Anybody else seen the changed loan offer screen?

I’ve just checked this screen and i’m still unable to get a loan even though before I was eligible for £15,000.

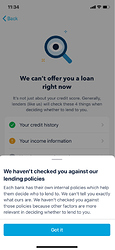

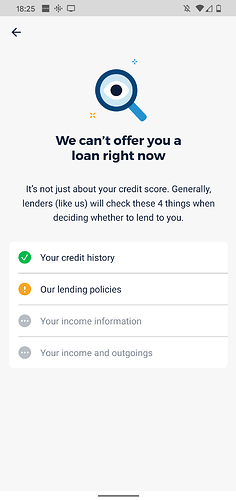

This seems to be rolled out too soon or is displaying it in a confusing way. I only have a green tick on credit history. The middle two are greyed out, even though all my income comes into Monzo, and all my outgoings come from Monzo, for around 10 months.

Is it because I only use a joint account? How long do you need to use Monzo for, for it to recognise these numbers?

Raises more questions than answers. Which ironically is the opposite of what it’s suppose to achieve.

I think in the current climate they are just having to be very careful about who they lend to and how much.

I’m just glad I took mine out on the day I checked the loan section out, it’s massively helped me out to a more stable and sustainable financial health.

If I’d played the Russian roulette game and tried the next day I may have found that the offer had vanished.

That new screen is much better though than the old, if you click on the sections does it take you through to other screens about what to do

You get these nice little Toast Popups when you click on each thing. I really like how they’ve done this.

I do however find the income one annoying, apart from cheques, it’s my main account that everything is in and out of and has been for a long time, summary and budgeting is set up and automated form my salary every month. They know exactly what my income is but oh well, what can you do

Cheers, odd about the income one with it been your main bank account, the info is already in the system so wonder why that’s not picked up on

I know, i find it very strange.

Before I knew they’d done this screen I just assumed it was due to credit history, I’ve made no secret on here that my credit history used to be awful but i’ve spent years working hard to fix it and have done so.

To know it’s the income i find amusing. Think they may need to take a look at the algorithm for that one

Yh for sure, it now makes me think about the overdraft section an all and is that basing it on duff data about income

No idea, they gave me a £1000 overdraft no quibbles, never been entitled to a loan.

I haven’t needed the overdraft since I got it but I accepted it in case they changed their minds

Was just coming to post the same screen.

It would be interesting to understand how often they check your eligibility, or when you can check again. I think that’s the only piece of info missing.

I find it a tad frustrating, just because when looking at the TransUnion report, it comes back as excellent. (validity of those scores not withstanding). The only thing I could action in per TU to improve is getting a mortgage… I know Credit ‘scores’ themselves aren’t the holy grail of factors of course, but it just seems a bit fruitless when the 1 provider they say they check, gives back a report with very little I can do to improve!

Though I did just look to see any reference to Monzo searches in my credit file - 2 soft searches, Nov 19 and Feb 2020 - so perhaps I’m due another recheck this month.

Not that I need a loan at all.

They seem to recheck quite often now, but i guess it might depend on what they need to check on how often they check it. For example they seem to think my credit score is ok so maybe don’t check that as often as I rarely get new soft checks from Monzo on my report.

I say this because twice in the last couple of weeks, my loan button on the all accounts and pots screen changed from “Learn about our Loans” to “See if you can get a loan”(that might not be the correct text, i can’t remember and can’t check but the point is the text changed). Both times i’ve clicked it, it has taken me to a screen asking my income and my percentage of rent etc. I’ve filled it out twice, they then decline as usual and the button changes back to Learn about Our Loans.

I don’t need a loan at all, just interested in the behaviour. It’s definitely more complex than most would think

Never?

That new screen is worlds better than the old. Much more monzo - giving you information, as transparent as possible. And it even looks beautiful. Great design.

So monzo don’t offer loans to self employed people. That’s what mine says, at least it gives a reason now as I have always had an excellent credit rating.

Nope

Perhaps Monzo can’t find your credit file? It happens. Do your details in TransUnion appear correctly? Are you on the electoral roll?

Is this the ‘thing’ the Monzo employee was Twittering about recently, do we think?

So? It’s Monzo’s money, not TransUnion’s.

This is a massive improvement

I wasn’t eligible for a loan and when I spoke to them a few month back it was due to affordability. This was down to the fact that Monzo couldn’t recognise a joint mortgage, so assumed I was responsible for the whole lot.

I’ve just answered those simple questions, stated that’s its a joint mortgage and now I’m eligible