Really disappointing to see them lower their interest rates when they were already significantly lower than the competition.

I would, of course, much rather use Monzo for everything, but when I get 5.1% on my instant access savings through Chase, I just can’t justify using Monzo for savings. 4.1% was already really low compared to Chase, but now at 3.85% it’s seriously uncompetitive.

I agree that the Monzo interest rate is not competitive even before this rate cut.

I just wanted to point out the Chase account is a tracker account so its “boosted” interest rate is changing to 4.85% later this week.

Uncompetitive or not, it’s likely most if not all variable products will reduce following the rate cut.

Virgin cut some rates even BEFORE the rate cut, which I found rather a bit much.

Totally agreed, but my point is that they have been uncompetitive for a long time, so disappointing to see them cut rates.

As pointed out above, Chase is due to fall to 4.85% (wasn’t aware of this yet, but expected it to fall at least somewhat), which is still far more than Monzo’s offering.

Received this from Zopa today, for those aggrieved by the already least competitive rates offered by Monzo.

Exactly this. This isn’t so much of a Monzo cut as a whole-of-market reduction that you’re about to see.

I’d assume everyone knew how variable rates worked.

I expect some will start taking the chance to cut their rates by more than the 0.25% and flatern the market a little. No insight, just my expectation.

It’s worth watching and waiting and compare apples with apples when new rates everywhere are known

I’m on Extra and still got this email.

It’s not quite going to plan. @andys, are you aware of this too?

Yes we’re aware of this one too - thank you for raising. You’ll see an email with the corrected changes shared later on today. Thanks for bearing with us!

Not having a good day with the messages- maybe the problem is lowering them… just keep the interest rates as they were or up them ![]()

Zopa Cash ISA has seen exactly that.

Cut by 0.28%points

5.08 to 4.80

I pay for Max, and I received the email about this, too.

This looks like a good option: https://www.trading212.com/terms/cash-isa

I imagine their free account’s rate will still be higher than I get from Monzo for my £17 per month (I am obviously l aware I do not pay £17 just for the interest rate, lol).

I didn’t know about this account. The actual annual interest is about 5.4% for comparison if you had £3k in an account compared to compound interest. Still good of course. Would net you about £31 difference to leaving £3k in a Monzo account at the current rate (assuming that doesn’t change for 12 months which is a big ask!)

Your “5.4% for comparison” assumes the interest earned on the lump sum outside the regular saver will be zero, which would be daft.

Not sure if this is an issue for anyone else. I am a legacy premium account holder. I just logged onto my Monzo app go be welcomed with this;

I’m presuming this is a push to get people onto the new tiers. My main issue with this that at no point has Monzo said this is going to happen- it would be courteous to notify customers of this change. And the other issue is that they are saying they are “upping” my interest rate when I fact it’s gone from 4.6% to 4.35%.

Welcome others thoughts on this.

Sorry my bad, just seen. Cheers

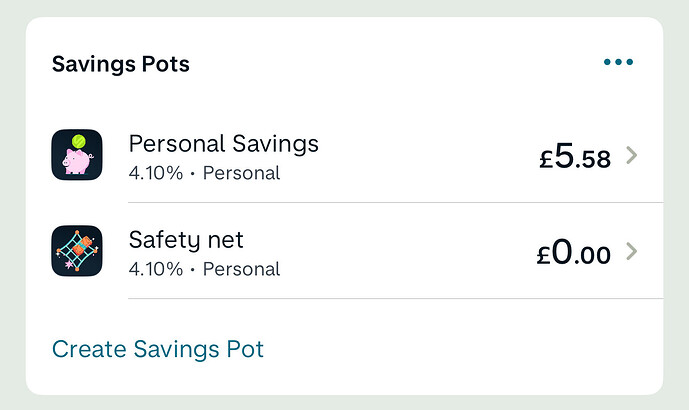

Think its a typo, original rate was 4.10% for a general savings pot

I have a personal savings pot and it was 4.6% and it does say “upped to” but it has been reduced.

I thought you had to be notified in advance?