Nice looking card but don’t have £5k a month to pay in or can’t justify the £15 month fee. Just copy the image and have a decal skin made for the Lloyds basic current account card ![]()

No I assumed UnionPay was the main provider, and AMEX wouldn’t be a big player in that market.

I have a feeling these are more for people who travel abroad… Or spend in luxury shops etc

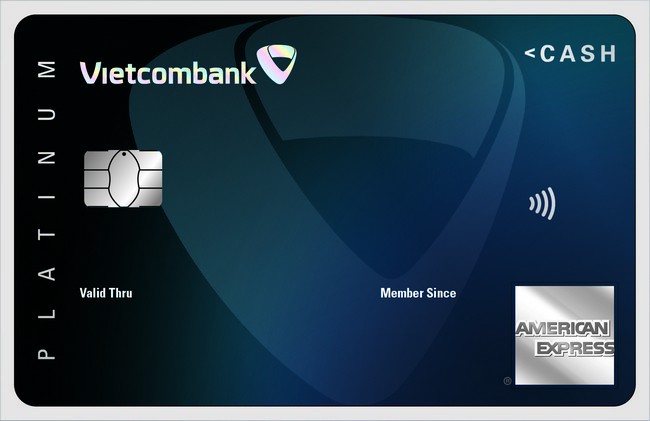

There is also a surge of Amex cards in Vietnam lately, though they’re still in the more premium territory

Well amex has had a joint venture in China for four years…so maybe they just want to expand their market, so does MasterCard, but the biggest difference between China Mainland and other international markets is that most of the daily spending were done through Alipay or WeChat pay, they work just like a Unipay card and they all pay via WeChat/Alipay channel, so we don’t have to worry about the acceptance(Unless you want to travel abroad), we just pick the card we like then apply. Btw some grapevine info indicates that Apple pay/Mi pay Huawei oppo blabla for both CNY Amex and MasterCard is on the way… CNY Amex may be available in July, CNY MasterCard could arrive by the end of this year. That is a good News for those who travelled abroad, since their physical cards are very likely to be copied during the trip and most of Chinese banks do not have a good fraudulent dispute system like you guys ( because such thing barely happen domestically..)

The second one is interesting, it’s the first time I’ve seen the Amex “box” logo in anything other than the standard blue colour. Seems contrary to all their branding guidelines (that I’m aware of) so will be interesting to see if this comes to any other cards.

Yeah sure! It’s 2am now so I’ll leave this open so I see it again, but I’ll lay them out properly and take a photo asap.

Wow I love these designs! I’ve got a HSBC HK UnionPay card, but these are something else!

Try turning off location services. This worked for me for my HSBC US credit card, it wouldn’t work no matter how many times I tried, them someone suggested that and it worked first time.

Easiest way in is to hold a UK Amex for 6-12 months, then global transfer. You need an address and phone number, but that’s easy enough. It’ll take about ~8 months of holding the Amex and you’ll have enough data reported to generate a FICO score, HSBC use that as the precise number was listed on my approval letter. I’d been in the US market for a couple of years before branching out of the Amex stable, and spent about a year with just a single Amex. Slow and steady unfortunately, there isn’t a fast route, that I know of.

Yeah it seems odd considering Gold is part of Platinum (maybe to keep people on that card?), but hike the fee and offer higher status maybe? It’s not a bad card other than that, was better when it was SPG, but still OK, considering Marriott’s strong list of partners. Also yes, crediting nights is a great bonus, I’ll have lifetime something with Marriott, from years Gold plus and nights, mostly contributed from Creation UK/Amex UK and now Amex US, soon enough. It may change now with Platinum, but they’ve been very lightly used from me in recent years (having higher status with Hilton, ALL and IHG means they take precedence).

Ah yeah, so the US Plat does have insurance, but it’s not as strong - and car rental insurance is weak, American rentals usually primarily use your personal car insurance policy (if you have one) before any other coverage (which sucks). No idea why they don’t cover Australia though, that’s a deal breaker in itself, because travel and car rental in one is great, but mostly I don’t know how their travel insurance tolerates overseas residents - Amex UK (or rather AXA) don’t care (I haven’t claimed since the change), this could be because it’s the same policy that covers the ICC cards that are no longer available to apply for, but still exist for those who hold them in certain countries (AU included). I had one until I re-opened a UK-proper Amex, then there was no point in keeping it (it was a weak card in all honesty, other than the insurance, but the annual fee was lower - no Amex offers, worse MR transfer rates, with the exception of SQ, which remained 1:1, even after Amex UK dropped to 3:2).

So the US one was actually a Gold card, but I got an upgrade offer I decided I’d take, and I’ll keep it for the year (which will make that account two years old) then downgrade, or maybe close it (Amex US don’t look kindly on one year only account holders in any case).

I’ve seen the HSBC Premier Insurance including the quite good looking recent domestic medical thing, neither of which I’ve looked into in huge detail.

Thankfully I’ve never had anything serious happen, the only travel claim I made I could have avoided, but it’d have meant sitting in a hotel doing nothing (I re-routed from DXB-DOH-AKL-MEL to DXB-MEL direct, because Auckland had flash flooding (early 2023) and it basically shut the place down. It took a while, as I replaced a cash J booking with a points F booking (the only seat I could get at T-24h, what a shame), so made it clear I was only claiming for the cash element of either the dead flight from AKL-MEL (rest were refundable) or the cash co-pay of DXB-MEL, both of which were around A$1,000.

The car claims have been sliding on ice in Canada at about 5mph (no damage to other car, small crack to bumper on rental); hit an animal in the dark in New Caledonia; and someone broke a rear window of a car parked at hotel in Darwin (but I was “at fault” as I have no idea who) - I don’t think it was malicious or theft motivated (it was clearly empty), but amongst the glass was an empty aluminium canister - I suspect someone was inhaling nangs in their room, throwing the empties out of the window and one unfortunately ended up in my boot. Zero issues with any of those, filled out the forms required (including a French translation in New Cal, thanks to Google Translate!), sent the whole lot to AXA and they were dealt with very efficiently.

But either way I’ll keep the Green card, US MR are almost all instant from experience as well as being good value.

Won’t they require a SSN or ITIN?

oh my days that looks so beautiful, but the shiny would be a huge letdown ngl

can you show some cleaner cooler looking photos ![]()

can we get an updated card collection?

I think your first card with Global Transfer doesn’t require it. It’s only required for any cards beyond your first, or to create a US credit file.

Does using global transfer create a local credit file for you automatically, or do you always need a local social security number? Wondering how that works as we’re moving to Australia in a couple of years.