Yeah I have some pots at 1.55% too, so will be interesting to see what happens.

Always best to not use interest pots with Monzo, much better rates elsewhere.

… do what works for you personally ![]()

I am not impressed with Ford Bank, everything is so so slow. It takes ages for deposits to be acknowledged and withdrawals seem to be BACS based.

I’m not sure how accurate that statement is. I think some of the saving pots are comparable, even if you go elsewhere it’s not a huge difference (1.5 vs 1.9).

Exceptions are FD paying 3.50% but they cap what you put in

I must admit when I first came across them I was like…

…they make cars don’t they?

(I’m aware a lot of car companies have banks for the likes of finance etc)

Easy access

2% with unlimited withdrawals RCI

5% (yes 5%) up to 5k with Barclays (currently a mass sign up)

For locked rates , you’re very much wrong.

The highest is 4.11% for 1 year with Atom you can put what ever you want in it up to £100,000

No, because you are not opening new accounts, just pots linked to your account but could be a pain in the *ss if you need to send statements like buying a property.

Noticed people on MSE forum closing existing, and opening new, Santander regular savers to earn an extra £3 and a bit over the 12 months.

Now that’s dedication, or desperation ![]()

I wasn’t aware about Atom and to be fair I don’t think Barclays was 5% when I noted it.

But yes they are good rates.

They’re not regular saver accounts but lump sum?

They are indeed regular saver accounts.

£200pm max

All the accounts I mentioned are NOT regular saver.

They’re all easy access.

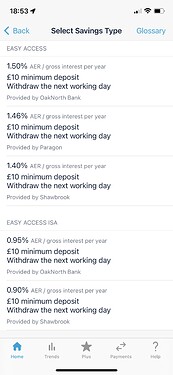

Spend 30 seconds on here

https://www.moneysavingexpert.com/savings/savings-accounts-best-interest/

5% easy access up to 5k Barclays

4% fixed Atom 1 year + any amount.

These are not regular savers but lump sum.

Maybe we’re talking about different things

We are indeed.

I was just highlighting how desperate some people are for every penny they can grasp, regardless of whether it is actually worth the effort.

The thread title is “Changing interest rates” and the actions I referred to was a change from 2.50% to 2.75% on a regular saver, with the same provider.

So a rise, in effect, of about 0.18% in return over the year ![]()

There is now easy access 2% flex savings account from nationwide. Just straightforward unlimited deposits and withdrawals, easy access.

Yup. Got it.

Although you have to hold a Nationwide current account to open one, and should you close said current account, your Flex Instant Saver will transfer to another savings account of lower return.

Source: Nationwide

OakNorth have upped their rate on new pots today from 1.38% to 1.5%.

Still quite a bit below the BoE base rate though.

Santander eSaver Limited Edition Issue 1 closed at midnight last night and has been replaced with a not very flattering 2.00% Issue 2. Available until 1 November 2022 unless sold out sooner.

Meanwhile, Tesco Bank have overtaken them with their latest offering on their Instant Saver.

2.06%, including a 12 month bonus of 1.71%

Both will be overtaken by Chase Bank next Monday, 24 October 2022, when they increase their savings account rate to 2.10%

With their recent outages and people having difficulty accessing or moving their money though, I am not convinced many will return. There are still better rates out there atm.

Current leader to new applicants is Cynergy Bank, with their Issue 53 easy access savings account at 2.75% (includes 0.15% bonus for a year).

Mixed reviews on MSE forum though about how easy it is to open and get access to your money. Appears withdrawals may be next day variety, as opposed to the almost instant transfers of Santander, Chase, Atom Bank, Tesco Bank.

Not sure what you mean by takes over, as there are already four banks offering higher easy access rates than Chase.

Zopa 2.15%

Gatehouse Bank 2.25% (Sharia expected profit rate)

Al Rayan 2.35% (Sharia expected profit rate)

Cynergy Bank 2.75% (edit: existing customers only now)

Granted, only Zopa will get the funds to you the same day, and Sharia banks are not for everyone (it seems)

I wouldn’t move for the first three rates though tbh.

It will be all change in the next month anyway ![]()

Can we merge these @AlanDoe because this thread was about Monzo changing interest rates not what the best one is out there vs the one linked which is