But they’ve been doing it forever and reckon they’re untouchable so who are we to debate ![]()

Just to try and bring it back on topic.

Good that the cashback is simpler £1500 a month in. I can get rid of my PayPal direct debits ![]()

Tell me again how her using her card to pay for the family’s Tesco/asda

shop or fuel (for example) as my cashback is done is unauthorised and not permitted?

Sometimes part of our holidays go on my card part goes on hers ![]()

I pay for most things the family needs until the cashback is hit the she uses her card. I have access as I too get the gain of the saving for us as a unit.

You assumed all sorts with “access” but for me it’s a cashback gain for our finances.

I just went down the inane rabbit hole to see what would be said.

I’m lost for words with the level of ignorance.

Good day to you.

Ahh so her using the card for the family purchases is ignorant after I use my card for the family purchases. It’s not my fault you think it’s some grand banking fraud when it’s simply 2 people putting purchases on their cards when cashback is maxed out. It’s all authorised.

Can explain how that’s a breach?

Is it because I gain from the shopping/bread and our family budget gets the 1%?

If you think using someone else’s card is ok then you crack on hun.

You do you xx

She is using her card for the family. I have access as I can ask her to buy things after mine is maxed.

Again how is that a breach?

We gain as we save 1% on the family budget.

Yeah it did as I was overly curt sadly but I hate typing on my phone and iOS has been getting worse with autocorrect.

This is no grand fraud, nor is it some random down the street I opened an account for.

Access was a poor word but I fear if I used “gain” people may have assumed more as well.

I will try to be more verbatim but likewise people should maybe ask questions before assuming.

My post was curt but you all assumed far worse without asking for clarification.

My gran came in because it’s a hugely common scenario which would have made her laugh if I told her the bank will debank her because I took £20 out of the cash machine for her to buy shopping, god that would have certainly made the daily fail.

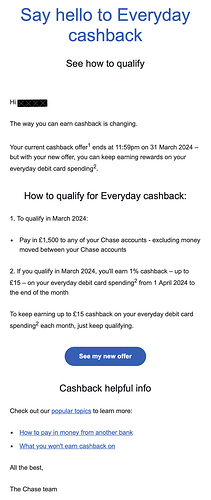

Reading through the new T+Cs the new Cashback offer is open ended (no ‘12 month period’) with the clause that they can stop running the offer at any time with 30 days notice.

So, it’ll be interesting to see how this ‘sits’ with the other 2 cashback offers.

Would it be going forward - first 12 months ‘unlimited’ cashback with no requirements, second 12 months £15 max with £500 + 2 DD requirement, after that £15 max with £1500 requirement (no DD). Or just anyone new joining will be the new ‘Everyday Cashback’ offer straight away and the other 2 annual offers will not be available (in which case, if you know anyone who’s on the fence about joining, get them to do it before 1st March?)

Happy with this one. Glad not to be able to faff about with DDs. Will be keeping using Chase as long as they keep the cashback.

Actually - just checking the Chase website and on that it says that new accounts have had their cash back capped at £15 for new joiners since 9th May 2023.

Have they also had the same pay £500 and 2 DD clause as well since then anyway? Or was it just £15 capped cash back but with no requirements?

18+, UK residents. Cashback available for your first 12 months for new customers. Max £15 per month for applications from 9 May 2023. Cashback exceptions apply.

Slightly complicated by the fact that the Nutmeg coloured lozenge shaped button is how you move forward. R-

Any word on the new credit card?

If there was this thread would have blown up with it.

They’re also on the last day to publish a February update if they’re going to keep that trend going (although I think they apparently always used to post press release at 5:59am so maybe we’re not getting one).

I would’ve thought that if they intended to publish a 12 month review/update this week, they would NOT have published the details of the new Cashback offer separately yesterday and instead would have just included that.

So, I don’t think there’s going to be any other news coming from Chase this week/month.

Sadly I think you’re right.

Hey team!

Happy Friday!!

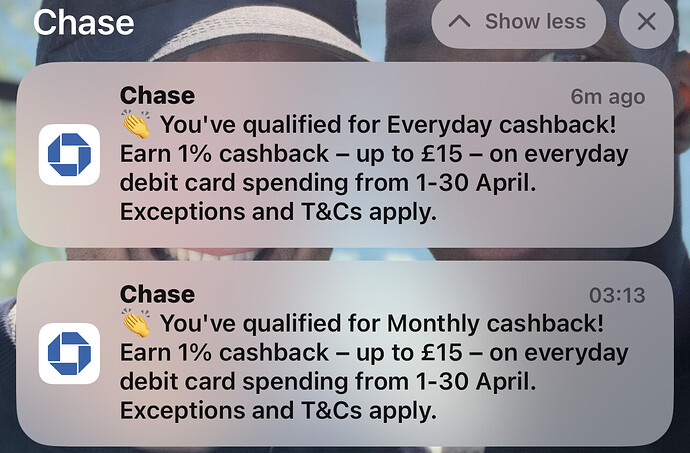

So, these need to iron out a bug. So I got a rent payment and it covers the old cashback offer. So it landed in early in the morning as normal, but it wasn’t enough to satisfy the new cashback offer however I got a notification to say that I had qualified for the new (£1500) offer.

When I clicked into the app, it was clear that it hadn’t maxed out to meet the requirements. So I topped up the rest and then boom I got another notification. Basically I’m saying that they shouldn’t have sent the first notification - because technically I hadn’t met the new cashback requirements.

See where the first one came in when the rent standing order was paid. And then the second when I paid in the difference.

Nope. Maybe I’ll do that now. ![]()