I have iPhone 13 mini and apparently Monzo uses 4% on mine but I’m always on Monzo app and in the feeds so maybe this is why. It’s no biggy as my phone lasts all day anyway and have a charger at hand along with an Apple MagSafe battery pack.

On another board, there is a post about an offer, signing up with Nutmeg, as a new user, but only through the CHASE app.

Would appear from the subsequent posts that it is visible in Android only atm.

Not as bummed out as before when I moved from Nutmeg to Dodl in this case. It’s basically a glorified in-app widget by the looks of it. There’s way more potential if they make investments it’s own tab in-app and give it its own Spotlight. Great start though nonetheless.

Paying over 1% in fees with no apparent cap is just crazy in a world where even HSBC allows me to hold on to shares for like £40 a year tops, and don’t forget Freetrade which is £0!

I’m not touching nutmeg with a barge pole until they bring down those ridiculous prices.

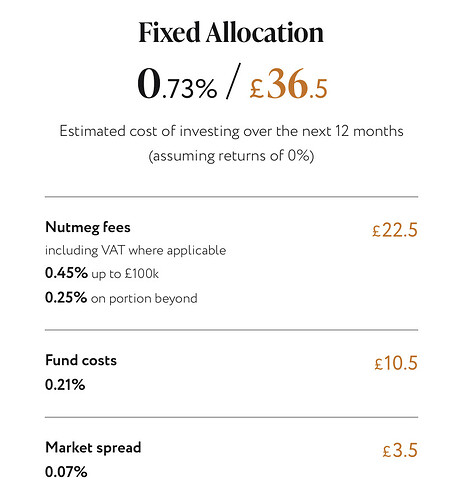

Personally, I agree. Nutmeg justify it based on their USP of ‘expertly managing’ your funds. Most would be better off going for their Fixed Allocation to save the % points while having the “peace of mind” your money is in good hands. I do think there is a market for paying for convenience, even in the Investment space as just getting started is the hardest step for the average person.

Based on £5000 input investment, these are the options:

Does it bug anyone else when prices are displayed as £3.5 instead of £3.50 ![]() Is that an actual convention I’m unaware of or just a formatting mistake.

Is that an actual convention I’m unaware of or just a formatting mistake.

Only in awful restaurants.

I equally hate no currency symbol.

Lasagne - 5

5 what? 5p? Sure.

The highest fee at Nutmeg is 0.75%, not more than 1%.

Anything additional is the fee charged by the fund, which you have to pay no matter what the management/custody costs are. And Nutmeg appears to construct its portfolios from cheap funds.

Anyway, as for encouraging people to get started with investing, I personally think most people shouldn’t consider an ISA unless they’ve maxed out their pension allowance - the tax relief is absolutely massive.

I would be pretty friendly too if I was charging one of the highest rates around, lets face it slinging insults wont get sales on top of the high fee’s

They explain it so it seems little when its actually really poor, I have the same issue with Moneybox and other robo investors.

I saw a review compare them vs vanguard funds and what an outcome was over a year and they didnt score well and thats before the increased fee’s.

If they halfed the fee I would be tempted for a year to see how they did.

It looks, based on their typical fund fee’s they may even be using Vanguard funds with a few others but you can just invest yourself into Vanguard and remove their fee: Vanguard Asset Management | Personal Investing in the UK

IF they have great performance each year then it can be argued its more worth it but the larger your pot grows the more it eats.

I feel this image needs reposting (remember its the total charge with their fee + fund fee’s that matter, I dont care if its less than 1% they charge if I pay more than 1% because of the extra charges)

Trading can be fun, or it can be a financial nightmare.

I have some money in Trading 212

(which is money I can afford to lose should things go belly up)

I have made money, but it does involve spending some of my free time sat in front of the computer buying and selling.

If you haven’t got the time or the inclination to do that, then maybe something like Nutmeg would suit the casual investor.

I am glad they have worked out for you in 2021, I just really think people need to be fully aware how fees can eat away at your ISA, 1% may not seem a lot but it compounds and eats away, thats great if returns are high each year but a few bad years and you get hit hard.

Also the review I read about it was a bit older and they had a fair lot of Vanguard funds mixed in at the time.

I think that’s a key thing here. It can go both ways. I’ve seen some good returns but equally there’ve been times where I’ve looked at it and gone (hope this gets better soon!)

Nutmeg publish the holdings on the website and you can see them for each investment style and risk setting, e.g. fully managed is here: https://www.nutmeg.com/fully-managed-portfolios (look at Asset Allocation, then “Show More”.

These are the current holdings for the 10/10 risk level fully managed portfolio:

ALLOCATION

|CSP1|iShares Core S&P500 UCITS ETF|19.4%|

|VUKE|Vanguard FTSE 100 UCITS ETF|11.7%|

|EMIM|iShares Core MSCI Emerging Markets IMI UCITS ETF|10.1%|

|GSPX|iShares Core S&P 500 GBP Hedged UCITS ETF|9.6%|

|ISF|iShares FTSE 100 UCITS ETF|8.8%|

|LCJP|Lyxor Core MSCI Japan UCITS ETF|4.8%|

|UB39|UBS MSCI EMU Socially Responsible UCITS ETF|4.3%|

|CUS1|iShares MSCI USA Small Cap UCITS ETF|3.9%|

|SUUS|iShares MSCI USA SRI UCITS ETF|3.1%|

|AWSG|UBS MSCI ACWI Socially Responsible UCITS ETF (GBP hedged)|2.8%|

|SLXX|iShares Core GBP Corporate Bond UCITS ETF|2.4%|

|XDN0|Xtrackers MSCI Nordic UCITS ETF|2.3%|

|CPJ1|iShares Core MSCI Pacific Ex Japan UCITS ETF|2.2%|

|VMID|Vanguard FTSE 250 UCITS ETF|1.9%|

|LCJG|Lyxor Core MSCI Japan UCITS ETF (GBP Hedged)|1.7%|

|EUSR|UBS MSCI EMU Socially Responsible GBP Hedged UCITS ETF|1.7%|

|UC87|UBS MSCI Canada UCITS ETF|1.7%|

|UC94|UBS MSCI Switzerland 20-35 UCITS ETF (GBP Hedged)|1.6%|

|SRUG|UBS MSCI USA Socially Responsible GBP Hedged ETF|1.2%|

|BBDS|JPMorgan BetaBuilders US Small Cap Equity UCITS ETF|1%|

|CES1|iShares MSCI EMU Small Cap UCITS ETF|1%|

|ISJP|iShares MSCI Japan Small Cap UCITS ETF|0.9%|

|UB23|UBS MSCI Canada UCITS ETF|0.9%|

|ENGW|SPDR MSCI World Energy UCITS ETF|0.8%|

|CASH|CASH|0.4%|

You can, of course, closely replicate that with your own brokerage account that charges lower management fees, but just buying that amount of diversification (in the riskiest settings they offer), is likely to cost you hefty upfront and rebalancing transaction costs, time and effort.

These allocations seem very odd. Why have FTSE 100 ETF from both iShares and Vanguard. Add a Pacific traffic that excludes Japan… Then add Japan… Have S&P500 unhedged and hedged ETF. Mix some bonds in. But not enough to provide any sort of hedge.

It feels like the Vanguard ESG Global All Cap ETF in trading212 will give roughly the same performance after fees.

The JPM funds are mostly in the Smart Alpha portfolios (not the “Fully Managed”), which you can also look up on the website for each of the various risk levels.

I don’t propose these as answers to your questions, but things that could influence this (and may not be relevant to you unless you’re managing large amounts of other peoples money) might include:

Why have FTSE 100 ETF from both iShares and Vanguard?

Risk, e.g. company-wide policies on holding a certain percentage of AUM in a single fund. As a UK-based ETF investor, I’m sure they have a high percentage in FTSE 100 trackers, which could breach limits if it was all in the same fund.

Why APAC ex-Japan and Japan separately, rather than an all APAC? This allows you to underweight/overweight Japan. No different to holding separate US and Global ex-US Funds rather than just a Global Fund.

Why hedged and unhedged S&P? Allows you to underweight/overweight USD-GBP.

Why have any bonds? It’s not an equities-only product. No reason you shouldn’t look at corporate bonds to for returns.

my megre pension is fully managed with nutmeg , which im quite glad of as i wouldnt have a clue where to put it