I want free money ![]()

No… while it was a missed payment based on the legal definition - in our system it wasn’t a missed payment - legal wording is dumb sometimes.

And even if it was we would have made sure to suppress the reporting of the missed payment to the credit bureau since it was our error and not the customers.

It does seem a tad unfair then that the next payment missed starts the letter process, effectively one “strike” has been removed from the customer through no fault of their own.

I know it’s the legality of it all, but it doesn’t seem very fair.

The interesting question is what happens if @the_chez misses two payments in a row now.

As in, if they miss the next one, get the letter, and miss the next. Will Monzo’s error be taken into account on the ‘third’ strike or will it result in account sanctions/debt recovery. Whatever that step is for Monzo.

It doesn’t seem very fair in my opinion. If its Monzo’s fault then they should cover the shortfall as good will so that the account isn’t ‘officially in arrears’ as their software made the mistake. Even asking for the outstanding shortfall to be paid would be preferential in my opinion.

I personally would push the complaint further as @the_chez isn’t technically in the same position as they were in before Monzo made the mistake.

What you say is correct however given the circumstances, where it’s not really a missed payment but it will be registered as one if it happens again (fault of my own or not), I’m personally happy how my issue was handled.

Now if this happens again, Monzo being at fault, and we have to trigger the strike letter etc. then it would be a different story.

A good question would be how long will this First Strike be valid against my account. If it’s for an unlimited time then it would be considered a handicap due to Monzo’s fault.

It’s just for your next payment, so you in all likelihood will be fine.

Looking up what a NOSIA is, it has to be issued before an account default notice can be issued (asking for repayment of the full balance before court proceedings). Therefore that third strike could be a default notice (depending how Monzo does things), giving you less opportunity to delay a default due to Monzo’s error.

However, as you are happy with the outcome and probably won’t miss the next payment, who am I to comment ![]() .

.

As someone looking at getting Flex, this is interesting. Was this a widespread issue affecting lots of customers or just a chosen few?

Interested in ditching credit card for certain spend but the alternative has to work.

The alternative works, it’s just been an isolated issue which Monzo had in relation to not taking a payment.

How do holds and temporary transactions work with Flex? I.e. when hotel makes a hold for a large amount, keeps it pending, and then releases / drops it? Is one supposed to pick a plan and pay first installment for the pending transaction just like any other transaction?

That would be unlike all other credit cards - with them pending transactions never end up in a statement until confirmed.

Theo Answered this earlier in the topic ![]()

Thanks… But it means one will loose savings interest on some of the money.

Whilst technically true, that’s a very niche way of looking at it. How much interest are you talking about? Do you keep every penny you’re not about to spend in the highest interest–bearing account possible?

I wouldn’t bother with Flex for a ‘hold’, but only because of the faff.

I closed my Flex facility this morning. I’ve enjoyed playing with it for a few months but it’s not something I need.

Pennies though? If you’re thinking of it like this, then you shouldn’t have any money in a current account.

*lose

Might just be me but can you not bill split a flexed transaction?

Use case: Ive just bought something quite expensive for the house. I want to spread my half over 3 month to ease the strain and get the other half off my partner - but i cant ![]()

Guess ill have to do it manually? ![]()

Only if purchased through debit card first ![]()

Same case here, I just request half the installment amount on every installment date.

It would be helpful if at least we could have scheduled requests perhaps.

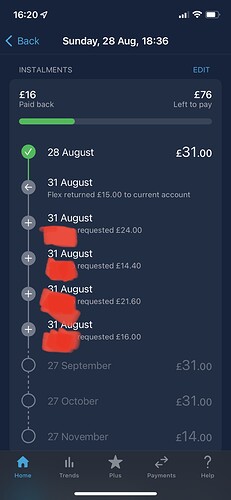

Does anyone who understands Flex have an idea of what’s going on here?

I paid for a purchase using my Flex card, total £92 split across three instalments. First instalment of £31 was paid fine.

Today I’ve been given a £15 refund from Flex, and another instalment has been added?

I have no idea what “vendor requested £x” is supposed to mean either?

Has the value changed of what you purchased?