I had this in the work canteen which is debit cards only, got told thats a credit card until I tried it and they said never had a mastercard debit card before. (Theres now a few monzo users at my work)

A stag named Frank???

(Ignore me - it’s Sunday ![]() ).

).

Pretty ridiculous!

They have evidently never come across Starling, a new Santander debit, Yorkshire/Clydesdale/Virgin Money or a Mastercard Revolut, or even a Curve card before.

First Direct are soon to be added to the list too.

They will be seeing many more Mastercards passing through in the not-too-distant future.

I started there over a year ago, now we have a few more monzo users via me and other people giving word of mouth it’s not a problem.

Theres alot more now, most common cards round here seem to be lloyds, nationwide or barclays debit cards.

My grandparents recently got sent new santander mastercard debit cards.

Yeah I’m always staggered by things like this but I suppose the “average Joe” does still make the connection that Visa = debit and Mastercard = credit.

Lloyds, Nationwide and Barclays are three out of the “big four”, so you can see where the idea comes from even though it is misguided, and I suspect the situation is similar across the country.

If First Direct changing to Mastercard is a precursor to the whole HSBC group doing it, then there will be greater understanding that Mastercard debit exists, as they make up a sizeable chunk of the market.

![]() Not unless we’ve timewarped back a couple decades. If I asked the next 1000 people in the street I’m confident 990 wouldn’t think Mastercard is only credit cards.

Not unless we’ve timewarped back a couple decades. If I asked the next 1000 people in the street I’m confident 990 wouldn’t think Mastercard is only credit cards.

I guess it’s what street you are stood on but even deep in the sticks I would have thought it’s now common knowledge.

I live in the countryside and I don’t think it’s common knowledge here.

It’s not the “deepest darkest countryside” either - there are places which are far more remote!

I was starting to wonder…![]()

I’ve never seen a distinction between MasterCard & Visa as described herein. If there ever was, it passed me by…

That’s true couple decades is probably over egging it.

But yeah the Maestro Debit into Mastercard Debit seems like forever ago.

I’m not old enough to remember, but I believe that “back in the day” (when this distinction sort-of existed) we had Switch debit cards in the U.K. and credit cards on either Visa or Mastercard.

Switch became part of Mastercard and was aligned with Maestro, but many banks switched to Visa Debit (probably just a commercial decision based on Visa’s terms being more favourable). Around the same time, most credit cards (with the exception of Barclaycard) happened to be Mastercard.

So we ended up, pre-fintech, with a situation where the majority of Visa cards were debit cards, and the majority of Mastercards were credit cards (and vice-versa).

The holdover effect of this is what creates the impression, to this day, that all debit cards are Visa; it is something which is reinforced by all the main big four banks using Visa for their debit cards.

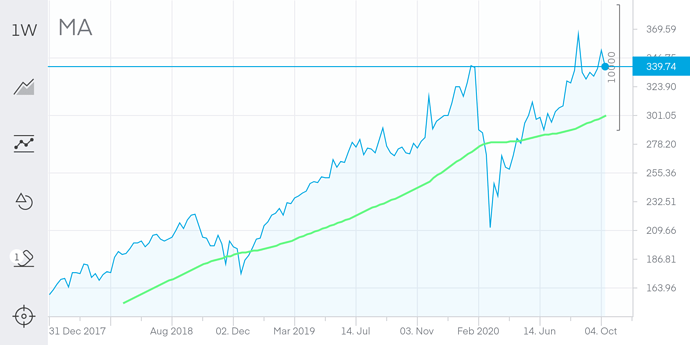

Just for giggles just seeing how VISA and MasterCard have dealt with the past couple of years. Added Amex too.

(Green is the 50 Simple Moving Average)

I hold none of these but if someone was forcing me to pick I’d go Mastercard. It has so much more life in it for the next decade at least.

Amex gets harder hit, and slower to bounce back. Buffett made a mistake not picking MA/V

Either way all three are going to be around for while unless crypto fucks them up.

Well that certainly passed me by.

Ta for the info…![]()

In fairness, only Santander in that list is a card I would consider in common UK use outside of the London fintech bubble.

On the main topic though, it is extremely unusual for a merchant to not accept Mastercard at all, especially in the UK outside of specific Visa sponsored events. Any service from an acquirer would almost always include connection through to at least the two main networks of Visa and Mastercard.

Which cafe did you visit? I was cycling through Richmond Park this morning. I went to the Pen Ponds Cafe and they definitely take Mastercard as I paid with a Virgin Money debit card using Apple Pay.

Interesting, perhaps they would have challenged you if they had noticed the card (if you hadn’t used Apple Pay). If so, it seems to prove the “debit only rule” they have, which appears to be wrongly enforced via card brand due to confusion. That’s my speculation anyway.

@Rika I totally agree with you, I was just being flippant really in pointing out those other banks - it shows how there are actually quite a few Debit Mastercards out there, even if they aren’t “mainstream”.

I think there is a possible exception to what you’ve said about the “fintech bubble”, though, with Clydesdale and Yorkshire customers potentially making up a significant number of customers in their respective regions?

It’s enforced on a bin blacklist maybe?

It’s allowed in network rules to only allow debit cards and it’s a canteen so who cares.

Tried my Tesco credit card and doesn’t work but my Monzo debit card does.

I suspect you are right about it being BIN-based.

I’m not an expert, but I do know that the BIN includes the status of the card as either debit, credit or prepaid, so it would be possible to identify and block credit in this way.

I keep my RBS account open, initially for depositing cash and cheques (fortunately very few of them these days) but also because if I’m ever out and forget my Monzo card and need cash for some reason (usually going to the barbers) I can instantly transfer over to RBS and then use their app to do the Emergency Cash feature on an RBS/Natwest/Tesco ATM. Or I could use it on Apple Pay if I was ever in Richmond Park and couldn’t use Mastercard but that’s unlikely. If i had coffee in a park I’d just spend the next two hours looking for a bathroom.

The BRC said the average cost of a cash transaction to retailers was just 1.42p. Accepting payment by debit cards costs retailers 5.88p, while credit cards cost them 18.4p.

This topic was automatically closed 180 days after the last reply. New replies are no longer allowed.