rate on that is currently 4.5% so I’m losing money by having my cash sat in Monzo at 3% and not paying off the remaining loan immediately. Normally grads are told not to worry about it because the rate is close to inflation so it doesn’t mean much - but in my position where I’m so close to paying it off, the 4.5% I’m paying has a real impact on my pocket.

Now I could go off on a whole tangent about how I’m planning to deal with this and balance reducing the loan whilst still having savings available over the next few months, but the point im trying to make is that it’s really interesting how such an insignificant feature in the grand scheme of things (showing daily interest) has really made me stop and think about the way I’m managing my money. Maybe it’s just the way my brain works, but there’s just something about seeing it there, daily in the account you use all the time vs in another bank’s account you rarely use.

This was a game changer for me with when I added my mortgage to my daily financial spreadsheets. Seeing that my mortgage loan was increasing by £13 in interest every day, and understanding that I could bring that down to £10 per day by making an overpayment of £XYZ really helped me understand the big picture.

I also really like this, very neat.

Chip do this with their new instant access saver (3.15%). It resets the interest counter at the beginning of the month but you don’t actually get the interest until the 4th working day, which is a little odd.