Slightly disagree here, in my experience, insurance companies are not no, but i’ve never seen the insurance company themselves carry out the repair. From my experience they always employ a 3rd party company to carry out the repair who will most likely be Apple Verified

Unless stated I wouldn’t expect the repair company the insurance provider uses to be an Apple Authorised Service Provider. My past experience (with Nationwide - who is the same insurer as Monzo) is that they use non-genuine parts.

In fact, unless they go out of the way to state that the repair will be an authorised official one I’d assume the worst. Post Office for example specifically advertise that you can get repairs done with Apple/Samsung directly as it’s such a selling point in the mobile phone insurance market.

Yes, swings and roundabouts I guess, I must’ve just been lucky so far.

I didn’t realise Protect Your Bubble was Assurant too so I guess you could expect similar repairs to what they’d do.

I just spent a short while googling trying to find a list of Assurant authorised repairers and unfortunately couldn’t find one.

If that’s all I’ve got worry about…my lifes pretty damn good. Thanks for your concern though

Assurant don’t carry out the repairs themselves.

They have a repair centre I can’t remember what the name of it is but it’s outsourced or possible they own it.

It’s a massive one who does repairs for plenty of the big phone manufacturers. Someone else may recall the name.

I’ve just gone through my emails to get their address from the last time I had an Assurant claim. The phones get sent to “Assurant” but the address is registered as TNT Tech Solutions and Mobile Phone Repairs Ltd. They’re a B2B phone repairer so it sounds about right.

Just recalled another one - Anovo is one of Assurants B2B repair centres. When you submit a claim you’ll get an address where you send your phone off to. It’ll say ‘Assurant’ with zero mention of this third party but if you search the address you’ll see who it is.

Assurant don’t really have anything to do with the repairs at all other than paying that repairer to do it all. The repairer sends it directly back to you once it’s done.

I wouldn’t trust any of them.

Which other banks use them?

They’re massive - a few of the big ones do.

I think the other big one is AVIVA which are generally better. They partner (or did) with Carphone Warehouse for their repairs and are all certified by the manufacturers so you don’t tend to get the refurbished crap.

Here’s a small selection on the LSG page - https://www.lifestylegroup.co.uk/index.html

Assurant own LSG and its actually LSG who the insurance has been arranged through according to the details on the Monzo claims portal - https://portal.monzo-assurant.com/ (edit - although going to some of those companies directly and looking at the t&cs, is even more confusing, as EE appear to mention Allianz despite their logo being on the LSG page).

Your Premium phone insurance has been arranged for Monzo Bank Limited by Lifestyle Services Group Limited with a single provider, Assurant General Insurance Limited.

Weirdly enough my insurance is with protect my bubble, the last and only time i had to claim about 6/7 months ago for a cracked screen i just went to apple and got it repaired and then reclaimed the fee ![]()

There definitely needs to be some proper clarification around this.

Can go to Apple = great cover and one I would pay for

Have to send it off/go somewhere weird = No chance

@maxwhite - thanks for confirming the name issue.

I signed up for LoungeKey’s app and the confirmation email references Monzo Plus rather than premium, but more importantly, it quotes £19 as the entry cost per person.

I believe I saw in another thread that the entry price has been lowered due to Covid-19. I could be wrong though.

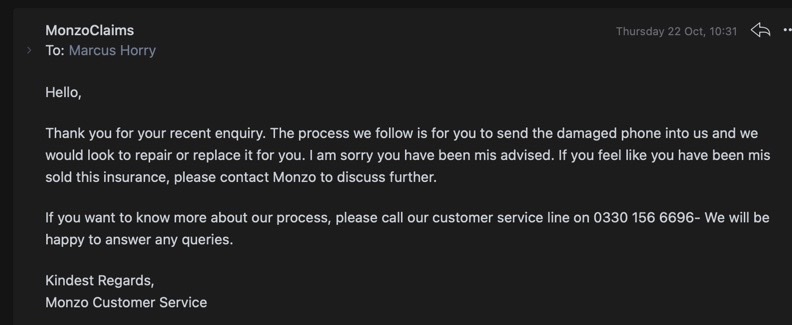

I find it kind of odd that this email says ‘contact Monzo to discuss further’ and then is signed off by ‘monzo customer service’  . Is it from Monzo or isn’t it?

. Is it from Monzo or isn’t it?

Sorry for any confusion!

Sorry for any confusion!

We think most customers who damage their phone will be best of sending their device into Assurant. This is a super fast process, which works smoothly. They send your phone back by DPD, so you get an hourly delivery slot, and a bunch of other delivery options.

In cases where this isn’t possible for you, Assurant will work with you to find the best way to repair your phone, including in-person options.

It’s important to note that this isn’t Apple Care - if the most important feature for you of phone insurance is being able to walk into an Apple Store, and walk out with a phone, Monzo Premium might not be your best option. But for most people this will work great!

Yes, confusing. I emailed MonzoClaims@assurant.com

But as you say, they sign off as Monzo Customer Service.

To be honest I’m less concerned about the delivery time. I am more concerned about the authenticity of parts used. If under Assurance I have a new screen for arguments sake. And they use third party sub standard parts. And for some reason my phone stops working and I send it to apple under the manufacture warranty. I know apple will say the warranty is now invalid due to an unauthorised repair. Now my £1300 device is no longer under manufacturers warranty.

I think the main question is about whether official Apple parts are definitely used (as previously stated) or whether they may use third party parts in the repair?

Assurant do seem to offer the in-store Apple option for other people though, just not Monzo?