I’m going to guess eventually there’ll be enhanced cashback at particular retailers etc.

Most likely, a bit like Apple Card.

Why? It’s money for free - who doesn’t like free money?!

Plus four bank accounts isn’t that many, it’s not like it’s going to get out of control with four.

That’s about the same time-frame as for me, normally. My guess is people who are seeing longer delays are (normally) having the transfer held by the sending bank to double-check it’s not money laundering.

Especially given that Chase have no Confirmation of Payee support, which is probably a bit of a red flag to banks.

I get what you mean about Tandem and Skipton though, haha, as a customer of both myself. It’s not just them either - most building societies are not instant, and Co-operative Bank isn’t. Tesco Bank didn’t used to be but they are now, which is good if you use Clubcard Pay. I personally don’t though because Chase’s cashback is better.

Credit where it’s due, Santander always allow a “don’t show again option”, which is much appreciated.

Couldn’t get a snap but there’s now quite a bit of Chase adverts on the tube here in London.

I’m surprised they’re pushing this so hard when they haven’t got basics like Direct Debits…

Me neither. I’m sure we can expect a full throated defence and explanation in due course, but my take is that most of the country just isn’t interested in bank accounts all that much. Some folk will move when it’s economically sensible for then to do so, and when it’s a like for like swap. But we’re not quite there yet, so we’re still very much in early adopter territory.

Nothing wrong with that, of course. But I still find JPM’s approach a bit baffling, tbh.

Unfortunately, Curve’s “dynamic MCC engine” doesn’t actually support the full range of MCCs.

This means some retailers are “translated” to a different, but similar, MCC when you pay via Curve. Usually this makes no difference but in this case it’s likely to be what has caused the transaction to become ineligible for cashback.

A cynic may suggest that Curve do this partly to increase their own income as they frequently seem to tend to translate the MCC to one attracting more in fees for them. Often, it is a transaction that would start as a “normal” transaction, but gets converted to an MCC for something “premium”. I think they then get paid more on the side where they are acting as the merchant than they have paid the actual merchant as a result.

Of course, it also might just be that it’s difficult to dynamically update MCCs, so they only use a limited number for that reason.

Agreed; which makes me wonder if it’s coming fairly soon. I’m guessing they are hoping that the cashback is sufficient at the moment to draw people in.

To be fair, a lot of people I know now have an account and use it for spending for the cashback, and use their old bank for bills. So it probably works better than we think on here.

I REALLY hope this new offers thing isnt like curves where they sell your data to target offers.

It’s more a case I push all spending via Amex which gets me around £25 back from normal spend.

Chase would be competing with Monzo and Starling.

Non Amex is for rare cases its not accepted, so cashback on a few quid ![]()

Oh I’m getting more than 1% via my Amex Nectar, and that’s being doubled via insurance which goes via Sainsbury’s bank.

I agree with that sentiment, I think it’s better just to have offers open to everybody like Apple Card.

It also means you don’t have to have shopped with a retailer before to get offers from them, which is nice (targeted offers basically try to get you back to the same retailers over and over, but if you have just bought something from them it’s likely you don’t need another of their products right away - so pretty useless, even aside from the data concerns).

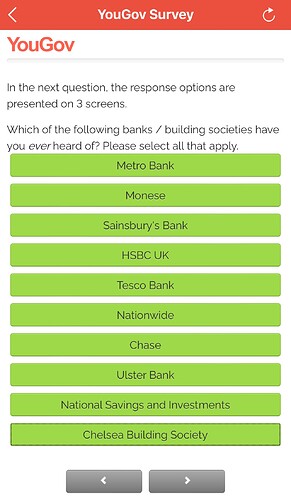

Interesting that Chase are included in this YouGov poll; I’m going to just hazard a guess that they commissioned it… it felt very much geared towards banking brands.

Either that or they are now known enough to be listed as a bank for the masses!

This was a tiring poll for me… given I have heard something positive or negative about most banks being on this forum, and they wanted to know what I heard for them all

Any reference to Monzling?

Not in this part; later on when it asks who my main current account is, Monzo is listed (and Chase is not, interestingly - short of direct debits it’s entirely possible for it to be my main current account) but that’s all that Monzo is listed in.

This is definitely new.

Imagine if they did cashback for direct debits

They haven’t announced direct debits though so it would be something I’d wait for…

That being said, if technically the account can take direct debits, does that make you protected with the direct debit guarantee?

Say I changed my phone bill over, and it set up fine, but then was rejected when it came to be taken out, would the mere fact it was eligible for direct debits protect me?

I wasn’t so sure, that’s what confused me. I read somewhere about someone setting a direct debit up and thought I would check.

Nope, that’s new