I wish I could like a post more than once. Perfect summary thank you.

Right but everything has its price. I was essentially paying £3.50 a month for plus. This makes it a clean £5, so about a 40% increase.

Sure, you can say ‘that’s just £1.50, but then again it’s not just this that goes up it’s everything. If Netflix went up by 40% I’d cancel it, same with many subscription services.

I budget very carefully and absolutely minimise the amount of recurring subscriptions. If any go up substantially in terms of percentage I reassess their value. Otherwise you end up with like £30 - £40 of subscriptions, which is a big hit when you only spend £500 a month or less

Do I understand correctly that we can now only get interest on one pot for Premium customers rather than across all of them? How is this a benefit? So now i have to lump all my pots that save money for the future (e.g putting aside money for six-monthly service charge bills for my flat, putting aside money for a holiday, etc. etc) into one pot and keep a note elsewhere of everything because you’re breaking the whole point of organising money in pots? Why is this meant to be a helpful feature? it’s basically taking interest on our current accounts away isn’t it? or am i missing something? (i appreciate that it’s a better rate, but why can’t we have a way of organising our money within the instant access savings account - it’s not a single pot in my book because i’ll need to move all my pots into it!)

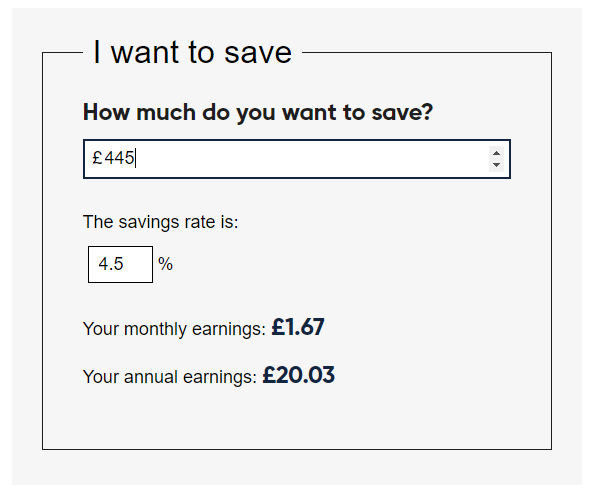

With this change, the main current account and any pots will now have no interest at all. If you have one of the Monzo-provided savings pots, that will now attract an additional 0.5% interest if you’re a plus or premium subscriber, so it will be 4.5% rather than 4%.

Anyone with £4,000 or above in a Monzo-provided savings pot will be better off. Anyone without a savings pot or with less than £4,000 will be worse off than before this change.

Thank you. For me this breaks the benefit I get from organising my money in pots to simply manage my finances (whilst benefitting from interest on my current account). Ideally i’d want the app to provide sub-pots within the Savings pot so that i could continue to organise and manage my money. Otherwise i will basically have to stop using all the pot features in order to continue to gain interest in the one pot. Perhaps time to review other products!

Wow, so basically taking away one of the few benefits of having a Plus account?

So the plus account now will cost me the full £5 and the only benefit I get is the monthly credit score which many services provided for free and the virtual credit cards which again many services provide for free.

So what is the incentive for me to stay as a plus customer or even to stay as a full Monzo customer?

Hugely disappointed and I have been a full Monzo customer since 2019. 0/10.

Is there someone at Monzo that’s gone off the idea that pots are there to help you manage your money? This is another step away from this it seems.

The 1% interest on the current account and pots was only on balances up to £2,000, so the maximum benefit anyone would ever receive was £1.67 per month. Although it’s slightly annoying they’ve cut one of the benefits of plus, it’s not enough for me to change how I do things.

I basically just saw the 1% interest on pots and balances as a subsidy of the £5 plus fee, whereas I’ll now have to pay the full £5. Again, mildly annoying but not really an issue for me personally.

You can open easy access savings pots in addition to the Monzo ones…

If like me you were holding money in savings pots to get the 1% , switching it to an easy access pot at 4.08% is an option to offset the loss of £1.67 pcm

Hey everyone ![]()

Thanks for all the feedback and for sharing your concerns. The team and I will be reading all your thoughts closely and be back to join the discussion, answer your questions and share more about this update.

I’m going to pause the thread for now as we wait for the team to come back – there’s been a lot of comments already so let’s give them a chance to respond fully to everything you’ve said so far.

I don’t think you can speculate that most people have less than £2k in their pots/account - we just don’t have access to this data

@cookywook This thread was closed while they review all the feedback from yesterday.

Maybe a good idea to keep it closed? Not sure how you will prevent the chatter trickling into the Savings Pot thread though.

I’ve reopened it for now to keep any feedback in one place. The team should be getting back to this thread shortly.

I’m not currently a Plus/Premium subscriber so this has no immediate impact on me. But I’ve been thinking about it and I think this change would probably make me less likely to choose to subscribe in the future.

As others have said, the 1.0-1.5% interest on first £2,000 spread across current account and regular pots was a perk that aligned nicely with use of Monzo budgeting tools (envelope budgeting via pots).

It’s been replaced with a 0.5% perk (relative to free account) on up to £100,000 which is only really of benefit to people who want to keep a large lump saving savings in Monzo. Perk on lump sum savings doesn’t really attract me to Plus/Premium.

So I need £445 in one pot to replicate what I had before

Still won’t work with the export correctly though ![]()

Well this thread was interesting to read.

I don’t think I can add much to what has been said really, just that I agree that while this might be a business move (which is fine) it’s absolutely not about simplifying how interest is earned for anyone. So it should not be marketed as such. Just be honest about what it really is, Monzo.

It’s this simple:

You pay us £5 and so long as you have £1700 (basic rate payer) in the pot, you’ll recoup it. Or in other terms, anything in that pot under this won’t make the plus payment make sense. Clearly in the case of premium, that’d be higher

I think that on balance as a software app, £5 a month is probably ok value for connecting accounts and budgeting. I have yet to find another application that does this as well as trends does.

But as a bank, which monzo is, it’s absolutely not value for money now, and doesn’t really stand out over the competitors, so there’s no incentive for me to rejoin as it stands.