I don’t use it so it doesn’t affect me.

Here’s Starling’s response, they don’t hold back ![]() -

-

It’s one thing to talk about API-first banking, but we put our money where our mouth is and truly invested in it.

To be fair, challenger banks such as ourselves, Atom, Monzo, and others, don’t have to comply with PSD2 or Open Banking on the same timescales as the CMA 9 (the big banks who are required to comply first). Rather, we have until spring 2019 to comply, but we didn’t build an API because we have to be compliant.

Simply keeping up with compliance and forced regulation is not innovation.

So we’re going to keep investing in our API and developer platform and evolve it to stay best-in-class and lead by example.

Side note - it looks like Starling are planning to integrate with a mortgage provider -

Gone will be the days of struggling through the complex process of finding and applying for a mortgage, or worse, remortgaging.

Revolut

The community site has increasingly become a place for lambasting the support.

Pleased to say I’ve used the card successfully and not needed recourse to help, but I’m worried about how long this state of affairs can run before real damage is done.

Revolut

I sold revolut hard to my family and friends… without realising the charges…

Before monzo they were awesome

Now not so sure, still awesome but where’s the real hard money earning game for the company

Crowd funding is coming soon, as advertised on the Victoria line  why should we invest … what are the real USPs now ?

why should we invest … what are the real USPs now ?

Me when I hear about Starling now…

https://img.memesuper.com/211253382b76a393462a245b7bf185c7_bored-meme-bored-face_900-900.png

Fair play, but as we all know in finance and banking ( and sadly in some areas even fintech companies fall under this banner ) time runs very very quickly…

I’d be worried about the resource and financial investment in technology advances that may not meet coming requirements

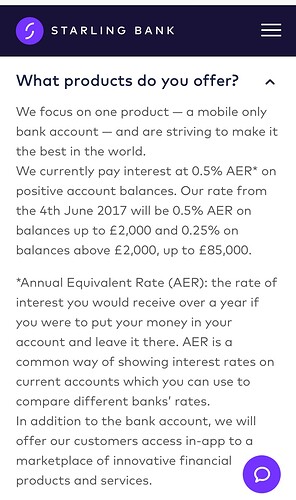

Starling say in the press today that they are now offering interest on their Current accounts from June 4th (??? ) - 0.5% up to £2000 and 0.25% after - no mention of it on their website

Wow so I can earn up to £5 each year, for every £1,000 I desposit - sign me up!

Edit - Here’s the link to the article which was linked to the tweet that Ian shared above -

spend it carefully  - two skinny lattes every year for you to enjoy ? or push the boat out and keep £2000 on deposit in my current account all year and get two pints of Guiness as a thank you - decisions decisions

- two skinny lattes every year for you to enjoy ? or push the boat out and keep £2000 on deposit in my current account all year and get two pints of Guiness as a thank you - decisions decisions

Yeah, slim rewards, but good to see the Starling offering taking shape nonetheless.

Not a customer but I don’t think this is new. It has been on their FAQ for a while: https://www.starlingbank.com/faq/ (“What products do you offer?”). Actually, I think what’s new could be a reduction in their interest rate if you have more than £2k.

Hi all, this might be slightly off topic but I thought this would be a good place to ask since I see a few people are Revolut users.

I just signed up to Revolut today to see what their offering was like but I assumed the delivery of the card would be free but they only tell you there is a charge once you have topped up. So now I have a virtual card with £10 on it that I don’t want to use. I have tried speaking to their support but as you all know, no reply! How can I get the money out of my account without spending it? For those familiar, can I use the turbo transfer feature to send the money to my bank account with incurring any charges?

Any help from any fellow Revolut users would be much appreciated and I apologise in advance if this is the wrong place for this to go.

Thanks!

Use the normal bank transfer option or possibly use the Revolut virtual card to top-up your Monzo card?

Regular bank transfer was how I cleaned out my Revolut account a while back.

@RichardR This is via the pink button with the two arrows and then selecting ‘to bank account’ on the next screen right?

Correct, then select “to myself” and fill that out. I left email and phone blank as I didn’t need a receipt for it.

Brilliant just wanted to make sure I won’t get charged. I don’t really trust Revolut. Thanks @RichardR!

They’ve got to be kidding, I run on a student budget (ie average of only £1000 in my Santander acc usually) and get over a pound in interest every month. Such generosity  I hope this isn’t a selling point for them?

I hope this isn’t a selling point for them?

Indeed - it would be a stretch to call it generous. But I guess they’d say that you’re getting free banking, no putative fees, free overseas transactions/withdrawals and a decent user experience… in addition to a current account interest rate that is actually higher than many others out there! I would be surprised if Monzo pay much more (if anything).

The point I was making was that, that interest rate is so low that it’s basically meaningless. Monzo won’t pay interest on in-credit balances but surely only people who have very bad maths skills will choose between one or the other based on that rate.

Obviously the other differentiatiors - features, products, services - are much more valuable than that rate.