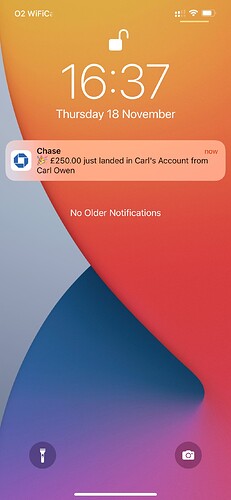

Not sure if this has been shown yet but it shows amounts for transfers now and vibrates.

I don’t think our statements contradict each other (at least I didn’t mean to contradict any of your as yet unwritten statements  ):

):

Firstly, I said that section 75 depends on “whether and how you took out credit” (emphasis added) - never did I say or imply that it applied to “just any credit”

Secondly, my only point - and I should’ve made that clearer - was that whether the card identifies as debit or credit card to the merchant is totally irrelevant. What matters is the product behind it. We know there are debit/prepaid cards that identify to the merchant as credit card - that won’t mean that S75 suddenly applies. And whilst I don’t know of any currently existing credit cards that masquerades as debit cards to the merchant, doing so would not invalidate S75.

Yes the amount is new recently but the vibrate and tone has been up and running for about 2 weeks

I wonder…

Once direct debits are set up would Chase consider offering an account opening bonus similar to their US offering of $225 (£166).

Like many things in the US, I don’t think the words are doing us any favo(u)rs here.

As I understand it, they have a domestic card network they call “debit”. Broadly, in our terms, consider it Switch before it was bought out.

Then they have the “credit” network that’s broadly MasterCard and Visa. On the US “credit” network you can run both debit and credit cards (in UK terms). Which is why, I think, when you go to the US to pay with your (well, not your, @coffeemadman ![]() ) Monzo card you need to make sure it’s using the credit network.

) Monzo card you need to make sure it’s using the credit network.

It’s confusing (and doesn’t necessarily invalidate what you said) but I thought I’d throw it out there as the US banking scene is still kinda in the 70s.

I lived in NY for most of the 00’s - had a HSBC (US) ‘checking’ account and an AMEX (NYC) credit card. HSBC was absolutely prehistoric. AMEX was amazing. But neither were digital as we know it now.

(I think I’ve still got my HSBC checking account card with a pre 9-11 Manhattan skyline image on it - I’ll have to dig that one out for a look)

Banking in the US can be both old-fashioned and efficient. Monzo should be able to slot in there really well. But it’ll take either - a lot of marketing money - or - slightly less marketing money and a lot of time to break it.

Chase, on the other hand, should be able to do this easily as it is a vice-versa market move.

Yeah I got similar text when I bought rail ticket.

It went through following day though so no free travel

I got similar with a vending machine at work that doesn’t vend very well.

Chase doesn’t charge me pending a refund, just takes the charge away. Every other card I have used has a pending charge for a while until it drops off.

Fine for a bag of crisps, but wouldn’t be great if it were a larger purchase.

Discovered today via another forum that you can use an NFC app to read the full card number of your physical Chase card - means you can add it to Airtime Rewards and similar services.

Lol

Your laughter confuses me.

Your confusion lols me.

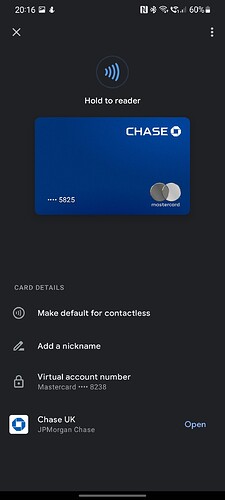

Just managed to manually add my chase virtual card details to Google Pay and it provisioned successfully. Even took me to the chase app which asked me to enter my pin number to activate the card on Google pay.

I haven’t actually tried it on a shop yet but I assume an official launch isn’t far off

Yep me too, added my Chase card to gPay earlier today - didn’t receive any notification that this was now available, just saw the option when I was looking for my card details on app I think. Wasn’t concentrating so can’t quite remember!

Will see if it works tomorrow!

Same here. Added okay.

Now to try use it

How did the direct debit set up go?

Nothing in the app yet; but nothing from the company to say it didn’t get set up. So we shall see.

In my chase app, I pulled down to see the card details and there was an Add to GPay button. I clicked it, it worked like monzo one, and then was gone. Chase added to GPay.

Hooray. Can stop carrying the card around I think.

I think I saw a TV advert for Chase yesterday. Didn’t seem particularly special and wouldn’t encourage me to look up the bank.

Very little on this forum ever appears special! We’re likely not the target audience for a bank’s campaign, given we know about it already.

People want stability with a bank, they want the mundane, they want the recognisable and don’t want to think much of their bank.

Sure, most of us here like more than that, like the new features and the flashy ways to do things in innovative ways, but that really isn’t how the rest of the country (particularly the older generations) think - broadly.