No I can’t make joint account top of list in Trends even when Show joint account first is switched on in Labs. However joint account is always on in Trends, for me at least

This gets even stranger. My Joint Account is first in the list/carousel and I can’t move it to be after my Personal Account and can’t get the Joint account to be included in Trends on start-up (after a log-out/log-in)

So my circumstances seem to be exactly opposite to yours!

How strange. Are we on the same OS? I’m iOS latest TestFlight

Uh oh, platform-parity-issue -I’m on Android beta

There we have it. Oh dear

Potential big trends / categories issue!

Potential big trends / categories issue!

I went through and recategorised a bunch of stuff last week, including transfers to pots as savings.

It looks like those categories aren’t being remembered, so new transactions are always being assigned to the default rather than the latest one selected.

This has made me very sad.

Something I’ve just noticed is if you have two accounts with the same bank like I do - Nationwide current account and a Nationwide credit card, you can’t distinguish between the two when looking at transactions within Trends

That was the default behaviour on first getting Trends, as I mentioned well above on this thread and on in-app feedback, but it has gone back to that state today after updating the app

Ah, so 3.95.0 fixed it and 3.95.1 broke it again?

I manually triggered the update today and did not look at the app yesterday, so it is possible I skipped 3.95.0

Love trends.

So my experience can sort every other account outside of Monzo but comes to my joint Monzo - nope not a chance!

So I now have loads of rubbish data and it means I can’t fully use this function.

So I get it in part but don’t let me sort joint accounts outside Monzo and give me better data to process than in-house accounts.

It just makes no sense to me at all?

Perhaps I just don’t get it!

It makes no sense to me either.

All it takes is for custom categories to be enabled on the Joint Account in-app for the Joint account user who also pays for Plus/Premium on their Personal account, so then at least one member of the Joint Account can use Trends properly. Ideally, both JA users could access features available to Plus/Premium users although this may mean both JA users must pay for Plus/Premium on their Personal accounts.

But whatever, Joint Account parity is becoming messier and messier as time goes by. I’m getting close to closing the JA and going with alternatives - my confidence in it is shot to pieces now.

Going to have to have a week or two of actually categorising things properly to see how this works for me - but so far, my feeling is “a bit meh”.

The data’s a bit all over the place because of a lack of categorisation so far, that’s on me of course, but I don’t really see that much useful insight right now.

I think it’s still that it’s all so reactive - I’d love to see it somehow link with the budget setting page - that would be nice.

The fact that joint accounts are again sub-standard is… just bizarre…

I hope more useful insights come, but right now a per-category summary isn’t that helpful I think, in the grand scheme of all the things that could be.

Forgive me if I’ve missed something but does the Trends tab actually show trends at a glance? i.e. differences (or trends) in spending in categories across different periods?

Or is it just a snapshot of spending in one period at a time?

To me ‘trends’ definitely implies movement over time would be what’s on show.

I get that this this is also a first glance of the feature so this may be the plan for the tab down the line?

It only [currently] shows a chosen reporting period of categorised spending, income, transfers and savings across all the connected accounts.

Comparing the Monzo Trends figures against my YNAB figures for the same multiple accounts, it’s 100% accurate so far. So a good base to build on.

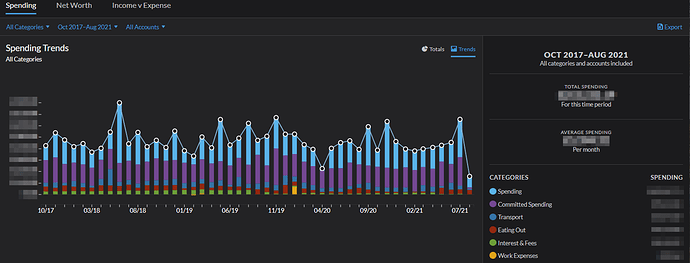

If multiple periods can be shown in a way to display actual trends properly, then it’d be a tool that would allow me to ditch YNAB. Here’s an example of YNAB data from October 2017-to-date in a way that I can see where we were OK and where we pushed the boat out a bit too much:

Drill-downs allow data analysis to see where the money went to the £

If Monzo Trends can do this, it’d be a winner.

Does that view really help you? To me it just looks like some months have a bunch of large blobs of opaque spending. Sure, it’s briefly nice to see that some months spending was higher, but what I’d much prefer is for Trends to evolve towards a nuanced view that incorporates irregular (mandatory) spending in a smoothed way over all months, and a way to create financial projections based on various scenarios (and then perhaps provide month-by-month steering to help achieve those goals).

It helps me looking back.

But looking forward is another matter. YNAB also excels here, as it allows you to add single/repeating future entries and shows them as greyed out at the top of the list of transactions. It also gives the future balance as affected by each future transaction, so by adding a ‘dummy’ purchase or new subscription, you can see how the ongoing future balance is affected and see if there are any corrections necessary (‘can really I afford this?’ / ‘to afford this, I need to reduce bills by £xx’ / etc.)

EDIT: Monzo already knows the future committed & scheduled payments, so if a running balance was shown against each transaction and you had the ability to add future ‘dummy’ transactions which affected that future running balance, you could do the same with Monzo. This is where I need to be with forecasting - ‘what if?..’

I haven’t done scenarios, but I have done some basic work to create forecasts and projections for my personal finance spreadsheets based on past account balances using excel’s ‘forecast’ functions;

Just thought I’d mention as its sort of related.

I was going to add that the way YNAB does trending is currently my Gold-standard, to beat approach.

I’m hoping the Monzo trends can deliver something similar eventually.

If you just hover on it, it’s plainly a Youtube link, not a ‘deep link for the win hashtag emoji monkey rocket rocket smiley hashtag’.