Banks get away with plenty of stuff. This is just a new bank having to get away with something different

but the “new” bit is very important there. People aren’t locked in to them yet for one thing.

banks have the ire of many people, perhaps bizarrely even people who have been their customers for a lifetime. That’s where Monzo is meant and billed to be different

If profitable millennium banking isn’t possible then just have a bigger loan book!

Having worked in this arena for some time I can confirm that banks (and big building societies) do make money from packaged accounts. A reasonable amount in fact. The kind of portfolio deals they’re able to strike make them marginally profitable per user but greatly profitable as a whole business segment when a large number are onboarded. It’s also a good way of confirming a relationship, which is what I think you’re probably getting at. One of the key things for Nationwide for instance was to cement the relationship with their customers (hence offering a few different packages at the time of launch) and then try and flog them other products and services off the back of it. They struggled for years to shrug the “account used for abroad” mentality (toughening up on the benefits didn’t even help - but closing infrequently used accounts did…), and discounted mortgages was the big winner here.

Genuinely interested to see how Monzo handles all this.

I think bad press does impact perception. Last week, I recommended Monzo to two travellers from the UK I’d met in Singapore - both of them millennials - who’d been using their Nationwide and HSBC cards to withdraw cash. I showed them the app, the instant notifications, and the feature that most grabbed their attention: pots.

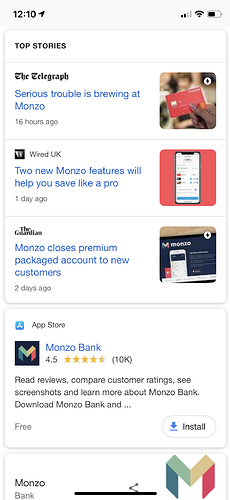

However, I was painfully aware while recommending Monzo to them that the first thing they’d likely do was Google them. And recently, the search results page is far less complimentary than it’s been in the past, and their first impression would certainly be mixed.

For the sake of honesty, I felt I had to caveat my recommendation with: “apply for a card, transfer over £100 and see whether it works for you. Don’t apply for any extras and don’t switch from your old account - at least for the timebeing.” I couldn’t be as unqualified with my praise as I had been in the past.

The sooner Monzo can sort out the legacy Plus issues - hopefully in the email they’ve promised next week - the sooner the press can return to covering what makes Monzo great.

That is also linked to perception of the user. I’ve never been able to praise Monzo without caveats (originally the android app was out of development sync, now the £200 foreign atm limit & the fact simple pot management is still not been developed (pot2pot transfer, pot ordering, editing scheduled pot transfers). But Plus for me was never more than a minor annoying advert - but also it never seemed remotely competitive and was relying too much on “it’s easier” which in the age of people comparing deals seems silly.

Of those three stories, one is bad, one is positive, and one is neutral. I don’t think the impression people get is as bad as you feared.

Granted, Plus probably feels like a big story to many forum users who were invested in it emotionally, but to the average man on the street, “Bank stops offering a product which hasn’t performed well” stories are a dime a dozen.

A lot is riding on how the next keratin of Plus pans out, though. Best case, it all goes well. Next best case, it never gets off the ground and is quietly out to pasture. Worst case, customers pay for an incomplete product that never works properly before being shut down again.

A one-off failure is dealable with. A pattern of failures less so.

Couldn’t disagree more (coming from an agile background).

The main reason I make the point is articles like:

It all seems to hinge on what exactly is meant by the word ‘minimum’

The following diagram is – at least in my experience – the single most important reference piece for Minimum Viable Products – which I think closely relates to the Minimum Awesome Product concept. Personally, I wish “MVP” would disappear from business speak because any meaning it once had has long been extinguished… and now it’s a justification for bad work. I pull out this diagram at any opportunity because I have yet to ever see a good MVP (where good means “an MVP that provides meaningful data that validates if a product is viable or not”). Typically an MVP is so bad that any data gathered from it is tainted by the poor user experience.

When you put it like that, the problem does seem greater than just Plus. My customer experience of late has been mixed, at best. I am just pleased that I have not experienced any major problem or emergency yet (touch wood). A 10 hour support turn around is no good to me, and no-one seems to be owning a problem any more - it is just picked up as and when by a passer by seemingly.

I am far away from Full Monzo.

I won’t deny that certain things within the company have been challenging recently. But hear me out here - that’s a good thing.

You cannot be afraid to fail. You cannot be averse to the possibility of things not going the way you hope. If your structure and governance is robust enough that project failures are not company ending, then you have to take bets. You have to consider and try new things and learn just as much from what doesn’t work as what does. The key is also knowing when and not being afraid to admit when you got something wrong.

Otherwise you remain on a path of mediocrity and status quo. And that’s not what we are here to do.

The reasons for our phenomenal successes and innovations are the same structures that mean we might sometimes get something very wrong. But as long as you remain in control, then it’s a far better path than never challenging, never innovating, because you don’t want to even consider the idea of making mistakes or something failing. There’s enough companies out there like that already.

Fail fast, fail often.

Yes, there are things Monzo has to improve and I’m sure (hope) that the whole company including those at the top recognise that - but Monzo have done well responding to things up to this point - I’m sure this will be no different.

Will require some compromise on both sides to get to where we need to be though.

I’m not going to deny that there are some areas that monzo could do better in, but sometimes I feel that the community here becomes like a echo chamber, sure there are issues but I’m pretty confident the wider customer base is for the most part unaware or indifferent about them. They just accept that nothing is perfect but for the most part the app/service is great.

So while somethings definitely need to be addressed I don’t think monzo have too much to worry about, they’re pretty fantastic on the whole and the only reason the press even cares to report on monzo is because of its popularity and continued success.

Your so right

You’re not an investor in a public company, if you get ‘fidgety’ there’s not really a lot you can do. It’s not like you’ve bought shares on the market.

Thanks for your input. Isn’t that a personal question, rather than one related to the topic?

This ![]()

I’ve been with the same high-street bank since my early teens. A few decades later, the’ve been, at times nothing short of appalling, but to their credit they’ve remedied the situation each time. They’d probably earn a score of “meh” overall. Whilst they’ve always made amends, they were errors that never should have been made.

I’d suspect the majority of Monzo customers are perfectly happy with their bank, but those of us interested enough to join the forum are likely to be holding the bank to a different set of standards that may or may not be realistic.

Fail fast. That’s what Monzo did with plus and it was perfect.

Keep up the good work and don’t be afraid to keep failing.

Nothing in this world can take the place of persistence. Talent will not: nothing is more common than unsuccessful men with talent. Genius will not; unrewarded genius is almost a proverb. Education will not: the world is full of educated derelicts. Persistence and determination alone are omnipotent.

Calvin Coolidge